Car Insurance Massachusetts: Ultimate 4-Step Guide

Why Car Insurance Massachusetts Matters for Every Driver

Car Insurance Massachusetts is more than just a legal requirement—it’s your financial safety net on the road. If you’re looking for quick answers, here’s what you need to know:

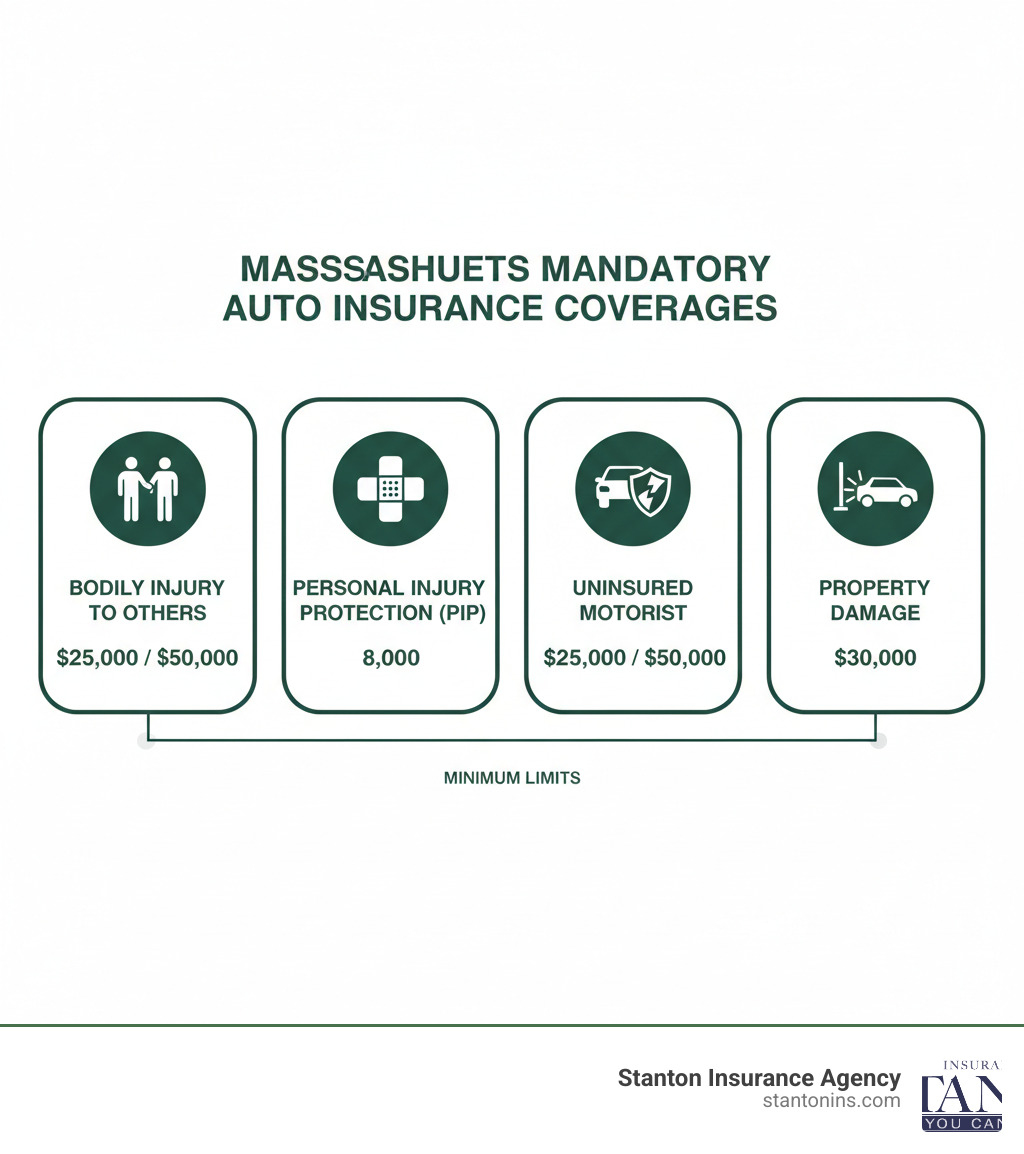

Massachusetts Mandatory Coverage Requirements:

- Bodily Injury to Others: $20,000 per person / $40,000 per accident

- Personal Injury Protection (PIP): $8,000 per person (covers medical expenses and lost wages)

- Bodily Injury by Uninsured Auto: $20,000 per person / $40,000 per accident

- Property Damage: $5,000 per accident

Average Cost: Approximately $1,346 per year, though your rate depends on your driving record, location, vehicle type, and coverage choices.

