Auto Insurance Manchester NH: Essential 2025

Why Commercial Auto Insurance is Essential for Your Manchester Business

When searching for auto insurance manchester nh, business owners need to understand that commercial coverage differs significantly from personal policies. Here are the key points:

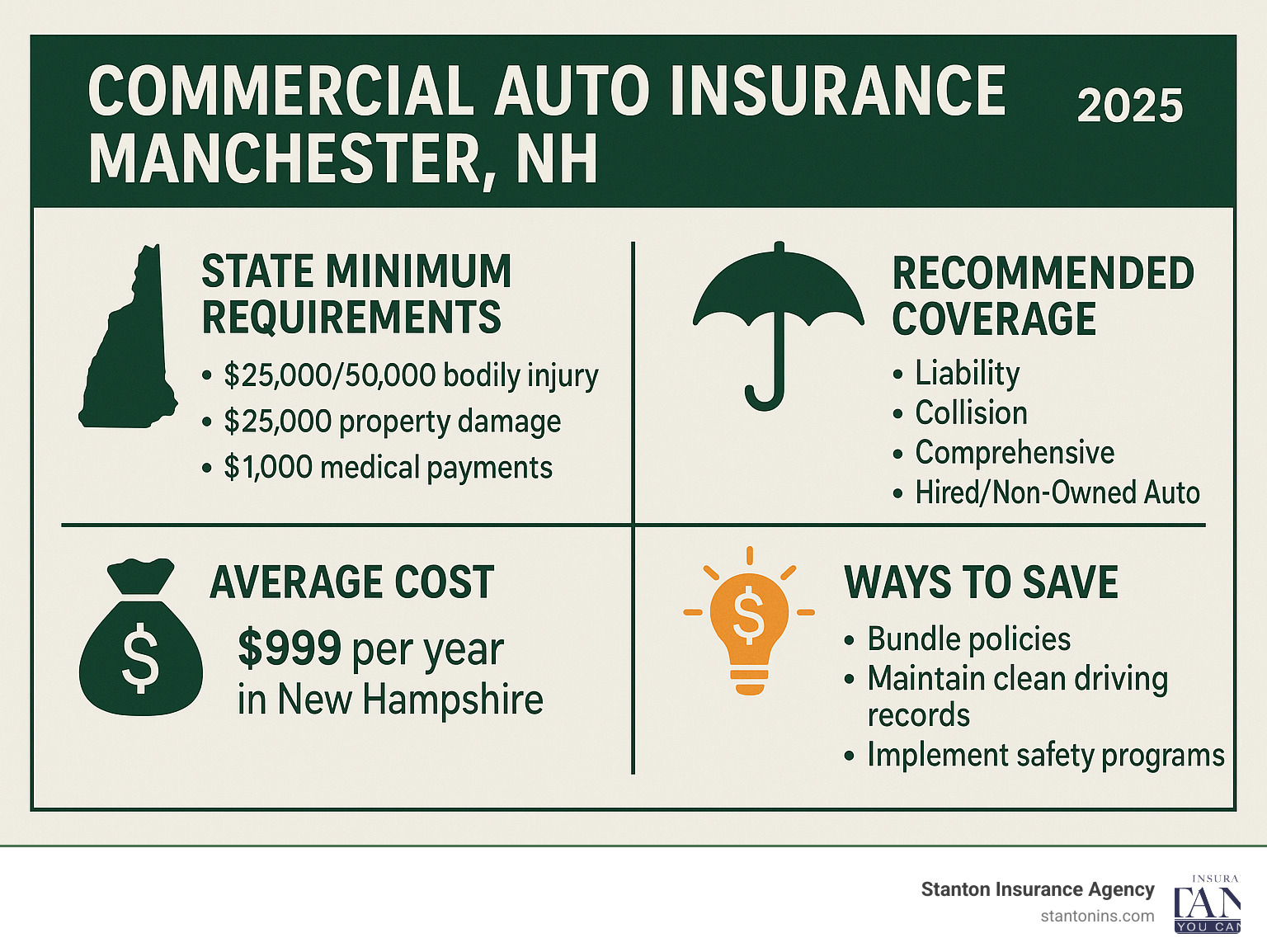

- New Hampshire Requirements: $25,000/$50,000 bodily injury, $25,000 property damage, $1,000 medical payments

