Auto Insurance Claims: 5 Steps to Confidence

Why Understanding Auto Insurance Claims is Essential

No driver wants to file an auto insurance claim, but with over 6.1 million police-reported motor vehicle crashes in the U.S. in 2022, it’s a process many will face. Here’s what you need to know:

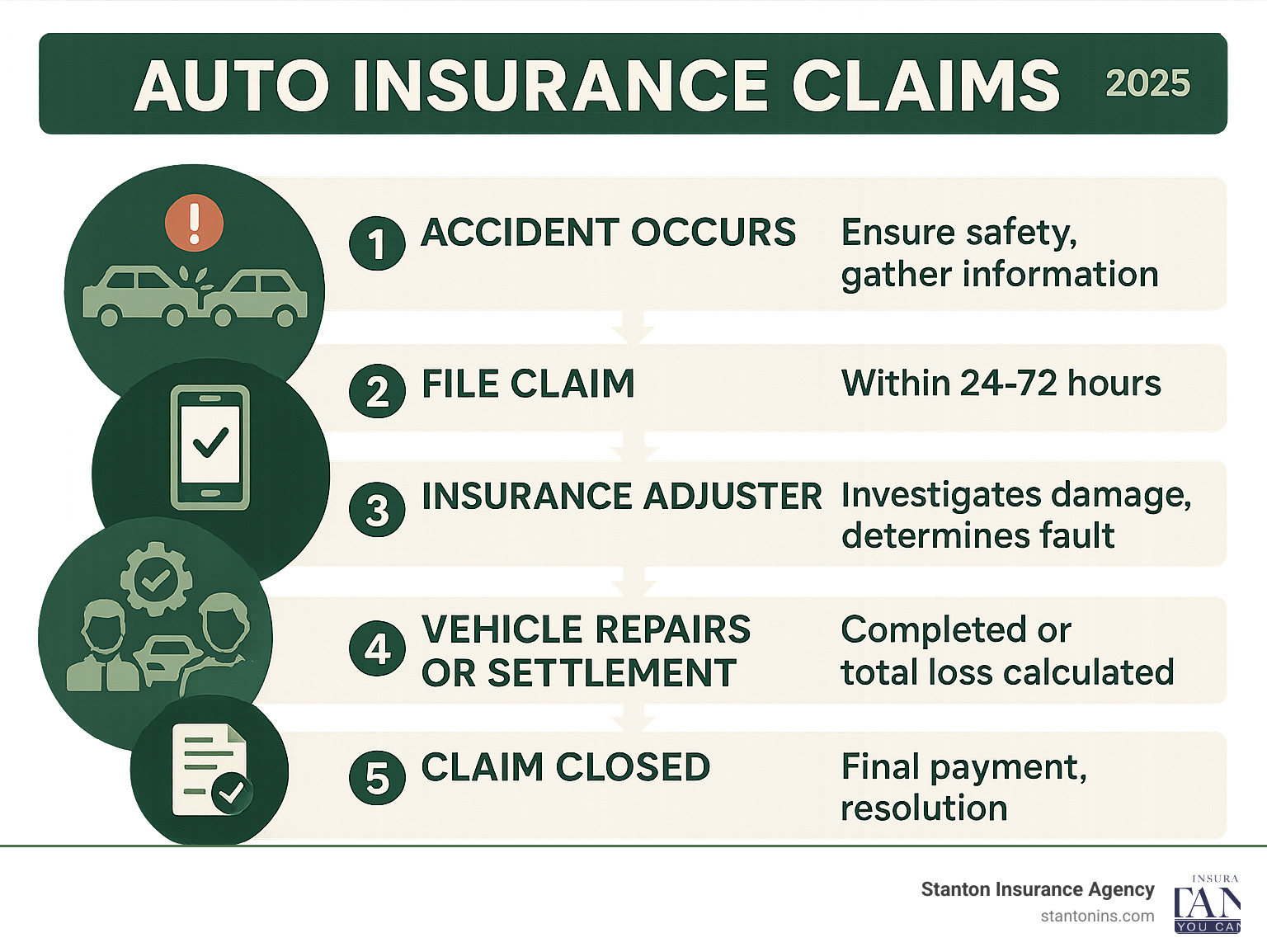

Key Steps in the Auto Insurance Claims Process:

- Report the accident – Contact police and your insurance company within 24-72 hours

- Document everything – Take photos, gather driver information, and collect witness details

- File your claim – Submit through phone, app, or online portal

- Work with the adjuster – They’ll investigate and determine fault

- Complete repairs or settlement – Get your vehicle fixed or receive total loss payment

The average property damage claim in 2022 was $5,200, while bodily injury claims averaged $24,033. These numbers show why having proper coverage and understanding the claims process is so important for protecting your financial well-being.