Driving in Massachusetts requires auto insurance by law. Beyond this legal mandate, the right policy protects you from potentially devastating financial losses after an accident. While understanding the state’s unique no-fault system and terms like Personal Injury Protection (PIP) can seem complex, the basics are straightforward, and this guide will help you make informed decisions.

I’m Geoff Stanton, President at Stanton Insurance Agency in Waltham, and I’ve been helping Massachusetts drivers steer Car Insurance Massachusetts requirements and find the right coverage since 1999. As a fourth-generation owner and Certified Insurance Counselor, I’ve seen how the right policy provides both legal compliance and genuine peace of mind.

Understanding Massachusetts’ Mandatory Auto Insurance

In Massachusetts, driving without insurance is illegal. Every registered vehicle must have a policy with four compulsory coverages. This isn’t just about avoiding legal trouble; it’s about being a responsible driver prepared for the unexpected. Knowing what your Car Insurance Massachusetts policy must include is the first step toward driving with confidence.

The Four Compulsory Coverages in Massachusetts

Massachusetts law requires all drivers to carry four types of liability coverage. These minimums create a basic level of financial protection for everyone on the road. Let’s walk through each one so you know exactly what you’re paying for.

Bodily Injury to Others protects you if you cause an accident that hurts someone else, paying for their medical bills, lost wages, and pain and suffering. Massachusetts requires minimum limits of $20,000 per person and $40,000 per accident. This coverage only applies to accidents within Massachusetts.

Personal Injury Protection (PIP) is central to Massachusetts’ “no-fault” system. It pays for medical expenses, up to 75% of lost wages, and replacement services for you, your passengers, or pedestrians injured in an accident, regardless of who is at fault. The maximum is $8,000 per person, per accident. If you have health insurance, PIP may only cover the first $2,000, with your health plan covering the rest. PIP does not apply to motorcycle accidents.

Bodily Injury Caused by an Uninsured Auto protects you and your passengers if you’re hit by an uninsured driver or are a victim of a hit-and-run. The minimum limits are $20,000 per person and $40,000 per accident.

Damage to Someone Else’s Property covers damage you cause to another person’s vehicle or property in an at-fault accident. Massachusetts requires a minimum of $5,000 per accident.

These four coverages are your legal foundation. However, accident costs can easily exceed these minimums, leaving you personally responsible for the difference. We often recommend higher limits for better protection. You can learn more about state requirements from the Commonwealth’s official resources.

Legal Requirements for Vehicle Registration

In Massachusetts, you cannot register a vehicle with the Registry of Motor Vehicles (RMV) without proof of insurance. When you buy a policy, your insurer electronically notifies the RMV, confirming your coverage and allowing registration.

If you cancel or let your policy lapse, your insurer also notifies the RMV. Lapses can trigger fines and the suspension of your vehicle registration and driver’s license. Continuous coverage is essential for staying legal and keeping your driving privileges. For more information on how auto insurance fits into your overall protection strategy, explore our personal insurance services.

Decoding the Cost of Car Insurance in Massachusetts

The average cost of Car Insurance Massachusetts is about $1,346 per year. Compared to many states, Massachusetts rates are reasonable. However, this is just an average. Your actual premium depends on your unique situation, as insurers calculate risk based on group characteristics and individual factors.

Massachusetts law prohibits insurers from using sex, marital status, race, income, or credit score to set rates. This sets the state apart, but many other legitimate factors still influence your premium for Car Insurance Massachusetts.