- Business vs Personal: Personal auto insurance won’t cover business use of vehicles

- Average Cost: New Hampshire averages $999 annually (35% below national average)

- Coverage Types: Liability, collision, comprehensive, hired/non-owned auto

- Money-Saving Tips: Bundle policies, maintain clean driving records, implement safety programs

Many business owners mistakenly believe their personal auto insurance provides adequate protection. However, if a vehicle is used for work-related tasks—such as transporting goods, carrying equipment, or traveling between job sites—a personal policy will likely deny any claims.

Commercial auto insurance is specifically designed to cover the unique risks and higher liability needs of a business. It’s a non-negotiable part of a comprehensive risk management strategy, protecting you from costly lawsuits, vehicle repair bills, and medical expenses that could otherwise jeopardize your company’s future.

While shopping for Manchester car insurance is straightforward, finding the right New Hampshire insurance agency is the tougher part. This is especially true for commercial coverage, where the stakes are much higher than personal auto insurance.

I’m Geoff Stanton, President of Stanton Insurance, and I’ve spent over two decades helping businesses steer commercial insurance needs, including auto insurance manchester nh policies. My experience in both claims and coverage has shown me how the right commercial auto policy can save a business from financial disaster.

Understanding New Hampshire’s Minimum Requirements

New Hampshire is famous for its unique approach to auto insurance. Unlike most states, it doesn’t strictly require drivers to carry auto insurance. However, this doesn’t mean you’re off the hook! The Granite State operates under a “financial responsibility” law. This means that if you’re involved in an accident and are at fault, you must be able to prove you have the financial means to cover any damages or injuries you caused. For businesses, this is a much higher bar. Operating legally and protecting your valuable assets almost always necessitates robust commercial auto insurance.

At a bare minimum, if you choose to secure coverage to demonstrate financial responsibility, your policy must meet these limits:

- Bodily Injury Liability: $25,000 per person / $50,000 per accident

- Property Damage Liability: $25,000 per accident

- Uninsured/Underinsured Motorist Coverage: Equal to your liability limits

- Medical Payments (MedPay): $1,000 per person

These figures represent the absolute floor. Think of these as the minimum ingredients for a cake – they’ll get you a cake, but probably not a very impressive one. A single serious accident, especially one involving multiple vehicles, significant property damage, or serious injuries, can easily exceed these limits. If that happens, your business would be directly responsible for the remaining costs, potentially putting your assets, profits, and even your future at risk. We strongly advise our Manchester business clients to consider coverage far beyond these minimums to adequately protect themselves. For more detailed information on state regulations, you can always consult the New Hampshire Insurance Department.

Key Commercial Auto Insurance Coverages Explained

Building the right auto insurance manchester nh policy for your business is like constructing a house – you need a solid foundation and the right components to keep everything secure. A robust commercial auto policy isn’t a cookie-cutter solution; it’s carefully crafted from several key coverages that fit your specific business operations in Manchester.

Commercial Liability Coverage forms the bedrock of your protection. This is what stands between your business and financial disaster when accidents happen. It covers bodily injury to others – think medical bills, lost wages, and pain and suffering – plus damage to their property like vehicle repairs or damage to buildings.

Here’s the reality: a single serious accident can result in settlements reaching hundreds of thousands or even millions of dollars. That’s why smart businesses often carry liability limits of $1,000,000 or more. This isn’t just about covering immediate damage; it’s about ensuring your business survives a major claim.

