150cc bike insurance price: Unlock Savings 2025!

Understanding Your 150cc Bike Insurance Price

150cc bike insurance price typically ranges from $15 to $25 per month for minimum liability coverage in Massachusetts and New Hampshire. Here’s what you need to know:

- Minimum Liability Coverage: $15–$25/month ($180–$300/year)

- Full Coverage (Comprehensive + Collision): $40–$80/month ($480–$960/year)

- Key Price Factors: Rider age, location, bike type (scooter vs. sport), driving record, and coverage level

- Massachusetts Requirements: $20,000/$40,000 bodily injury, $5,000 property damage, plus PIP

- New Hampshire Requirements: $25,000/$50,000 bodily injury, $25,000 property damage, plus uninsured motorist

Riding a 150cc scooter or motorcycle in Massachusetts or New Hampshire is a popular choice for its fuel efficiency and easy handling. Like any vehicle, it requires insurance, and understanding what drives your premium can save you money.

Research shows that 150cc bikes sit in a sweet spot for insurance costs. They’re more affordable to insure than larger motorcycles but cost slightly more than 50cc mopeds. Sport-style 150cc bikes may cost more to insure than scooters due to higher perceived risk, while electric models may have different rates based on repair costs.

At Stanton Insurance Agency, we’ve spent more than two decades helping new and experienced riders find the right coverage at the right 150cc bike insurance price. We’ll walk you through how to find affordable, comprehensive protection for your bike.

What is the Average 150cc Bike Insurance Price?

Insurance for a 150cc scooter or motorcycle is budget-friendly. For minimum liability coverage in Massachusetts and New Hampshire, most riders pay between $15 and $25 per month ($180 to $300 per year). This is a great deal compared to larger motorcycles, which can cost $500 or more annually.

Of course, minimum liability only covers damage you cause to others. To protect your own bike from theft, accidents, or weather, you’ll need comprehensive and collision coverage. This “full coverage” typically runs between $40 and $80 per month, or about $480 to $960 annually. The exact cost depends on factors like your bike’s value, your age, and where you live.

Depending on your situation, you might find quotes as low as $14 per month for basic liability. This affordability, combined with fuel efficiency and easy handling, makes 150cc bikes a popular choice for commuters and new riders.

For a deeper dive into how motorcycle insurance costs compare across different bike sizes and styles, check out our guide on How Much is Motorcycle Insurance?

How Engine Size Affects Your Premium

Insurers use engine size to gauge risk. A bigger engine means more speed and power, leading to a higher potential for expensive claims. This is why a 1000cc sportbike costs much more to insure than a 150cc scooter.

A 150cc engine puts your bike right in the middle of the pack. It’s powerful enough to keep up with traffic and handle short highway trips, but it’s not in the same league as the high-performance machines that insurance companies consider high-risk. You’ll pay more than someone riding a 50cc moped but far less than someone on a 600cc sportbike.

Beyond speed and power, insurers also consider theft rates and repair costs. While 150cc bikes aren’t usually the top target for thieves, parts and labor can still add up after an accident. This balance of moderate power and manageable repair costs is exactly what keeps your 150cc bike insurance price reasonable.

Comparing Scooters vs. Motorcycles in the 150cc Class

Even with the same engine size, a 150cc scooter and motorcycle can have different insurance rates due to their design and typical use.

Scooters tend to get the better rates. With their step-through frames and upright seating position, they’re seen as practical commuter vehicles. Most scooter riders stick to city streets and suburban roads, traveling at moderate speeds. Insurers notice this pattern and often reward scooter owners with lower premiums.

Motorcycles in the 150cc class can be a bit different. A standard or commuter-style motorcycle might cost only slightly more to insure than a scooter. But if you’re looking at a sport-style 150cc motorcycle, expect to pay more. Sportbikes—even smaller ones—have a reputation for aggressive riding, higher accident rates, and being more attractive to thieves, all of which translates to higher insurance costs.

The bottom line? When you’re comparing quotes, your 150cc bike insurance price isn’t just about the numbers on the engine—it’s also about what kind of bike you’re riding and how insurers think you’ll use it.

