Uninsured motorist stacked meaning: Essential 2025 Guide

Why Understanding Uninsured Motorist Stacking Matters

Uninsured motorist stacked meaning refers to combining the UM/UIM coverage limits from multiple vehicles on your policy to create a larger pool of protection when you’re hit by an uninsured or underinsured driver.

Quick Answer:

- Stacked = Combines coverage from all your vehicles for higher total limits

- Unstacked = Only uses coverage from the single vehicle involved in the accident

- Vertical Stacking = Multiple cars on one policy

- Horizontal Stacking = Multiple separate policies under your name

With approximately one in eight drivers on the road lacking proper insurance coverage, according to the Insurance Research Council, understanding this protection is critical. In states like Massachusetts and New Hampshire, where stacking is allowed, this feature can mean the difference between financial recovery and devastating out-of-pocket costs.

The reality is stark: if an uninsured driver causes $75,000 in medical bills and you only have $25,000 in unstacked coverage, you’re personally responsible for the remaining $50,000. With stacked coverage from multiple vehicles, you could have $50,000 or more in total protection.

I’m Geoff Stanton, a 4th generation insurance professional. At Stanton Insurance, I’ve seen how proper stacking protects families from financial hardship after an accident with an uninsured driver.

Key uninsured motorist stacked meaning vocabulary:

- do you need uninsured motorist coverage

- uninsured motorist bodily injury liability

- uninsured underinsured motorist bi

The Foundation: Understanding UM and UIM Coverage

Before we explore the uninsured motorist stacked meaning, let’s build a solid foundation by understanding the core coverages that stacking applies to. Uninsured and Underinsured Motorist coverages are your financial safety net when other drivers can’t cover the damage they cause. These protections form a critical part of any comprehensive auto insurance policy.

What is Uninsured Motorist (UM) Coverage?