Physical Damage Coverage protects your own vehicles, and it comes in two essential flavors. Collision Coverage is your “oops, I hit that” protection – it pays for damage when your vehicle crashes into another vehicle, object, or overturns. Comprehensive Coverage handles everything else: theft, vandalism, fire, hail storms, floods, or even those unfortunate encounters with deer that seem to love New Hampshire roads.

One coverage that many business owners overlook is Hired and Non-Owned Auto (HNOA) Coverage. This is absolutely critical if your employees ever use their personal vehicles for business errands or if you rent vehicles. When an employee takes their personal car to pick up supplies and gets into an accident, their personal policy might not cover business use. HNOA coverage fills that gap, protecting your business from liability.

Uninsured/Underinsured Motorist (UM/UIM) Coverage addresses a harsh reality: not everyone on the road has adequate insurance, despite New Hampshire’s financial responsibility laws. This coverage protects you, your employees, and your vehicles when you’re hit by someone who either has no insurance or not enough to cover the full damage.

Depending on your industry, you might need specialized protection. Businesses that transport valuable goods need Cargo Coverage to protect items in transit. Contractors with expensive equipment benefit from Single-Deductible Options – when both your tools and the truck carrying them get damaged in the same incident, you only pay one deductible instead of two.

The key is building a policy that leaves no gaps in your protection, whether your vehicles are delivering goods, transporting equipment, or making service calls around Manchester. For more details about comprehensive protection options, you can explore comprehensive car insurance to see how thorough coverage can secure every aspect of your business’s mobile operations.

Factors That Determine Your Auto Insurance Manchester NH Rates

When you’re shopping for auto insurance manchester nh rates, insurers aren’t just pulling numbers out of thin air. They’re carefully evaluating your business like a detective examining clues, looking at everything that might indicate how risky it would be to insure your vehicles.

The good news? New Hampshire drivers typically enjoy lower insurance costs than most of the country. Personal auto insurance here averages around $999 annually—that’s 35% below the national average! But commercial policies play by different rules, with unique risk factors that can push your rates up or down depending on your specific situation.

Your vehicle type and use is probably the biggest factor insurers consider. Think about it: a heavy-duty dump truck hauling gravel through Manchester construction sites faces very different risks than a compact car making occasional client visits. Insurers look at vehicle weight, safety features, how often you’re on the road, and how far you typically travel. The more your vehicles are exposed to potential hazards, the higher your premium will likely be.

Industry matters too. A plumbing contractor racing to emergency calls at all hours faces different challenges than a real estate agent showing homes on weekends. Construction companies, delivery services, and other businesses with vehicles constantly on the move typically see higher rates than office-based businesses with lighter vehicle usage.

Here’s where it gets personal: driving records carry enormous weight in determining your rates. Every employee who’ll be behind the wheel of your company vehicles gets scrutinized. A team of safe drivers is like gold to an insurance company—it signals that you’re serious about safety and less likely to file claims.

Your claims history tells a story too. If your business has had frequent accidents or expensive claims in the past, insurers see that as a red flag. They’re betting that past behavior predicts future risk, so a clean claims record can save you serious money.

Even where you park your vehicles in Manchester can influence your rates. Areas with higher crime rates, more traffic congestion, or frequent weather-related damage might bump up your premium slightly. It’s not usually a huge factor, but it’s one more piece of the puzzle insurers consider.

Finally, you have some control through your coverage choices. Higher liability limits mean more protection but also higher premiums, since you’re asking the insurer to take on more potential risk. On the flip side, choosing a higher deductible can lower your premium because you’re agreeing to shoulder more of the initial cost if something happens.

How Driving History Impacts Your Premiums

Let’s be honest—your employees’ driving records are probably the single most important factor in determining what you’ll pay for commercial auto insurance. Insurance companies treat driving records like a crystal ball, using them to predict future accidents and claims.

