Umbrella policies for rental properties: 1 Ultimate Shield

Why Landlords Need Financial Protection Beyond Standard Coverage

Umbrella policies for rental properties provide additional liability coverage that kicks in when your standard landlord insurance limits are exceeded. Here’s what landlords need to know:

- Purpose: Extends liability coverage beyond your primary policy limits (typically $200,000-$1,000,000)

- Cost: Generally $150-$350 per year for $1 million in additional coverage

- Coverage: Protects against lawsuits for bodily injury, property damage, libel, slander, and wrongful eviction

- Requirements: Must have underlying landlord insurance policy first

- Types: Personal umbrella (1-2 properties) or commercial umbrella (multiple properties/LLCs)

Building a profitable rental portfolio is the American dream for many investors. But as one landlord found when a tenant’s slip-and-fall injury resulted in a $1.2 million lawsuit, standard insurance limits aren’t always enough to protect your hard-earned assets.

The median award in premises liability cases is $90,000, but catastrophic incidents can easily exceed your primary policy limits. When a single lawsuit threatens not just your rental income but your entire financial future, an umbrella policy becomes your most critical line of defense.

Standard landlord insurance covers property damage and basic liability, but umbrella policies for rental properties provide that extra layer of protection when disaster strikes. They’re surprisingly affordable – often just a few hundred dollars per year – yet can save you from financial ruin.

I’m Geoff Stanton, and I’ve spent over two decades helping property owners in Massachusetts and New Hampshire protect their investments through comprehensive insurance strategies. At Stanton Insurance, I’ve seen how umbrella policies for rental properties can mean the difference between a manageable claim and personal bankruptcy for landlords.

What is an Umbrella Policy and How Does It Differ from Landlord Insurance?