A car accident is stressful, but the claims process doesn’t have to be. This guide walks you through every step of the auto insurance claims process, from the accident scene to the final resolution. You’ll learn how to file your claim, what to expect during the investigation, and how to handle repairs or total loss settlements.

I’m Geoff Stanton, President of Stanton Insurance Agency. Since 1999, I’ve helped Massachusetts and New Hampshire drivers steer auto insurance claims. My experience shows that informed clients who understand the process have less stress and achieve better outcomes during a difficult time.

First Steps: What to Do Immediately After a Car Accident

The moments after an accident are chaotic. Taking a deep breath and following a clear plan will set the stage for your entire auto insurance claims experience.

Your safety and the safety of others always comes first, but a clear plan can make a difference for your wellbeing and your future claim.

At the Scene: A Step-by-Step Checklist

Feeling shaken is normal, but taking the right steps immediately protects your safety and strengthens your future insurance claim.

Start with safety first – check yourself and any passengers for injuries. If anyone is hurt, call 911 immediately. Your health is the top priority. In 2022, 42,795 people died in U.S. traffic crashes, a sobering reminder to prioritize safety above all else.

Call 911 even for minor accidents. A police report provides an official, unbiased account that is invaluable for your auto insurance claims process. Many insurers require a police report, often within 24 hours to 30 days.

Move to safety when possible. If your car is drivable, pull over to the side of the road. This keeps you out of traffic and prevents more accidents. If your vehicle won’t move, call for a tow truck and remember to grab your valuables before it’s taken away.

Exchange information with everyone involved. This step is crucial for filing your claim. Stay calm and professional, even if the other driver is upset.

Document everything you can. Take photos and videos of the accident scene, including all vehicle damage, road conditions, and traffic signs. The more visual evidence you have, the better. While it’s fresh in your mind, jot down the date, time, location, and what you remember happening.

Don’t admit fault. Stick to the facts when talking with police or other drivers. What seems obvious at the scene can become more complicated later. Let the insurance companies investigate and determine fault.

Here’s what information you should gather at the scene:

- Full name and contact information for all drivers involved

- Insurance company and policy number for each driver

- Driver’s license and license plate numbers from all vehicles

- Vehicle details like make, model, and color for every car involved

- Witness information – names and contact details of anyone who saw what happened

- Police officer details including name, badge number, and the police report number if available

- Visual documentation through photos or videos of the scene, damage, and road conditions

Do your best to gather what you can, stay safe, and know that your insurance company is there to help guide you through the rest of the process.

How to File and Process Your Auto Insurance Claims

Once you’re safe and have gathered information, it’s time to start your auto insurance claims process. Contacting your insurer promptly helps you get back to normal faster. With the average property damage claim at $5,200 in 2022, starting the process correctly saves time and money.

Submitting Your Claim: Online, App, or Phone

Filing a claim today is easier than ever. Insurance companies have created multiple convenient ways to get your claim started.

Calling your agent or the 24/7 claims hotline is ideal for major damage or if your car isn’t drivable. Speaking to a person provides step-by-step guidance, and many insurers can start your claim within 30 minutes.

Mobile apps have revolutionized auto insurance claims. If your car is drivable, you can often start your claim from the scene, upload photos, and track its progress.

Filing online through your insurer’s website offers flexibility. Many portals guide you through each step and allow you to save your progress.

No matter which method you choose, have your policy number and the details you gathered at the scene ready. For more comprehensive information about coverage options, check out our auto insurance page.

Essential Documentation for Your Auto Insurance Claims

Documentation tells your claim’s story. Providing a complete picture helps the process go smoothly, as your insurer needs this information to help you effectively.

The police report serves as the official, impartial record of the incident and carries significant weight.

Photos and videos are invaluable. Capture vehicle damage from multiple angles, the accident scene, road conditions, and traffic signs.

Keep every receipt from accident-related expenses like towing or a taxi ride home. These reasonable costs might be covered under your policy.

If anyone was injured, medical documentation is crucial. With bodily injury claims averaging $24,033 in 2022, proper medical records can significantly impact your settlement.

Don’t forget witness information and contact details for everyone involved. Outside perspectives can clarify what happened.

The Role of the Insurance Adjuster and Fault Determination

After you file, a claims adjuster is assigned to your case. They are trained professionals who investigate what happened to determine the next steps.

Your adjuster will review all evidence, including the police report, photos, and witness statements. They’ll interview everyone involved and inspect the vehicle to assess the damage and estimate repair costs.

Fault determination is when the adjuster applies state laws to determine who was responsible. In Massachusetts and New Hampshire, specific fault standards guide this process. This determination directly affects how your claim is paid.