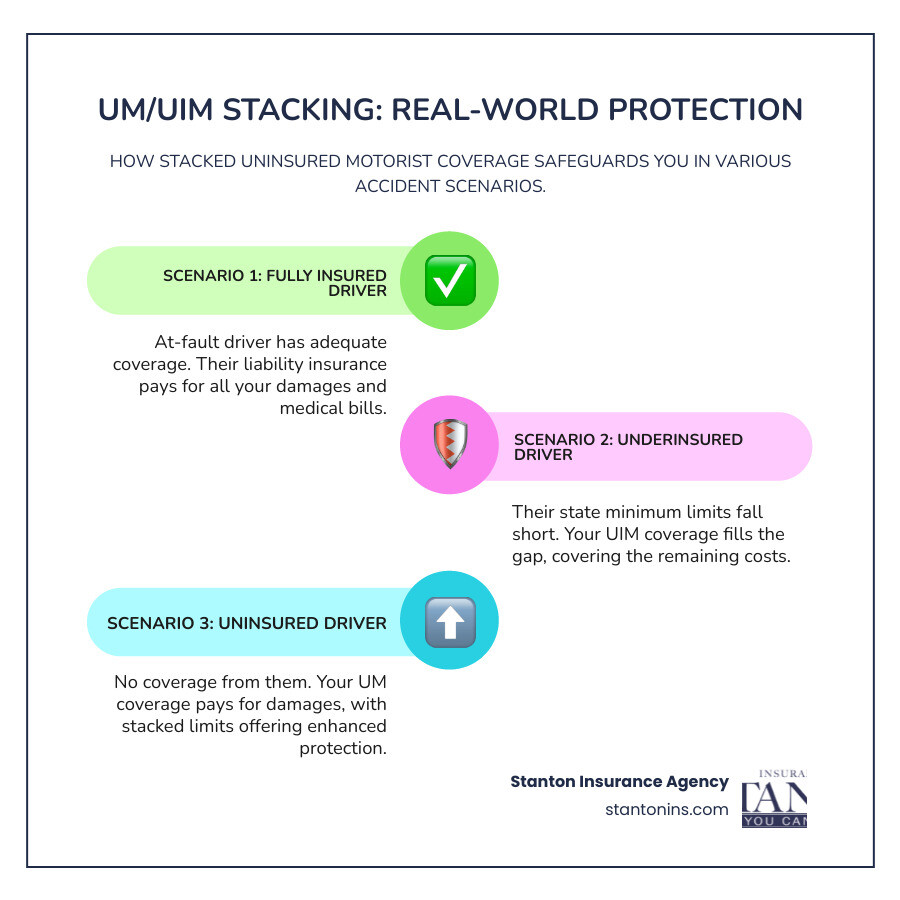

Imagine another driver runs a red light and slams into your car. It’s clearly their fault, but they either have no insurance or it’s a hit-and-run. This is when Uninsured Motorist (UM) coverage becomes your financial lifesaver. UM coverage protects you when the at-fault driver has no insurance at all.

Your UM coverage steps in to handle your medical bills, lost wages, and pain and suffering costs. It also extends to family members in your household and passengers. In some cases, it even covers you if you’re struck as a pedestrian or cyclist by an uninsured driver. Think of it as your own insurance company stepping into the shoes of the absent insurance policy that should have been there.

What is Underinsured Motorist (UIM) Coverage?

Now, consider a scenario where the at-fault driver does have insurance, but their policy limits are too low to cover your injuries. For example, they may carry the state minimum of $25,000 in Bodily Injury Liability coverage, but you’re facing $75,000 in medical bills from a serious injury.

Underinsured Motorist (UIM) coverage bridges this dangerous gap. When the at-fault driver’s insurance isn’t enough to cover your full damages, UIM coverage kicks in to pay the difference, up to your policy limits.

Here’s how it works: the at-fault driver’s Bodily Injury Liability coverage pays out first. Once that’s exhausted, your UIM coverage takes over to cover the remaining costs. It’s like having a backup plan for someone else’s inadequate planning.

Both UM and UIM coverages protect not just you, but also your resident relatives and passengers in your vehicle. They’re essential protections that help ensure one bad driver’s poor choices don’t derail your financial future. And when you understand the uninsured motorist stacked meaning, you’ll see how these foundational coverages can become even more powerful.

Uninsured Motorist Stacked Meaning: How It Works

The uninsured motorist stacked meaning is about combining protection. Instead of having just one vehicle’s coverage, you stack the Uninsured/Underinsured Motorist (UM/UIM) limits from multiple vehicles to create a larger pool of protection. For example, if you have two cars, each with $50,000 in UM coverage, stacking gives you $100,000 in total coverage instead of just $50,000. This can be a financial lifesaver, as serious accidents can easily result in six-figure medical bills.

The Core of Uninsured Motorist Stacked Meaning: Vertical vs. Horizontal Stacking

There are two main ways to stack your coverage, and understanding both helps you grasp the full uninsured motorist stacked meaning.

Vertical stacking occurs when you have multiple cars on a single insurance policy. If you insure two cars on the same policy, each with $50,000 in UM coverage, vertical stacking lets you combine them for $100,000 in total protection.

Horizontal stacking works across multiple separate policies in your name or household. If you have one car on Policy A and another on Policy B, horizontal stacking allows you to combine the UM/UIM limits from both.

Not every state allows both types of stacking, and insurance companies have different rules. The good news is that both Massachusetts and New Hampshire permit stacking, giving you more options to protect your family.

How Stacking Protects You, Your Family, and Your Passengers

The protection from stacking is broad. Your stacked coverage follows you, whether you’re driving your own car, borrowing another, or even as a pedestrian.

Resident relatives in your household get this same protection. Your spouse and children are covered whether they’re driving one of your insured vehicles or someone else’s car. Even if they’re injured as pedestrians or cyclists by an uninsured driver, your stacked coverage can provide financial support.

Passengers in your vehicle also benefit from your stacked coverage. When you’re giving friends or family a ride, you’re not just sharing your car; you’re sharing your protection. This comprehensive safety net extends far beyond the single vehicle involved in an accident, making stacked coverage a smart choice for families who want maximum security.

