Auto liability coverage: Crucial protection for 2025

Why Understanding Auto liability Coverage Matters Most

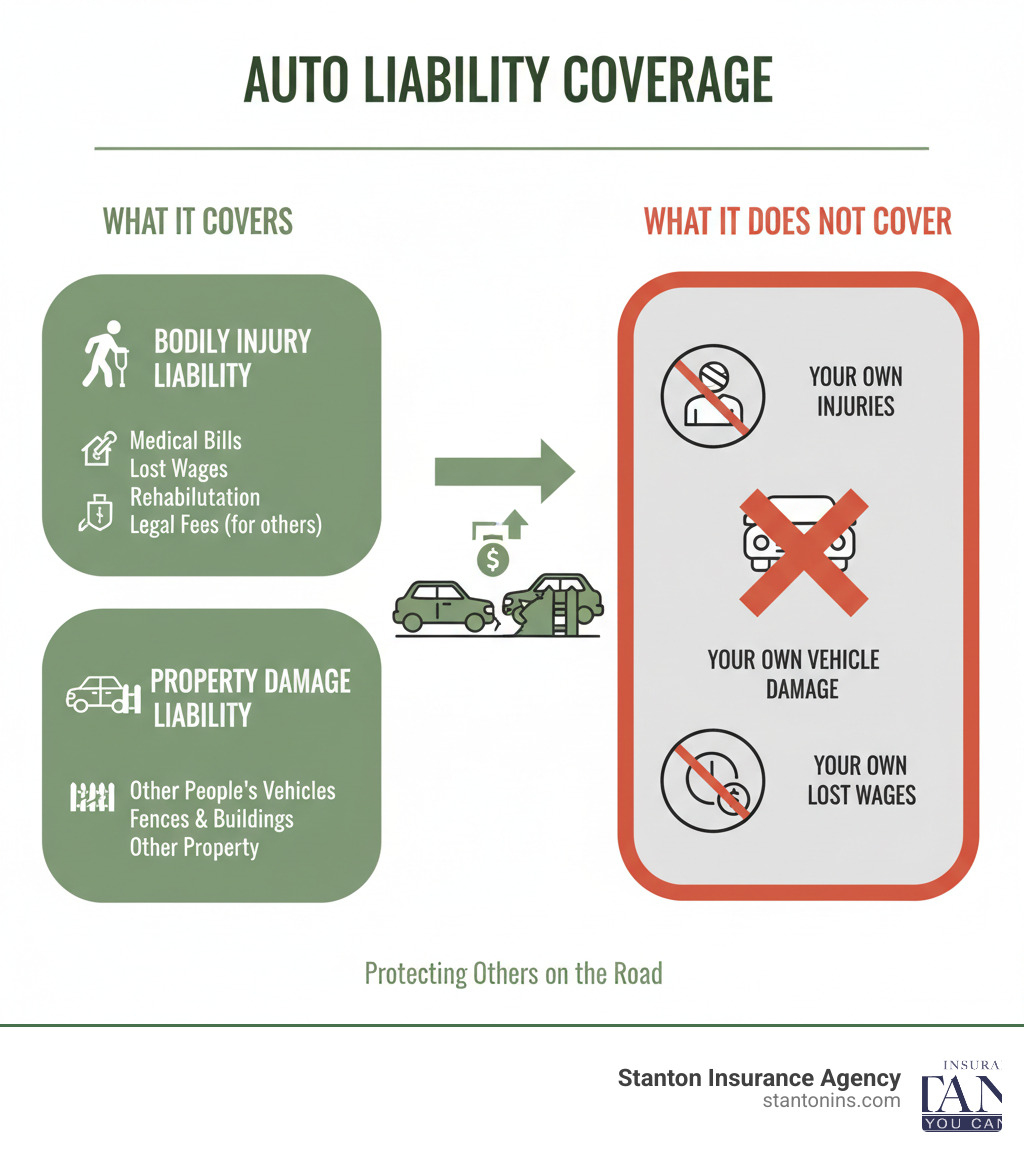

Auto liability coverage is the foundation of your car insurance policy. It pays for injuries and property damage you cause to others when you’re at fault in an accident. This coverage includes:

- Bodily Injury Liability: Covers other people’s medical bills, lost wages, and legal fees if you injure someone.