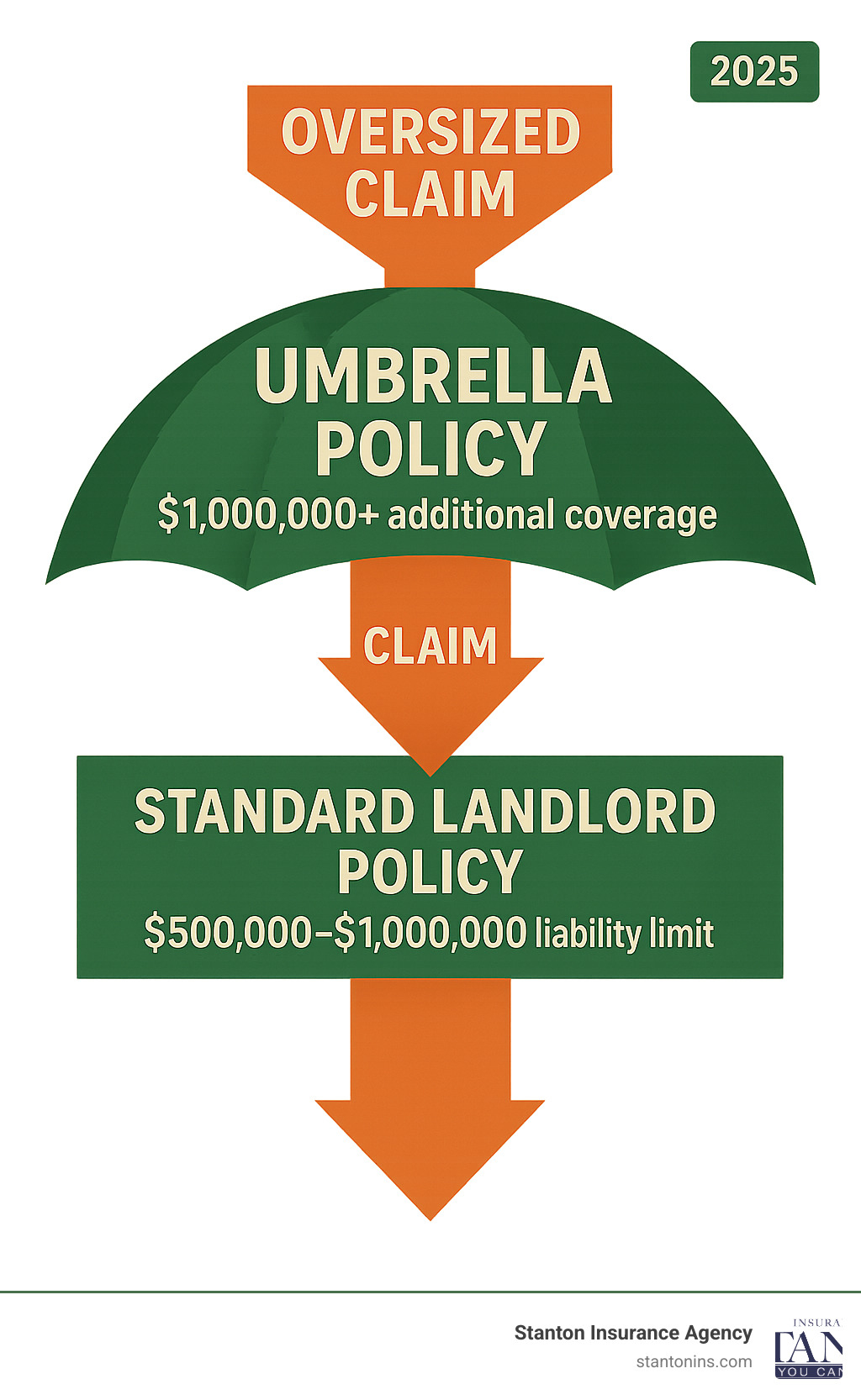

Think of umbrella policies for rental properties as your financial safety net when everything else fails. An umbrella policy is excess liability insurance that swoops in when your regular landlord insurance has reached its limits and tapped out.

Here’s the thing – your standard landlord policy might cover you up to $500,000 or $1 million in liability claims. That sounds like a lot, right? But in today’s world, a single serious accident can easily blow past those limits. A tenant suffers a traumatic brain injury from a fall, or someone drowns in your property’s pool – suddenly you’re looking at medical bills, lost wages, and pain and suffering awards that can reach into the millions.

That’s where your umbrella policy becomes your financial superhero. It provides an additional layer of protection that can extend your coverage by another $1 million, $2 million, or even more. For most landlords, this extra protection costs just a few hundred dollars per year – a small price to pay for potentially saving your entire financial future. You can learn more about the basics at What is Umbrella Insurance?.

How an Umbrella Policy Works

Your umbrella coverage sits patiently in the background, waiting to spring into action only after your primary policy limits are completely exhausted. It’s like having a backup quarterback who only enters the game when your starter gets injured.

Let’s say a visitor slips on ice at your rental property and suffers serious injuries. After a lengthy court battle, they’re awarded $1.2 million in damages. If your apartment building insurance has a $1 million liability limit, that policy pays out its maximum first. Then your umbrella policy kicks in to cover the remaining $200,000, plus any additional legal fees.

Without that umbrella coverage, you’d be personally responsible for that extra $200,000 – and potentially much more when you factor in your own legal costs. Your personal savings, your home, even your other rental properties could be at risk. The umbrella policy acts like a financial firewall, protecting your personal assets from the flames of a major lawsuit.

Landlord Insurance vs. Umbrella Policy

Here’s something crucial to understand: umbrella policies for rental properties don’t replace your regular landlord insurance – they work together like a tag team.

Your landlord insurance is the workhorse that handles the day-to-day risks. It covers property damage when a pipe bursts or a fire damages your building. It protects your rental income if the property becomes uninhabitable. It even covers some of your personal property, like appliances you provide to tenants. Most importantly, it provides that first layer of liability protection for accidents that happen on your property.

But here’s where it gets interesting – your umbrella policy is laser-focused on just one thing: excess liability coverage. It won’t fix your roof, replace your furnace, or cover lost rent. Think of it as a specialist that only handles the big, scary liability claims that could otherwise wipe out your wealth.

This partnership between your landlord policy and umbrella coverage creates a comprehensive shield around your rental business. Your landlord insurance handles the common, predictable risks, while your umbrella policy stands guard against those rare but potentially catastrophic events that could otherwise end your investing career.

The High Stakes of Landlording: Common Liabilities You Face

As a property owner, you’re responsible for maintaining a safe environment for tenants and visitors. When you fall short of this responsibility, the financial consequences can be devastating. According to industry data, the median award in premises liability cases is $90,000, but severe incidents can easily result in judgments worth millions.

Picture this: a tenant slips on an icy walkway outside your property and suffers a traumatic brain injury. What started as a simple maintenance issue could now threaten your entire financial future. Without proper protection through umbrella policies for rental properties, you might find yourself facing bankruptcy over a single accident.

The reality is that landlords face an incredibly broad spectrum of potential liabilities. It’s not just about obvious hazards like broken stairs or icy sidewalks. Even seemingly minor oversights can lead to major lawsuits that quickly exceed your standard policy limits.

Common Landlord Liabilities

Slip and fall accidents represent one of the most frequent and costly claims landlords face. In Massachusetts and New Hampshire, landlords have a duty to use reasonable care to keep common areas safe, especially concerning potential hazards like icy walkways, broken stairs, or uneven flooring, which can quickly turn into six-figure lawsuits. A tenant needing extensive medical care after a serious fall can easily push damages well beyond your standard policy limits.