The adjuster’s job is to be fair and thorough. If you’re found at fault, the claim typically comes out of your liability coverage. If the other driver is at fault, their insurance should handle your damages. Insurance companies maintain claims databases that track your history for several years, which can impact future premiums.

For specific questions about Massachusetts claims, the Frequently Asked Questions about Auto Insurance Claims – Mass.gov provides helpful state-specific guidance.

Understanding Claim Outcomes and Your Options

After the investigation, your adjuster will decide how your auto insurance claims will be resolved. The outcome could be vehicle repairs or a total loss settlement. Understanding these possibilities helps you feel more confident about what comes next.

When Your Vehicle is a Total Loss

Hearing your car is “totaled” means it’s a total loss. This happens when repair costs exceed the vehicle’s actual cash value (ACV) before the accident. Even moderate damage can total an older vehicle.

When your car is declared a total loss, your insurer will pay you the vehicle’s ACV minus your deductible. This settlement is your starting point for replacing your vehicle or paying off a car loan.

If you owe more on your car loan than the settlement amount, you’ll have a gap. This is exactly why gap insurance exists. If you’re curious about this coverage, you can learn more here: What is Gap Insurance?.

Using Recommended Repair Shops vs. Your Own

If your vehicle can be repaired, you’ll need to choose a shop. Your insurer will likely suggest shops from their preferred network.

Recommended shops often streamline communication with your insurer, offer lifetime guarantees on work, and can arrange rental cars directly. This can save you time and stress.

However, you always have the right to choose your own repair shop in both Massachusetts and New Hampshire. Your insurer cannot force you to use their preferred facilities. If you have a mechanic you trust, you are free to use them.

If you choose your own shop, get a written estimate and discuss it with your adjuster beforehand to avoid any surprises about coverage.

What to Do If You Disagree with the Insurer’s Decision

If you feel the adjuster’s decision on fault or the settlement amount is wrong, you have options.

Start with a conversation. Call your adjuster and ask them to explain their reasoning. Present any additional photos, witness statements, or repair estimates you have.

If you can’t resolve the issue with your adjuster, ask to speak with a claims manager. They have more authority to negotiate and may offer a different perspective on your case.

For complex disputes, many states offer mediation services where a neutral third party helps find a resolution. Your state’s Department of Insurance can also investigate complaints if you feel your insurer isn’t following proper procedures.

Being polite but firm shows you’re serious about a fair outcome. If you have an at-fault accident on your record, you can appeal any resulting surcharges: Simple Tips to Appeal Driving Surcharge.

You are not powerless in this process. Auto insurance claims involve negotiations, and you have the right to advocate for yourself.

The Financial Side of a Claim: Deductibles, Premiums, and Special Coverages

Filing an auto insurance claim has financial implications beyond the immediate repairs. Understanding deductibles, potential premium increases, and special coverages will help you make smarter decisions.

What is a Deductible and How Does It Work?

Your deductible is the amount you pay out-of-pocket for a claim before your insurance coverage begins. This cost-sharing model helps keep premiums affordable.

For example, if you have a $500 collision coverage deductible and your car needs $3,000 in repairs, you’ll pay the shop the first $500, and your insurer covers the remaining $2,500.

The deductible you choose affects your premium. Higher deductibles mean lower monthly payments, while lower deductibles mean higher premiums but less out-of-pocket cost per claim. For more details, visit our page on collision coverage.

Most deductibles apply to comprehensive and collision claims. Your liability coverage, which pays for damage you cause to others, typically doesn’t have a deductible.

How Auto Insurance Claims Affect Your Premium

Many drivers worry about how a claim will affect their premium. Filing an auto insurance claim, especially an at-fault one, will likely increase your premium at renewal.

Insurance companies view claims as a predictor of future risk. At-fault accidents signal higher risk, which translates to higher rates. The impact depends on the accident’s severity, your driving history, and your insurer’s rating system.

Insurers share claims information through databases, so your accident history follows you. While not-at-fault claims typically have minimal impact, they are still recorded. For perspective, a speeding ticket can raise rates by about 20%, while a DUI can cause a 70% increase. An at-fault accident may increase rates by 15% to 55%. With average full coverage premiums in Massachusetts and New Hampshire often ranging from $1,200 to $1,800 annually, this financial impact can last for years.

Special Coverages: Accident Forgiveness and Glass Repair

Fortunately, there are ways to protect yourself from some financial consequences. Smart insurers offer special coverages to soften the blow.

Accident Forgiveness is an optional coverage that prevents your rates from increasing after your first at-fault accident. It’s valuable for good drivers who want to protect their record and discounts.

Glass coverage addresses windshield chips and cracks, with rules that vary by state. In Massachusetts, specific glass coverage is available, often with a $0 or low deductible, and a glass claim will not affect your premium. In New Hampshire, glass repair is usually covered under your comprehensive policy and subject to that deductible, though you can often buy down the deductible for glass. These claims typically don’t count against your record, helping you avoid premium increases.