- Property Damage Liability: Pays for repairs to other people’s vehicles or property you damage.

Crucially, it does not cover your own medical bills or damage to your own vehicle. While every state has minimum requirements, they are often dangerously low.

- Massachusetts: $20,000 per person / $40,000 per accident / $5,000 property damage (minimums increasing in 2025).

- New Hampshire: $25,000 per person / $50,000 per accident / $25,000 property damage (or proof of financial responsibility).

Recent data shows the average bodily injury claim cost over $21,000 and the average property damage claim was over $5,000. These figures can easily exceed state minimums, leaving you personally responsible for the difference. Relying on minimum coverage leaves your home, savings, and future income vulnerable. If an accident’s costs exceed your policy limits, you could face wage garnishment, property liens, or even bankruptcy.

I’m Geoff Stanton, President of Stanton Insurance Agency in Waltham, Massachusetts. With over 20 years of experience, I’ve helped countless clients secure the right auto liability coverage to protect their financial futures. Let’s walk through what you need to know to make informed decisions about your protection on the road.

What is Auto Liability Coverage and What Does It Protect?

When you get behind the wheel, you accept responsibility for others on the road. Auto liability coverage is the part of your car insurance that pays for injuries or property damage you cause to others in an at-fault accident. It is your financial safety net for other people’s losses, ensuring their medical bills are paid and vehicles are repaired without you having to drain your savings.

This coverage is broken down into two main components.

The Two Pillars of Liability: Bodily Injury and Property Damage

Auto liability coverage consists of two distinct protections:

Bodily Injury Liability covers costs related to injuries or death you cause to another person. This includes their medical bills, emergency room visits, hospital stays, and ongoing rehabilitation. If their injuries prevent them from working, it also covers lost wages. Crucially, this coverage also helps pay for your legal fees if you’re sued as a result of the accident.

Property Damage Liability pays for the damage you cause to someone else’s property. Most often, this means repairing or replacing the other person’s vehicle. However, it also covers damage to other property, such as a fence, mailbox, street sign, or building.

These two components work together to ensure that when you’re at fault, the financial burden doesn’t fall on you.

What Auto Liability Insurance Does Not Cover

It’s critical to understand that auto liability insurance is designed to protect others from you, not to protect you. If you only have liability coverage, you are not covered for:

- Repairs to your own vehicle after an at-fault accident.

- Damage to your car from theft, vandalism, fire, or weather.

- Your own medical expenses after an accident.

- Lost wages while you are recovering.

- A rental car for yourself while your vehicle is being repaired.

To cover these situations, you need to add other types of coverage to your policy. Collision coverage pays for damage to your own vehicle in a crash, and Comprehensive coverage handles non-collision events like theft or weather damage. To cover your own medical expenses, you would need coverage like Personal Injury Protection (PIP), which is mandatory in Massachusetts, or Medical Payments (MedPay), which is an optional but highly recommended coverage in New Hampshire.

Liability vs. ‘Full’ Coverage

You’ve likely heard the term “full coverage,” but it isn’t an official insurance term. It’s shorthand for a policy that includes more than just auto liability coverage.

Typically, “full coverage” means a policy that combines liability with Collision and Comprehensive coverage. This creates a more robust safety net that protects your own vehicle as well as others.

| Feature | Liability-Only Coverage | “Full” Coverage (Liability + Collision + Comprehensive) |

|---|---|---|

| Covers other’s injuries? | Yes | Yes |

| Covers other’s property damage? | Yes | Yes |

| Covers your car’s damage from an at-fault crash? | No | Yes (Collision) |

| Covers your car’s damage from theft, weather, etc.? | No | Yes (Comprehensive) |

| Meets lender requirements for a financed car? | No | Yes |

That last point is key. If you have a car loan or lease, your lender will almost certainly require you to carry both Collision and Comprehensive coverage to protect their investment in your vehicle. Even if you own your car outright, this broader coverage might make sense depending on your vehicle’s value and your financial situation.