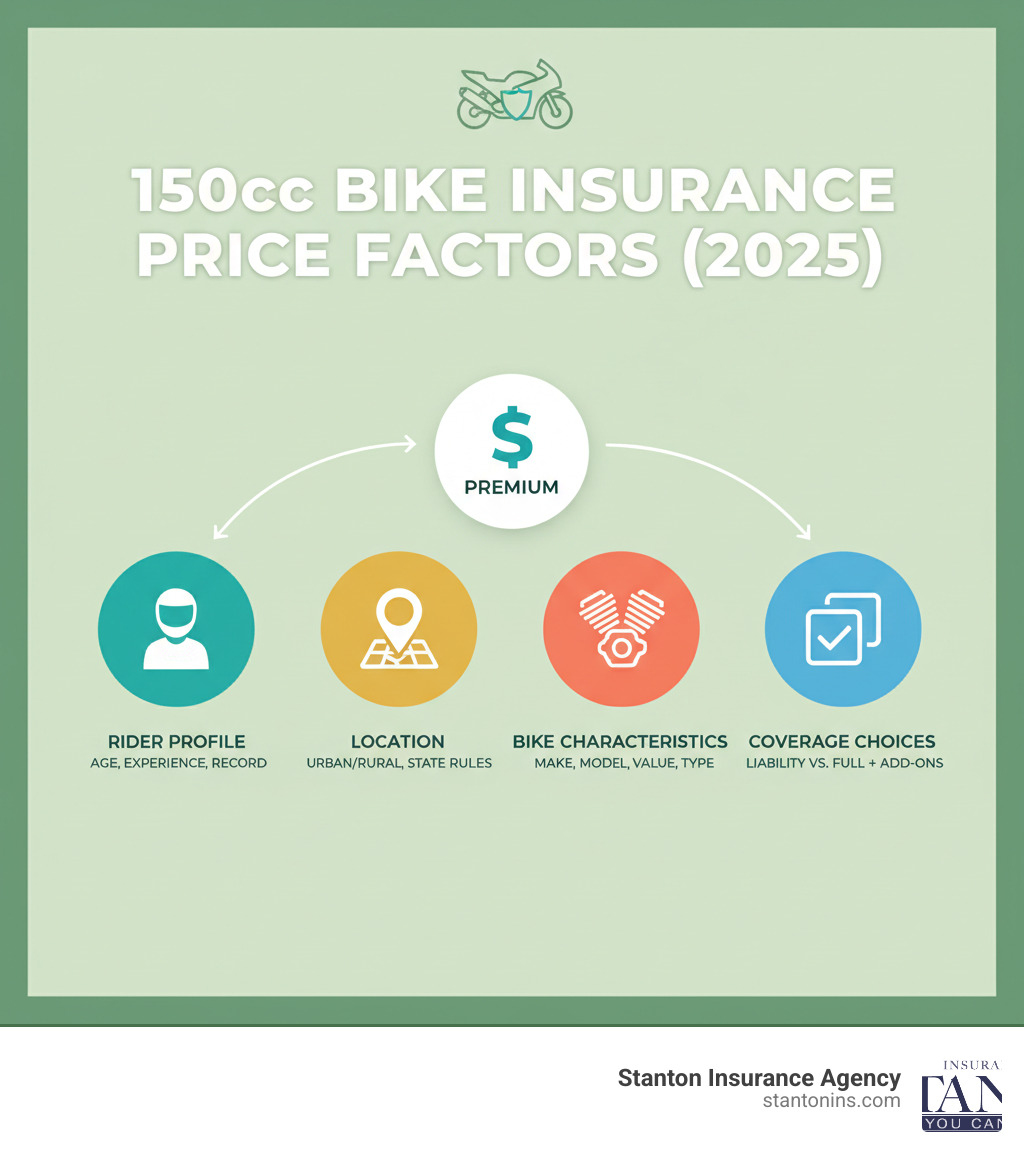

Key Factors That Drive Your Insurance Premiums

Your 150cc bike insurance price is calculated based on your profile, location, and bike. Understanding these factors can help you find ways to lower your rate.

For a more comprehensive look at all the ways insurance applies to your ride, check out our Motorcycle Insurance page.

Your Rider Profile: Age, Experience, and Record

Your personal riding history is a key factor for insurers in assessing risk.

Age and experience are key factors. Riders under 25 typically face higher premiums due to accident statistics. However, an older, inexperienced rider might pay more than a younger rider with years of experience. Experience is a crucial determinant of your rate.