Dog bite incidents create another significant liability exposure. If a tenant’s dog attacks someone on your property, you could be held partially responsible. This risk is heightened in states like Massachusetts, which has a strict liability dog bite statute, meaning a landlord could be held liable even if they didn’t know the dog was dangerous.

Properties with swimming pools carry dramatically higher risk profiles. The “attractive nuisance” doctrine means you could face catastrophic injury or drowning claims, even from unauthorized visitors or trespassers who are drawn to the water feature.

Inadequate security claims arise when break-ins or assaults occur due to your failure to provide reasonable safety measures. In Massachusetts, for example, the State Sanitary Code mandates specific security features like working locks on all doors and windows. Failure to comply makes these legal requirements, not just nice-to-have amenities, and can lead to significant liability.

Wrongful eviction lawsuits can result from attempting to remove tenants without following proper legal procedures. These cases often involve damages for emotional distress, temporary housing costs, and significant legal fees.

Here’s one that surprises many landlords: libel and slander claims can emerge from heated disputes with tenants or inappropriate responses to online reviews. These “personal injury” claims are typically covered by umbrella policies but excluded from standard landlord insurance.

Failure to inform tenants about hazardous conditions during repairs creates another liability trap. If you’re fixing a handrail but don’t direct tenants to use alternate stairs, any resulting accidents could become your financial responsibility.

The common thread in all these scenarios? A single incident can generate claims that far exceed typical landlord insurance limits, making umbrella coverage an essential safeguard for your rental business.

A Deep Dive into Umbrella Policies for Rental Properties

When you’re building your rental portfolio, understanding umbrella policies for rental properties isn’t just helpful—it’s essential for protecting everything you’ve worked to build. These policies might seem complex at first, but they’re actually quite straightforward once you break them down.

The beauty of umbrella policies lies in their simplicity and affordability. For just a few hundred dollars a year, you can add millions in additional protection to your rental business. It’s like having a financial bodyguard that only costs you about a dollar a day.

What’s Covered (and What’s Not)

Umbrella policies for rental properties cast a much wider protection net than your standard landlord insurance. They cover the big three liability areas: bodily injury, property damage liability, and personal injury liability. That last category is particularly important because it includes things like libel, slander, false arrest, malicious prosecution, and even shock and mental anguish claims.

Here’s where it gets interesting—umbrella policies can sometimes provide “first dollar” coverage for specific claims that your regular policy might not touch. Think about a heated argument with a difficult tenant that escalates into a defamation lawsuit. Your standard landlord policy probably won’t help you there, but your umbrella policy might step in immediately.

But there are limits to what’s covered. Your umbrella policy won’t pay for your own injuries or damage to your own property—it’s designed to protect you when you’re liable for someone else’s damages. It also won’t cover intentional or criminal acts you commit. And here’s a crucial point: if you only have a personal umbrella policy, it likely won’t cover business-related claims due to “business pursuits” exclusions.

How Much Does an Umbrella Policy Cost?

This is where most landlords are pleasantly surprised. According to industry data, a $1 million umbrella policy typically costs between $150 and $300 per year. That’s less than most people spend on their monthly coffee habit!

The exact cost depends on several factors. The number of rental units you own is a big one—more properties generally mean slightly higher premiums. Your location matters too—rates can vary between different areas in Massachusetts and New Hampshire based on local risk factors. Your underlying policy limits and personal risk profile (like your claims history or whether you have high-risk features like pools) also influence the price.

Each additional million in coverage typically adds just $50 to $75 to your annual premium. When you think about it, that’s incredibly cost-effective protection. For a personalized quote that reflects your specific rental portfolio, consider getting an apartment building insurance quote.