The glass repair process is usually quick. Some insurers let you contact approved glass shops directly, and the shop handles the paperwork. For guidance on handling windshield damage, check out our guide: More info about Cracked Windshield: Easy Fix.

Understanding these financial aspects of auto insurance claims helps you make informed decisions and gives you realistic expectations about costs.

Frequently Asked Questions about Auto Insurance Claims

We’ve compiled some of the most common questions we hear from clients about auto insurance claims at Stanton Insurance Agency.

How long does the auto insurance claims process typically take?

The timeline for an auto insurance claims varies. Simple claims with minor damage might resolve in a week or two, especially when using a mobile app for submission. However, claims involving injuries, disputed fault, or multiple parties can take several weeks or months. Total loss claims also take longer as the adjuster must determine the vehicle’s actual cash value and negotiate the settlement.

You can help speed things up by promptly providing all requested documentation and staying in regular contact with your adjuster. The more organized and responsive you are, the smoother the process will be.

What should I do if the other driver is uninsured?

Being hit by an uninsured or underinsured driver is a real possibility that can leave you feeling helpless. Fortunately, Uninsured Motorist (UM) coverage is your financial lifeline in this situation. This coverage steps in when the at-fault driver has no insurance to pay for your injuries or vehicle damage.

In Massachusetts, UM coverage is mandatory, while in New Hampshire, it’s optional but highly recommended. UM coverage protects you by paying for medical expenses, lost wages, and sometimes vehicle repairs when the other driver can’t. Without it, you might have to pursue the uninsured driver personally for damages, which is often a lengthy and unsuccessful process.

For more details on why this coverage is so important, check out our guide: Do You Need Uninsured Motorist Coverage?

Should I file a claim for minor damage?

Deciding whether to file a claim for minor damage is tricky. The key is to get a repair estimate first.

If your repair costs are less than or only slightly more than your deductible, paying out of pocket often makes financial sense. For example, with a $500 deductible and a $400 repair, filing a claim means you’d pay the full $400 anyway and still risk a premium increase.

If the damage estimate is significantly higher than your deductible—say, $1,200 in repairs with a $500 deductible—then filing a claim usually makes sense, as you’d save $700.

Even small claims can appear on your driving record and potentially impact your rates for several years. When in doubt, call us. As your insurance agent, we can help you weigh the pros and cons based on your specific situation.

Beyond Auto: Other Claims We Help With

While this guide focuses on auto insurance claims, unexpected events can happen anywhere. At Stanton Insurance Agency, we help clients steer all kinds of claims, from home to travel, because knowing what to do when disaster strikes is always important.

For travel insurance claims, such as a medical emergency or trip cancellation, act quickly. Contact your administrator, keep all receipts, and document everything with photos. The right documentation makes all the difference.

Home insurance claims feel personal, but the process is similar to auto claims. Your insurer will need the date and cause of loss, descriptions of the damage, photos, and a police report for theft or vandalism.

Water damage requires immediate action. If safe, turn off your main water supply, document everything with photos, and move undamaged items. For wind or hail damage, secure your property by covering broken windows or tarping the roof, then list everything affected. Keep receipts for emergency repairs, as these costs are often covered.

If your home is robbed, call the police immediately and avoid touching anything. Once you have a police report number, create a detailed inventory of stolen items. Old receipts and appraisals are invaluable here.

Whether it’s a cracked windshield or a flooded basement, the principles are the same: act quickly, document thoroughly, and ask for help. We’re here to guide you through any claim, protecting what matters most.

Your Trusted Partner in Navigating Claims

Navigating auto insurance claims is overwhelming, but you don’t have to do it alone. Understanding the process and your rights is the first step, but having a trusted insurance professional in your corner makes all the difference.

As your personal guide through the insurance maze, we help you understand the adjuster’s decisions, explain the reasoning, and advocate for you when things get complicated. We know the right questions to ask and what documentation will strengthen your case.

At Stanton Insurance Agency, we’ve been helping Massachusetts and New Hampshire drivers for decades. We know how frustrating it is to deal with repairs, rental cars, and paperwork while trying to get life back to normal. That’s why we’re committed to providing expert guidance and dedicated support when you need it most.

Our role extends beyond selling a policy. We help you understand coverage before an accident, guide you through the claims process during a stressful situation, and ensure you have the right protection moving forward. Whether you need a coverage review or help understanding options like accident forgiveness, we’re here.

Ready to get the peace of mind that comes with proper coverage and expert support? Contact us today for a comprehensive review of your auto insurance needs. Because when life throws you a curveball, you deserve a team that’s got your back.