Your driving record is like your report card for the road. Every speeding ticket, traffic violation, or at-fault accident on your motor vehicle record adds dollars to your premium. Most violations fall off your record after three years, so a past mistake won’t affect your rates forever. A clean record leads to significant savings.

Your credit rating can also affect your 150cc bike insurance price, but this varies by state. In New Hampshire, insurers may use a credit-based insurance score to help determine rates, as it can be an indicator of future claims. In Massachusetts, however, the use of credit scores for setting auto and motorcycle insurance premiums is prohibited. This is a key regulatory difference between the two states.

Your Location: Why Massachusetts and New Hampshire Rates Differ

Your location significantly impacts your rate. A scooter in downtown Boston will cost more to insure than one in a quiet New Hampshire town due to higher risk concentration.

Urban areas like Boston or Manchester bring higher traffic density, more opportunities for fender-benders, and unfortunately, more theft. Rural areas typically see fewer accidents and less theft, which translates to lower premiums. It’s simple math for insurers: more claims in an area means higher rates for everyone there.

State regulations also create interesting differences between Massachusetts and New Hampshire. Each state has its own insurance requirements and regulatory environment, which affects how insurers price their policies. While both states experience similar weather and riding seasons, the legal frameworks differ enough to create distinct pricing structures.

Your specific neighborhood’s claims history factors in too. Insurers track accident rates, weather-related claims, and theft statistics down to surprisingly local levels. If your ZIP code has seen a spike in motorcycle thefts recently, everyone in that area might see a bump in their rates.

To explore specific auto insurance quotes and requirements for our region, visit our pages on New Hampshire Auto Insurance and Car Insurance Quotes Massachusetts.

Your Bike’s Profile: Make, Model, and Value

The specific 150cc bike you ride plays a big role in your premium.

The make and model of your bike carries its own reputation. Some 150cc models are known for reliability and low repair costs, while others might have pricier parts or be more attractive to thieves. Even within the same engine size, a sporty-looking model might cost more to insure than a practical commuter scooter, simply because of how insurers perceive the typical rider of each style.

Your bike’s market value directly impacts your 150cc bike insurance price, especially if you’re adding comprehensive and collision coverage. A brand-new 150cc scooter worth $4,000 will cost more to insure than a five-year-old model worth $1,500, because there’s more at stake if something goes wrong. This is particularly important if you’re financing your bike—lenders typically require full coverage until the loan is paid off.

Safety features and anti-theft devices can work in your favor. Installing an alarm system, GPS tracker, or immobilizer shows insurers you’re serious about protecting your investment. Some bikes come with anti-lock brakes (ABS) or other advanced safety features that can qualify you for discounts. These additions might cost a bit upfront, but they can pay for themselves through lower premiums.

The rise of electric scooters adds an interesting wrinkle to the 150cc market. While electric models are quieter and environmentally friendly, their specialized components and batteries can sometimes mean higher repair costs. However, this difference in insurance pricing is often minimal—the fundamental factors of risk and repair expense matter more than the power source.

Choosing the Right Coverage for Your 150cc Bike

Choosing the right insurance for your 150cc bike is about more than meeting legal requirements; it’s about ensuring you’re protected. It’s like finding a helmet that fits your needs and budget.

To help you make the best choice for your ride, we’ve put together some insights on Best Insurance for Motorcycles.

State-Mandated Legal Requirements

Let’s start with the non-negotiables. In both Massachusetts and New Hampshire, you cannot legally register or ride a 150cc scooter or motorcycle without meeting specific insurance requirements. This is state law, designed to protect everyone on the road.

In Massachusetts, the compulsory insurance system requires bodily injury liability with minimums of $20,000 per person and $40,000 per accident. This protects others if you cause an accident. You’ll also need property damage liability of at least $5,000 per accident to cover damage to someone else’s vehicle or property. Massachusetts also mandates Personal Injury Protection (PIP), which is actually pretty helpful—it covers your own medical expenses and lost wages regardless of who caused the accident.

New Hampshire takes a slightly different approach. The Granite State requires bodily injury liability minimums of $25,000 per person and $50,000 per accident, along with property damage liability of $25,000 per accident. New Hampshire also requires uninsured and underinsured motorist coverage, which protects you if someone without adequate insurance hits you. Given that not every rider carries sufficient coverage, this requirement makes a lot of sense.