Before they’ll even quote you, insurers pull Motor Vehicle Reports for every person who might drive your company vehicles. They’re looking for patterns: speeding tickets, at-fault accidents, DUIs, reckless driving citations—anything that suggests a driver might be more likely to cause problems down the road.

A clean driving record is like having a golden ticket. It tells insurers that your team takes safety seriously and follows traffic laws. This translates directly into lower premiums because you’re seen as a lower risk for future claims.

But here’s the flip side: drivers with multiple violations or a history of at-fault accidents will drive up your rates significantly. In some cases, certain high-risk drivers might even be excluded from your policy entirely.

The smart move? Implement a formal driver screening process before anyone gets behind the wheel of your company vehicles. Regular MVR checks, ongoing safety training, and clear policies about cell phone use while driving aren’t just good business practices—they’re investments in keeping your insurance costs manageable.

Many of our Manchester clients have seen their rates drop after implementing driver safety programs and maintaining strict hiring standards for drivers. It’s one of the most effective ways to control your insurance costs while protecting your employees and business assets.

Smart Strategies to Lower Your Commercial Insurance Costs

Let’s be honest – running a business in Manchester means watching every dollar, especially when it comes to insurance costs. The good news? You don’t have to choose between proper protection and a reasonable price. There are proven ways to bring down your auto insurance manchester nh premiums without cutting corners on coverage.

Bundling your policies is hands down the most effective money-saver we see. When you combine your commercial auto insurance with other business policies like general liability or property coverage, insurers reward your loyalty with significant discounts. It’s the same principle that helps personal customers save when they bundle home insurance with their auto policy, except the savings for businesses are often even better.

Driver safety programs are another smart investment that pays dividends. When you establish clear policies about cell phone use, require defensive driving courses, and maintain regular vehicle inspections, insurance companies take notice. They see you as a business that takes risk seriously, and they’ll often reward that with lower premiums. Plus, safer drivers mean fewer headaches for you as an owner.

The quality of your driving team makes a huge difference too. Hiring drivers with clean records and conducting regular motor vehicle report checks helps keep your rates manageable. Think of it as building a team of safety-minded professionals who happen to also save you money on insurance.

When it’s time to add vehicles to your fleet, choosing wisely can impact your rates for years to come. Vehicles with high safety ratings and modern features like automatic emergency braking or blind-spot monitoring often qualify for discounts. It’s like getting rewarded for making smart business decisions.

Telematics and GPS tracking might sound high-tech, but they’re becoming standard tools for cost-conscious businesses. These devices monitor driving habits and can lead to substantial discounts when they show your drivers are maintaining safe speeds and avoiding harsh braking. Many of our clients are surprised by how much they can save with these systems.

Finally, consider adjusting your deductible strategically. If you can comfortably handle a higher out-of-pocket expense in case of a claim, increasing your deductible can meaningfully reduce your monthly premiums. Just make sure you’re not stretching your cash flow too thin.

The key is finding the right combination of these strategies for your specific business. Every Manchester company is different, and what works for a small delivery service might not be the best approach for a construction company with a large fleet.

Frequently Asked Questions about Manchester Commercial Auto Insurance

Over my years helping Manchester business owners steer auto insurance manchester nh needs, I’ve noticed the same questions come up time and again. These concerns are completely understandable – commercial auto insurance can feel overwhelming when you’re trying to run a business. Let me address the most common questions we hear at Stanton Insurance Agency.