What Can (and Can’t) Be Stacked?

Understanding what types of coverage can be stacked helps clarify the uninsured motorist stacked meaning and prevents confusion.

The main coverage that can be stacked is Uninsured/Underinsured Motorist Bodily Injury (UMBI/UIMBI). This is designed to protect people when other drivers don’t have enough insurance.

However, several types of coverage typically cannot be stacked. Liability coverage protects others if you cause an accident, and those limits are fixed per incident. Collision coverage pays for damage to your specific vehicle, so it’s tied to that car. Comprehensive coverage works the same way, covering your individual vehicle against theft or weather damage. You can learn more about these coverage types in our guide on collision vs. comprehensive coverage.

Most states also don’t allow stacking of Uninsured/Underinsured Motorist Property Damage (UMPD) since your collision coverage typically handles vehicle damage.

When we talk about the uninsured motorist stacked meaning, we’re focusing on the bodily injury protection that can make the biggest difference in your financial recovery.

Stacked vs. Unstacked Insurance: A Head-to-Head Comparison

With an unstacked policy, your UM/UIM coverage is limited to the amount selected for the specific vehicle in the accident. Even with three cars on your policy, each with $50,000 in coverage, you can only access that single $50,000 limit.

A stacked policy lets you combine the coverage limits from all your vehicles. Those same three cars with $50,000 each would provide $150,000 in total protection. This is the power of the uninsured motorist stacked meaning.

The Pros and Cons of Stacking Your Coverage

| Feature | Stacked Insurance | Unstacked Insurance |

|---|---|---|

| Total Coverage Amount | Combined limits from all vehicles (e.g., 2 cars × $50K = $100K) | Single vehicle limit only (e.g., $50K maximum) |

| Premium Cost | Higher monthly cost (typically $20-$40 more) | Lower monthly cost |

| Flexibility | Covers you in other vehicles and as a pedestrian | Limited to the specific vehicle involved |

| Ideal Candidate | Multi-car households, frequent drivers, those wanting maximum protection | Single-car owners, budget-conscious drivers with lower risk tolerance |

Stacked coverage costs more, typically an increase of $20 to $40 per month, because you are buying significantly more protection. In return, you get dramatically higher coverage limits, which can be the difference between financial recovery and bankruptcy after a serious accident.

The broader protection scope is another major advantage. With stacked coverage, you and your family are often protected even when not in one of your insured vehicles, such as when you are a pedestrian or in a rental car.

On the flip side, stacked coverage isn’t available everywhere. While both Massachusetts and New Hampshire allow it, some states and insurers restrict this option.

Debunking the Uninsured Motorist Stacked Meaning in Real-World Scenarios

A real-world example illustrates the uninsured motorist stacked meaning. The Johnson Family owns two cars in Massachusetts, each with $50,000 per person / $100,000 per accident in UM/UIM coverage. Their daughter is injured by an uninsured driver, resulting in $75,000 in medical bills.

With stacked coverage: They can combine limits for $100,000 per person in protection, fully covering the $75,000.

With unstacked coverage: They are limited to the $50,000 from the single vehicle involved. After insurance pays its maximum, the Johnson family would still owe $25,000 out-of-pocket.

This difference highlights why understanding stacked coverage is so important.

Are There Restrictions on Stacking?

While stacking offers powerful protection, it’s not available in every situation. Single-vehicle policies can’t be stacked because there’s nothing to combine.

Some drivers reject stacking in writing to keep their premiums lower. Insurers in many states must offer stacking, but you can formally decline it. If you’ve signed such a rejection, your coverage will remain unstacked.

Business vehicles and motorcycle policies often have different rules, and your insurer might restrict stacking options for them.

Each state handles stacking differently. We’re fortunate that both Massachusetts Auto Insurance Requirements and New Hampshire Auto Insurance Requirements allow drivers to stack their coverage, giving our clients this valuable protection option.

Is Stacked Insurance Right for You?