How Much Liability Coverage Do You Need?

While nearly every state requires drivers to carry minimum auto liability insurance, these minimums are often dangerously low and may not cover the costs of a serious accident. Average claims can easily exceed state-mandated limits, leaving you personally responsible for thousands of dollars in damages.

Meeting your state’s minimum requirement keeps you legal on the road, but it rarely provides enough protection to safeguard your financial future.

State Minimum Requirements in Massachusetts & New Hampshire

As a local agency serving Massachusetts and New Hampshire, we want to ensure you understand what’s required in our community.

In Massachusetts, the current minimums are $20,000 for bodily injury per person, $40,000 per accident, and $5,000 for property damage. The state also requires Personal Injury Protection (PIP) and Uninsured Motorist Coverage. Importantly, these liability minimums are set to increase in 2025, so it’s wise to purchase higher limits now. For more details, you can review the Basics of Auto Insurance on Mass.gov.

New Hampshire has a “financial responsibility” law, meaning you must prove you can pay for damages if you cause an accident. For most drivers, purchasing auto liability coverage is the easiest way to meet this rule. The required minimums are $25,000 for bodily injury per person, $50,000 per accident, and $25,000 for property damage. While forgoing insurance is an option, the financial risk is immense.

Choosing Limits to Protect Your Assets

The best practice is to choose auto liability coverage limits that match or exceed your total net worth. Consider your assets: your home, savings, investments, and even future income. If you cause an accident where costs exceed your policy limits, the injured party can sue you for the difference, putting everything you’ve worked for at risk.

Increasing your liability limits is one of the most cost-effective ways to buy peace of mind. The cost to boost your coverage from state minimums to a much higher level—say, 100/300/100—is usually small compared to the immense financial protection it provides. This small investment safeguards your entire financial future from a single incident on the road.

Understanding Your Auto Liability Coverage Limits and Costs

When reviewing your policy, you’ll see auto liability coverage limits expressed as three numbers, like 50/100/25. This format tells you exactly how much financial protection you have.

How to Read Liability Coverage Limits (e.g., 50/100/25)

Let’s decode the 50/100/25 format. Each number represents a coverage cap in thousands of dollars for a single at-fault accident:

-

$50,000 (per-person bodily injury): The maximum your policy will pay for injuries to any one person you hurt in an accident. If their costs are $60,000, you are responsible for the remaining $10,000.

-

$100,000 (per-accident bodily injury): The total amount your policy will pay for all bodily injuries in a single accident, no matter how many people are hurt. If three people have injuries totaling $150,000, you are responsible for the $50,000 difference.

-

$25,000 (per-accident property damage): The total your policy will pay for all property you damage in one accident. If you cause $35,000 in damage, you owe the remaining $10,000.

Some policies offer a Combined Single Limit (CSL), but the three-number format is most common.

What Happens If Damages Exceed Your Limits?

If an accident’s costs exceed your auto liability coverage limits, you are personally responsible for every dollar over that amount. This is a genuine financial risk.

Medical bills for severe injuries can reach six figures, and costs from multi-vehicle accidents add up quickly. If you carry Massachusetts’ minimum 20/40/5 liability and cause an accident with $45,000 in injuries to one person and $15,000 in vehicle damage, you would be personally liable for $35,000 ($25,000 for injuries + $10,000 for property damage).

This gap can lead to wage garnishment, liens against your home, or bankruptcy. It’s why carrying only the bare minimum is a risky gamble. The Insurance Information Institute’s guide on auto insurance basics provides more context on these scenarios.

Can I Increase My Liability Coverage Limits?

Yes, and you should review your limits regularly. You can contact your insurance agent any time to boost your protection, and it’s often more affordable than people expect. As your life changes—you buy a house, get a promotion, or build your savings—your coverage should grow with your assets. The cost difference between minimum coverage and substantially higher limits is often surprisingly small, making it one of the smartest financial moves you can make.