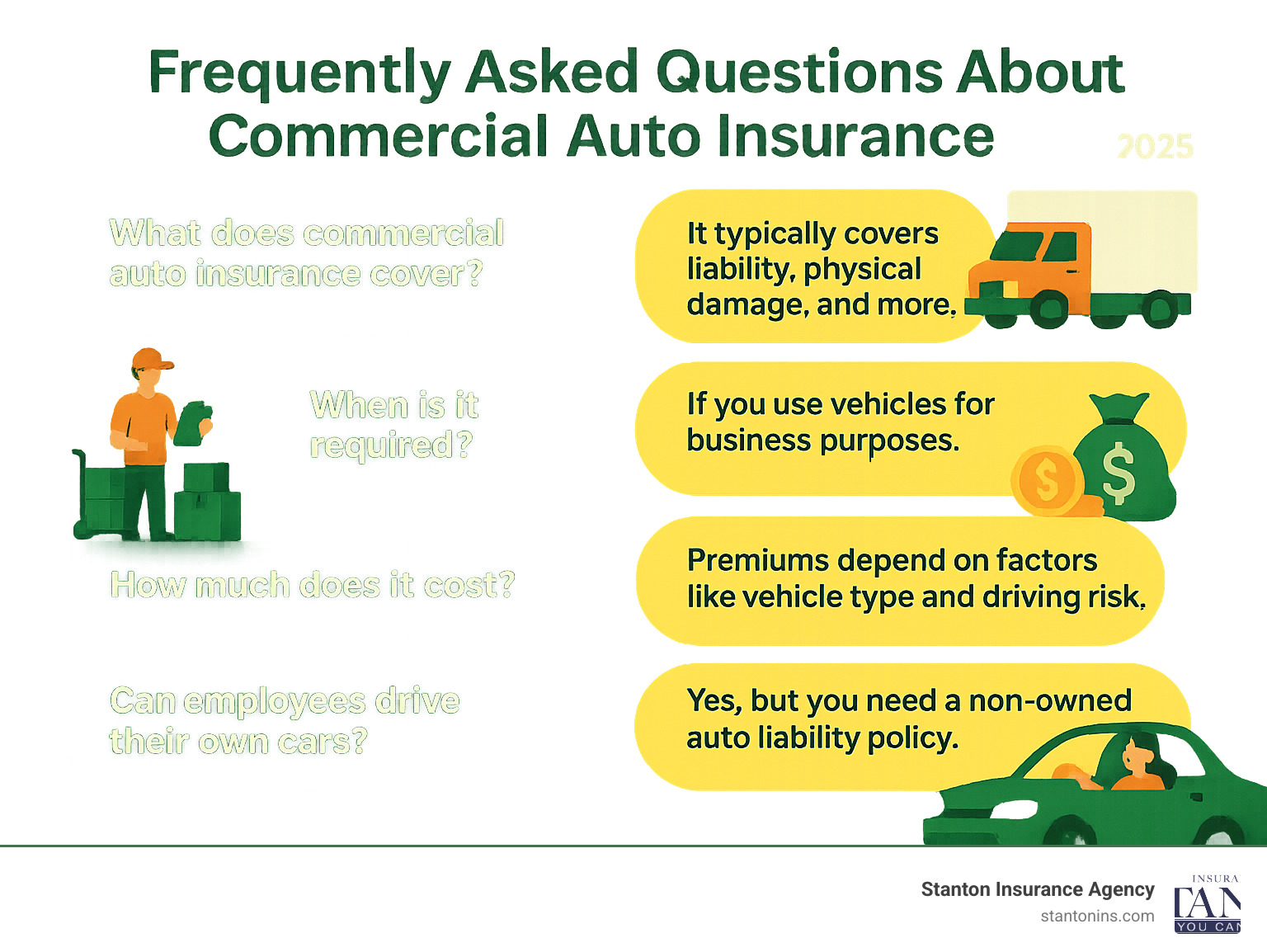

Do I need commercial auto insurance if I use my personal car for work?

This might be the biggest misconception I encounter, and it’s one that could cost you dearly. The short answer is yes, absolutely. Even if you’re just using your personal vehicle to visit clients, pick up supplies, or drive to different job sites, your personal auto policy likely won’t protect you.