Key Factors That Influence Your Premium

Understanding what drives your premium helps you find ways to save. Here are the primary factors insurers consider:

Your driving record is a top factor. The Massachusetts Merit Rating Board (MRB) tracks every driver’s history of accidents and violations. Insurers use this data to apply surcharges for at-fault accidents (over $1,000 in claims) and traffic violations. A clean record earns credits that lower your premium, and most incidents only affect rates for six years.

Where you live significantly impacts your rates. Urban areas like Boston typically have higher premiums than rural areas due to more traffic, theft, and accidents. Where you park your car (street vs. garage) can also affect your premium.

Your vehicle type is a major factor. Insurers consider your car’s make, model, age, safety ratings, theft rates, and repair costs. A high-performance sports car will cost more to insure than a safe, sensible sedan.

Your driving experience and usage are also key. More years of licensed driving usually means lower rates. Your annual mileage also matters; driving more increases your statistical risk of an accident.

Your coverage choices directly impact your premium. Higher liability limits or lower deductibles for optional coverages provide better protection but increase your premium.

How to Find Affordable Car Insurance in Massachusetts

Finding affordable Car Insurance Massachusetts means being strategic. Here’s how to get better rates:

Shopping around is the most effective strategy. Rates for identical coverage can vary wildly between companies, so compare quotes. Working with an independent agent can save you time and money by comparing multiple insurers for you.

Asking about discounts can save you money. Insurers offer many discounts, but you often have to ask. Common ones include good driver, multi-car, safety features, good student, low mileage, and advanced shopper discounts.

Bundling your policies is an easy way to save. Combining your auto insurance with your home insurance or renters insurance with the same provider usually earns a significant multi-policy discount.

Maintaining a good driving record is the best long-term strategy for low rates. Avoiding accidents and violations prevents Merit Rating Board surcharges and makes you eligible for the best rates. Safe driving is an investment in lower insurance costs.

Beyond the Basics: Optional Car Insurance Coverages

Mandatory Car Insurance Massachusetts coverages provide a crucial but basic safety net. Optional coverages, or endorsements, offer improved protection for your vehicle and finances. These add-ons can be customized to fit your needs, providing peace of mind beyond the state minimums.

If an accident totals your car, compulsory coverages handle the other driver’s damages and your initial medical bills via PIP. But who pays to replace your car? Optional coverages fill this gap, providing protection for real-world scenarios.

Popular Optional Coverages for Car Insurance Massachusetts

Collision Coverage pays for damage to your vehicle from a collision with an object or a rollover, regardless of fault. Lenders typically require it for car loans or leases. Even if your car is paid off, it’s a smart investment if your vehicle has significant value.

Comprehensive Coverage complements collision, covering non-collision damage from events like theft, vandalism, fire, natural disasters, or hitting an animal. Lenders also typically require it for financed vehicles. Together, collision and comprehensive are often called “full coverage.”

Medical Payments (MedPay) adds coverage for medical bills for you and your passengers, regardless of fault. It supplements PIP, which covers the first $8,000, and is valuable for serious injuries. Since PIP doesn’t cover motorcycles in Massachusetts, MedPay is crucial for riders.

Underinsured Motorist Coverage protects you when an at-fault driver has insurance, but their limits are too low to cover all your injuries. This coverage pays the difference up to your policy limits. Since many drivers only carry minimum coverage, this can be a financial lifesaver.

Substitute Transportation (Rental Reimbursement) helps pay for a rental car if your vehicle is being repaired after a covered accident. This convenience coverage keeps you mobile, which is vital if you depend on your car daily.

Towing and Labor covers towing and on-site labor costs (like a tire change or jump-start) if your car is disabled. Check if you already have similar benefits from a motor club to avoid duplicate coverage.

Choosing these optional coverages allows you to tailor your Car Insurance Massachusetts policy to your needs. For even greater financial protection, consider an umbrella policy for ultimate protection, which provides an extra layer of liability coverage.

Navigating Special Circumstances: High-Risk Drivers and MAIP

If a challenging driving record makes it hard to find Car Insurance Massachusetts, standard insurers might decline to offer you a policy. This can leave you wondering how to meet the state’s mandatory insurance requirements. The good news is that Massachusetts has a safety net ensuring all eligible drivers can get coverage, regardless of their history. This system is vital for those turned down by traditional insurers.