State minimums set your baseline 150cc bike insurance price, but they only protect others. Minimum liability won’t cover damage to or theft of your own bike.

You can learn more about the necessity of coverage on our Do Motorcycles Need Insurance? page.

Beyond the Basics: Protecting Your Investment

Protecting your 150cc bike, especially if it’s new or financed, requires more than the bare minimum. This is where comprehensive and collision coverage are essential.

Comprehensive coverage protects your bike from non-collision incidents. This includes theft—a significant risk for scooters and smaller bikes—as well as vandalism, fire, natural disasters, and hitting an animal. If your bike is stolen, comprehensive coverage helps you replace it.

Collision coverage pays to repair or replace your bike after an accident, regardless of fault. This includes sliding out on a wet road or being hit by another vehicle. For many, the peace of mind is worth the higher premium.

You can dig deeper into these types of coverage on our pages dedicated to Collision Insurance and Comprehensive and Collision Coverage.

Beyond comprehensive and collision, consider accessory coverage if you’ve added custom parts, upgraded exhaust systems, or special paint to your 150cc bike. Standard policies often don’t fully cover aftermarket additions, so this coverage ensures your personalization investments are protected.

Roadside assistance might seem like a small thing until you’re stuck on the side of Route 128 with a dead battery. This coverage typically includes towing, tire changes, fuel delivery, and lockout services—all for a modest addition to your premium. For the price of a couple of lattes per month, it’s hard to beat the peace of mind.

Some riders also add extra medical payments coverage beyond what PIP provides, especially if they frequently carry passengers. And uninsured motorist property damage can cover your bike if someone without insurance damages it and can’t pay for repairs.

Beyond insurance, protecting your bike physically matters too. Consider investing in quality locks, alarms, and secure parking to reduce theft risk. Store your bike in a locked garage when possible, and use a heavy-duty chain lock when parking in public areas.

The right combination of coverage depends on your bike’s value, how you use it, and your personal comfort level with risk. That’s where talking to a local agent who understands New England riding conditions can make all the difference in finding the right 150cc bike insurance price and coverage balance.

How to Find an Affordable 150cc Bike Insurance Price

Finding an affordable 150cc bike insurance price is about being strategic without sacrificing quality. At Stanton Insurance Agency, we help riders in Massachusetts and New Hampshire find the perfect balance between protection and affordability.

For more general advice on securing cost-effective coverage, check out our guide to Affordable Motorcycle Insurance.

Unlocking Discounts for Your Policy

Qualifying for discounts is one of the smartest ways to lower your 150cc bike insurance price. There are many opportunities, and we know where to find them.

Completing an approved Motorcycle Safety Foundation (MSF) course is a great investment. Not only will you become a safer, more confident rider, but most insurers reward this with a significant premium discount. It’s a win-win that pays dividends long after you’ve finished the course.

Bundling policies is another powerful way to save. If you already have Auto Insurance or home insurance, combining them with your motorcycle coverage under the same provider often opens substantial multi-policy discounts.

Your clean driving record is worth real money. Every year you go without tickets or at-fault accidents strengthens your case for lower rates. Insurance companies consistently reward good riders with better prices.

If you’re a mature rider—typically over 25 or 35 depending on the insurer—you’ll often qualify for an experience discount. Similarly, if you’re a good student, many insurers recognize academic achievement with reduced rates. Installing an anti-theft device on your 150cc bike can also trim your premium, as it directly reduces the risk of theft.

Here’s a money-saving tip that’s often overlooked: paying your premium in full rather than in monthly installments can earn you an upfront discount. And if you’re insuring multiple bikes, ask about multi-vehicle discounts.

We take pride in helping our clients identify and apply for every discount they deserve. It’s not uncommon for riders to find they’re eligible for three, four, or even five different discounts—and those savings add up quickly.

Comparing Quotes and Choosing a Deductible

Insurance rates vary dramatically between providers. That’s why shopping around is essential for finding an affordable 150cc bike insurance price.

As an independent agency, we access multiple top-rated carriers in Massachusetts and New Hampshire. We do the heavy lifting for you, comparing policies to find the best value and coverage for your 150cc bike. This provides multiple quotes without the hassle of calling different companies, uncovering savings you might otherwise miss.