Here’s what most people don’t realize: personal auto policies contain what we call “business use exclusions.” This means if you’re running a work errand and get into an accident, your personal insurer could deny your claim entirely. I’ve seen this happen to business owners who thought they were covered, only to find they’re personally responsible for thousands in damages, medical bills, and potential lawsuits.

The solution is either a commercial auto policy or adding a business use endorsement to your personal policy (though this may not provide enough coverage for most businesses). It’s always better to have protection you don’t need than to need protection you don’t have.

What is the average cost of commercial car insurance in Manchester, NH?

I wish I could give you a simple number, but commercial auto insurance costs vary dramatically – much more than personal coverage. While personal auto insurance manchester nh averaged around $999 annually in 2021 (which is great news since that’s 35% below the national average!), commercial policies tell a different story.

Your actual cost depends on so many factors that each quote is truly unique. A small consulting firm with one sedan for client visits might pay a few hundred dollars monthly. Meanwhile, a construction company with multiple trucks and equipment trailers could easily pay several thousand dollars. Industry type, vehicle usage, driving records, and coverage limits all play huge roles in determining your premium.

The only way to know your real cost is through a personalized quote. That’s why we take the time to understand your specific business needs before providing numbers that actually mean something for your situation.

How is commercial auto insurance different from personal auto insurance?

Think of personal auto insurance as a comfortable pair of everyday shoes, while commercial coverage is like specialized work boots – they’re both footwear, but designed for completely different purposes and challenges.

Personal auto insurance covers your daily commute, weekend trips, and personal errands. It’s designed for individual use with relatively predictable risks and lower liability limits that might seem adequate for personal situations.

Commercial auto insurance is built for the business world, where the stakes are much higher. It covers vehicles used for work purposes – whether that’s making deliveries, transporting equipment, or visiting job sites. The coverage limits are typically much higher (often $1 million or more) because businesses face greater liability exposure.

Commercial policies also include specialized coverages you won’t find in personal insurance. Hired and non-owned auto coverage protects you when employees use their personal vehicles for business. Cargo coverage protects goods you’re transporting. These aren’t just nice-to-have features – they’re essential protections for businesses that could face significant financial losses without them.

The underwriting process is different too. While personal insurance focuses on you and your household, commercial coverage evaluates your entire business – from your industry’s risk level to every employee who might drive a company vehicle.

Protect Your Business with the Right Coverage

Navigating commercial auto insurance manchester nh can feel overwhelming at first, but it’s truly one of the smartest investments you’ll make in your business’s future. Think about it – your vehicles aren’t just ways to get from point A to point B. They’re the workhorses that keep your operations running, the mobile offices that help you serve customers, and often the first impression people have of your company rolling down the street.

Here’s the reality: without proper coverage, one unexpected accident could turn your successful business into a financial nightmare. We’ve seen it happen – a single serious collision leading to lawsuits that drain bank accounts, force asset sales, or even shut doors permanently. It’s heartbreaking, and it’s completely preventable.

The good news? You don’t have to figure this out alone. By taking the time to understand your unique risks and choosing coverages that actually fit your business operations, you can build a policy that acts like a safety net for everything you’ve worked so hard to create. Smart cost-saving strategies – like bundling policies or implementing driver safety programs – mean you can get robust protection without emptying your budget.

At Stanton Insurance Agency, we’ve made it our mission to take the complexity out of commercial auto insurance. We’re not interested in selling you the most expensive policy or pushing coverage you don’t need. Instead, we sit down with Manchester business owners like you, listen to how you actually use your vehicles, and design protection that makes sense for your specific situation.

We believe every business deserves trusted protection for valuable assets, whether you’re running a single delivery van or managing a fleet of construction trucks. Our goal is simple: help you drive forward with confidence, knowing that whatever happens on the road, your business will survive and thrive.

Ready to stop worrying about “what if” and start focusing on growing your business? Let’s build you the perfect auto insurance manchester nh policy that keeps you protected without keeping you up at night.

Get a personalized quote for auto insurance in New Hampshire today!