Advanced Liability Topics and Related Coverages

Auto liability coverage has nuances that interact with other types of insurance. Let’s explore some common scenarios.

How does liability coverage apply to rental cars or financed vehicles?

When you rent a car for personal use, your personal auto liability coverage typically extends to that rental. However, it does not cover damage to the rental car itself. For that, you would need Collision coverage from your personal policy (if you have it) or purchase a waiver from the rental company.

For financed or leased vehicles, your lender will almost always require you to carry both Comprehensive and Collision coverages in addition to liability. This protects their financial stake in your vehicle. If you let these coverages lapse, the lender may purchase expensive “force-placed” coverage and add the cost to your loan.

What is the difference between personal and business auto liability insurance?

This distinction is critical if you use your vehicle for work. A personal auto policy is designed for everyday activities and often has exclusions for business use, such as making deliveries, transporting clients, or hauling equipment. If you have an accident while working, your claim could be denied.

A business auto insurance policy is designed for these situations. It offers higher limits and covers the specific risks of commercial activities. If your business owns the vehicle or you use it primarily for work, you almost certainly need a commercial policy.

What is the role of an insurance agent in understanding liability coverage?

An independent insurance agent is your advocate and expert guide. We don’t work for one company; we work for you. Our job is to assess your personal risk, help you understand your needs, and compare options from multiple carriers to find the best policy for your situation.

As your life changes, we’re here to help you adjust your auto liability coverage to ensure you’re properly protected. For even greater protection, an umbrella insurance policy provides an extra layer of liability coverage above your auto and homeowners policy limits. It’s an affordable way to protect your assets from catastrophic claims.

Frequently Asked Questions about Auto Liability Coverage

Here are answers to the questions we hear most often about auto liability coverage.

What happens if the damages from an accident exceed my liability coverage limits?

If you are at fault and the costs are higher than your auto liability coverage limits, you are personally responsible for paying the remaining balance. The injured party can sue you, which could lead to having your wages garnished, liens placed against your property (like your home), or even bankruptcy. This is why we recommend coverage limits well above the state minimums.

What is the difference between liability coverage and ‘full’ coverage auto insurance?

This is a common point of confusion. Auto liability coverage is mandatory and pays only for damages you cause to other people and their property. It does not cover your own car or injuries.

“Full coverage” is an informal term for a policy that includes liability plus Collision and Comprehensive coverage. Collision repairs your car after an accident, and Comprehensive covers it from non-collision events like theft, vandalism, or weather. In short, liability protects others, while “full coverage” protects others and your own vehicle.

How much does liability coverage typically cost?

The cost of auto liability coverage varies based on several factors: your chosen coverage limits, driving record, vehicle type, and where you live. A clean record earns better rates, while tickets and at-fault accidents increase your premium.

The good news is that increasing your liability limits from the state minimum to a much more protective level is often surprisingly affordable. The small increase in premium provides a huge boost in financial protection and peace of mind, making it one of the best values in insurance.

Secure Your Financial Future on the Road

Now you know that auto liability coverage is the foundation of your financial protection on the road. It stands between you and potentially devastating costs if you’re at fault in an accident. While meeting the minimum required liability in Massachusetts or New Hampshire is necessary to drive legally, it’s rarely enough to protect what you’ve worked so hard to build.

Choosing auto liability coverage limits that match your assets means you can drive with genuine confidence. You’re not just checking a box; you’re actively protecting your home, savings, and future income. That peace of mind is priceless, especially when the cost to upgrade your coverage is often surprisingly affordable.

Navigating insurance can feel overwhelming, but you don’t have to do it alone. The experienced team at Stanton Insurance Agency is here to help our neighbors in Massachusetts and New Hampshire get the protection they truly need. We take the time to understand your situation, explain your options in plain English, and build a policy that fits your life and budget.

Whether you’re a new driver, a homeowner, or just want to ensure your current coverage is adequate, we’re ready to help. Let’s have a conversation about your coverage—no pressure, just honest guidance.