What is the Massachusetts Auto Insurance Plan (MAIP)?

The Massachusetts Auto Insurance Plan (MAIP), or Assigned Risk Pool, is a state-mandated program guaranteeing access to Car Insurance Massachusetts for drivers who can’t find coverage in the voluntary market.

If standard insurers deny you coverage due to your risk profile, an insurance agent can submit an application to MAIP for you. The plan assigns you to an insurer that must offer you a policy, ensuring you can meet state requirements and drive legally.

MAIP premiums are typically higher than the standard market because they cover higher-risk drivers. However, the program keeps you legally insured and provides a chance to rebuild your driving record.

MAIP isn’t necessarily permanent. By maintaining coverage and driving safely, you can improve your record and eventually qualify for more competitive rates in the voluntary market. Think of it as a bridge to better insurance options. For official guidance, the Commonwealth provides resources on shopping for auto insurance. An experienced agent can make navigating the MAIP process much smoother.

Frequently Asked Questions about Car Insurance in Massachusetts

Car Insurance Massachusetts can be complex, with state-specific rules that raise many questions. Here are clear, straightforward answers to the most common ones.

Does insurance follow the car or the driver in Massachusetts?

In Massachusetts, auto insurance primarily follows the car, not the driver. This means the vehicle’s policy is the first line of defense in an accident. If you lend your car to someone and they cause an accident, your policy is the primary source of coverage. Their insurance would be secondary, if used at all.

For this reason, it’s crucial to list all regular operators on your policy. Massachusetts law requires listing all licensed household members and anyone else who regularly drives your car, even if they have their own insurance. Failing to do so can lead to serious consequences, including claim denial. When in doubt, disclose anyone who might drive your vehicle.

How does my driving record affect my premium?

Your driving record is a major factor influencing your Car Insurance Massachusetts premium and one of the biggest you can control. The state’s Merit Rating Board (MRB) maintains detailed driving histories, which insurers use to apply surcharges for at-fault accidents and traffic violations.

An at-fault accident with over $1,000 in claims or certain traffic violations (like speeding or DUI) will likely result in a surcharge. Conversely, a clean driving record leads to lower rates. Insurers review the last six years of your driving history; an incident-free record often qualifies you for valuable discounts. The bottom line: A clean driving history is the best way to keep rates affordable.

What happens if I can’t get car insurance in Massachusetts?

If you’re denied coverage in the voluntary market due to your driving history, you still have options. Massachusetts has the Massachusetts Auto Insurance Plan (MAIP), or Assigned Risk Pool. This program ensures all licensed drivers can get the mandatory Car Insurance Massachusetts coverages.

An insurance agent can submit a MAIP application for you. The plan then assigns you to an insurer that must provide a policy, allowing you to meet state requirements and drive legally. MAIP premiums are higher, reflecting the increased risk, but it guarantees you can get legal coverage.

The good news is that MAIP isn’t permanent. By improving your driving record, you can eventually qualify for more affordable rates in the voluntary market. You can find more details through the official information on shopping for auto insurance from the Commonwealth.

Your Trusted Partner for Massachusetts Auto Insurance

Navigating Car Insurance Massachusetts is easier when you understand the basics. From compulsory coverages to optional endorsements, knowledge is power. Understanding your policy means you’re not just meeting a legal requirement; you’re building a financial safety net for your family.

The best policy fits your unique situation, whether you’re a new driver, adding a teen to your policy, or rebuilding your record. The right coverage exists, and finding it means working with someone who listens.

Stanton Insurance Agency has helped Massachusetts drivers since 1999. As a fourth-generation family business in Waltham, we understand your needs. For us, insurance is about protecting what matters: your independence, financial security, and peace of mind on every drive.

Our team is dedicated to finding you the right coverage at a competitive price. We compare options, find discounts, and explain everything in plain English. We offer honest guidance to make the process straightforward, whether you’re a new or existing customer.

Ready to see what the right Car Insurance Massachusetts policy looks like for you? Get your personalized car insurance quote today! Let’s find coverage that protects your valuable assets without breaking your budget.