Your deductible choice is another powerful tool for managing your premium. The deductible is the amount you agree to pay out-of-pocket before your insurance kicks in after a claim. Choosing a higher deductible—say $1,000 instead of $500—will lower your premium. However, it’s crucial to select a deductible you’re genuinely comfortable paying if you need to file a claim.

We also help review your coverage levels. For an older, paid-off 150cc bike, a liability-only policy might be sensible. Conversely, for a newer or financed bike, we’ll ensure you aren’t under-insured and vulnerable in an accident.

Working with a local agent who knows Massachusetts and New Hampshire requirements inside and out means you’re not navigating this alone. We’ll help you find the right balance of coverage and cost, ensuring you ride with confidence and peace of mind.

Frequently Asked Questions about 150cc Bike Insurance

Have more questions? We have straightforward answers to common concerns about 150cc bike insurance.

Do I need insurance for a 150cc scooter in Massachusetts or New Hampshire?

Yes, absolutely. In both Massachusetts and New Hampshire, motorcycle insurance is required by law to register and operate a 150cc scooter or motorcycle on public roads. This protects you and others.

In Massachusetts, you’re required to carry specific minimums: Bodily Injury Liability of $20,000 per person and $40,000 per accident, Property Damage Liability of $5,000, and Personal Injury Protection (PIP) to cover your own medical expenses and lost wages regardless of fault.

In New Hampshire, the requirements are slightly different but equally mandatory. You need Bodily Injury Liability of $25,000 per person and $50,000 per accident, Property Damage Liability of $25,000, plus Uninsured and Underinsured Motorist Coverage to protect you if you’re hit by someone without adequate insurance.

Riding without coverage can lead to hefty fines, license suspension, and personal liability for thousands in damages. It’s not worth the risk.

Is insurance for a 150cc bike expensive?

No, insurance for a 150cc bike is generally affordable compared to larger motorcycles or cars. The 150cc bike insurance price typically falls into the budget-friendly category because these bikes are considered moderate-risk by insurers.

For minimum liability coverage, most riders in Massachusetts and New Hampshire pay somewhere between $15 and $25 per month. If you opt for full coverage with comprehensive and collision, you’re looking at roughly $40 to $80 per month, depending on your bike’s value and your personal profile.

A 150cc bike is significantly less expensive to insure than a 600cc sportbike or a heavyweight cruiser. It’s also only slightly more than a 50cc moped. Your exact rate will depend on factors like your age, riding experience, driving record, where you live, and whether you’re riding a scooter or a sport-style motorcycle. But overall, 150cc bikes remain one of the most economical options for two-wheeled insurance.

Does my motorcycle insurance cover theft of my 150cc bike?

This depends on your coverage. Basic liability insurance—the legal minimum—does not cover theft of your bike. It only covers damages you cause to others.

To protect your 150cc bike against theft, you need to add comprehensive coverage to your policy. Comprehensive coverage protects you from theft, as well as vandalism, fire, natural disasters like hail or floods, and even hitting an animal. If your bike gets stolen, comprehensive is what will help you recover its market value so you can replace it.

We strongly recommend comprehensive coverage, especially if your bike is new, financed, or has significant value. The relatively small addition to your premium can save you thousands of dollars if the worst happens. For more information on how comprehensive coverage works alongside collision, visit our detailed guide on Comprehensive and Collision Coverage.

Get the Right Protection for Your Ride

Now that you understand what goes into your 150cc bike insurance price, the next step is finding a policy that fits your life, budget, and gives you peace of mind. Knowing the facts is half the battle; finding the right fit is the real win.

The cheapest premium isn’t always the best deal. Inadequate coverage can be costly after a theft or accident. The key is to find a balance between cost and protection, avoiding both under-insuring and overpaying.

That’s where Stanton Insurance Agency comes in. For over two decades, we’ve helped riders in Massachusetts and New Hampshire find that perfect balance. We take the time to understand your needs to ensure you’re covered correctly, whether you’re a new city commuter or an experienced rural rider.

We believe in building relationships. Our team works with multiple top-rated carriers, shopping on your behalf to present the best options. You get our expertise without the hassle of calling for quotes yourself. We do the legwork so you can focus on the ride.

Ready to get started? We’ll walk you through every step, answer every question, and help you open up every discount you’re entitled to. Your 150cc bike insurance price should reflect smart choices, not guesswork. Let’s make sure you’re protected, confident, and ready to hit the road.