Deciding whether to stack your coverage is a personal choice based on your family’s needs. The uninsured motorist stacked meaning is most valuable when it aligns with your circumstances. The decision involves weighing the modest premium increase against potentially life-changing financial protection.

Who Should Consider Stacking?

If you’re nodding along to any of these scenarios, stacking is probably worth serious consideration.

- Drivers with multiple vehicles are the primary candidates.

- Households with multiple drivers (like teens or commuting spouses) multiply their risk and benefit from higher limits.

- Individuals with high-deductible health plans may find stacking especially useful to cover out-of-pocket medical costs.

- People who frequently have passengers can extend this improved protection to everyone in their car.

- Commuters and frequent drivers face more time on the road and more exposure to risk.

- Anyone seeking maximum financial protection should consider stacking for the peace of mind that comes from knowing you’ve maximized your coverage.

How Stacking Works with PIP and Other Coverages

It’s important to understand how your coverages work together. Personal Injury Protection (PIP) and Medical Payments (MedPay) are your first line of defense, covering initial medical costs regardless of fault. In Massachusetts, PIP is required.

Once those limits are exhausted, your UM/UIM coverage takes over. For example, if you have $8,000 in PIP but $60,000 in total damages, you still need $52,000. Unstacked UM of $50,000 would leave you short. Stacked coverage from two vehicles might provide $100,000, easily covering the remaining costs.

This coordination of benefits ensures you’re not left with significant bills from someone else’s mistake. Your stacked UM/UIM coverage acts as a crucial safety net, catching the significant costs that can arise from severe injuries, such as ongoing treatment, lost income, and pain and suffering.

Frequently Asked Questions about Stacked Uninsured Motorist Coverage

We often get questions about the uninsured motorist stacked meaning and how it applies to different situations. Here are the ones we hear most often.

Can I stack my insurance if I only have one car?

No, you cannot stack coverage if you only have one vehicle on your policy. The principle of uninsured motorist stacked meaning is combining coverage from multiple vehicles. With a single car, your UM/UIM coverage is simply the limit you selected for that vehicle.

How much more does stacked insurance cost?

The cost increase for stacking is often more affordable than people expect. While it varies by state, insurer, and coverage amount, the increase typically ranges from $20 to $40 per month for many policies in Massachusetts and New Hampshire. Considering this could double or triple your protection, many families find it a worthwhile investment. The only way to know the exact cost is to get a personalized quote.

Is stacking allowed in Massachusetts and New Hampshire?

Yes! Both Massachusetts and New Hampshire allow drivers to stack their Uninsured/Underinsured Motorist coverage. This gives you a valuable tool to boost your financial protection.

Each state has its own specific rules, which you can learn more about by reviewing Auto Insurance in Massachusetts and Auto Insurance in New Hampshire. While both states permit stacking, insurance company offerings can vary. Some may require you to request it specifically. An experienced agent can help you steer these options.

Our team at Stanton Insurance Agency has been helping families in both states understand and implement stacking strategies for years. We’re well-versed in the specific regulations and can walk you through how it would work for your situation.

Conclusion

Understanding the uninsured motorist stacked meaning empowers you to make a better decision about your protection. Stacking allows your vehicles’ UM/UIM coverages to work as a team, creating a stronger financial shield than one policy could alone.

With about one in eight drivers uninsured, you can’t control others’ choices, but you can control your own protection. Stacking transforms a single safety net into multiple layers. Instead of being limited to one vehicle’s coverage, you might have double or triple that amount available when medical bills rise. This can be the difference between financial recovery and debt.

For a modest premium increase, often just $20 to $40 per month, you gain significant protection. In Massachusetts and New Hampshire, where stacking is allowed, this is especially valuable for families with multiple vehicles and drivers. The peace of mind from knowing you’ve maximized your family’s financial security is priceless.

Every family’s situation is unique, so it’s important to weigh your options. At Stanton Insurance Agency, we help New England families steer these choices. We can review your coverage, explain your options clearly, and provide quotes so you can choose what’s right for you.

Ready to see how stacked coverage could strengthen your financial safety net? Let’s have a conversation about your specific needs.