Personal vs. Commercial Umbrella Policies for Rental Properties

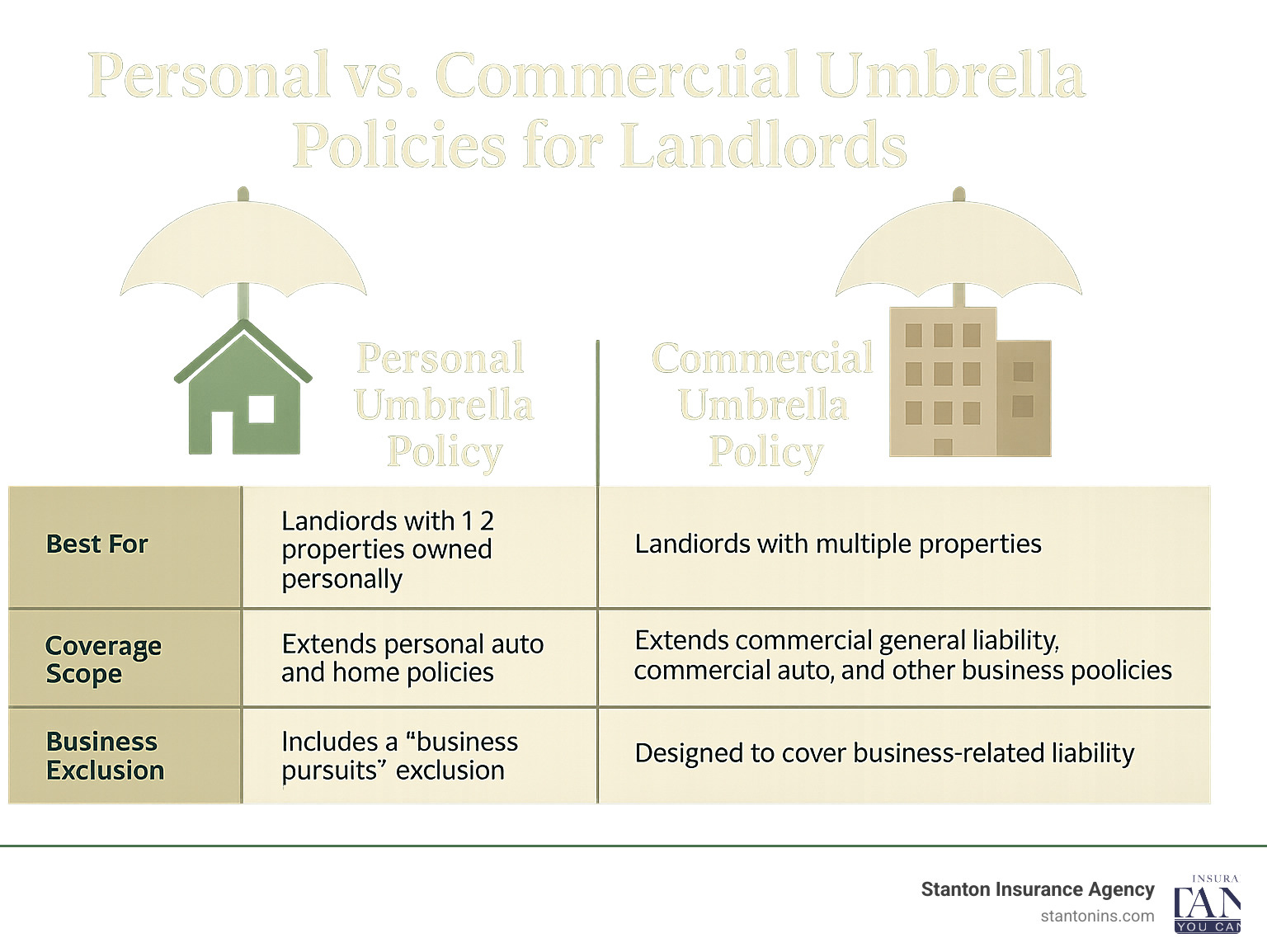

This distinction trips up many landlords, but it’s absolutely critical to get right. The type of umbrella policy you need depends entirely on how you own your properties and how many you have.

If you own just one or two properties in your personal name—especially if you live in a multi-family home and rent out the other units—a personal umbrella policy might work perfectly. This type extends the liability coverage from your personal home and auto insurance policies.

But here’s where it gets tricky. If you own multiple properties or hold any properties in an LLC or trust, you’ll almost certainly need a commercial umbrella policy. Why? Personal umbrella policies typically include “business pursuits” exclusions. If the insurance company considers your rental activities a business (which they often do with multiple properties), your personal umbrella policy might leave you completely exposed when you need it most.

Commercial umbrella policies are specifically designed to work with your commercial general liability policies. They understand that you’re running a rental business and provide coverage custom to those unique risks.

| Feature | Personal Umbrella Policy | Commercial Umbrella Policy |

|---|---|---|

| Best For | Landlords with 1-2 properties owned personally; Landlords residing in a multi-family rental property. | Landlords with multiple properties; Properties held in an LLC, trust, or corporation; Landlords operating as a real estate business. |

| Coverage Scope | Extends personal auto and home policies. | Extends commercial general liability, commercial auto, and other business policies. |

| Business Exclusion | Almost always includes a “business pursuits” exclusion, limiting coverage for income-generating activities. | Designed specifically to cover business-related liability, including rental operations. |

| Property Ownership | Must be in personal name; May cover properties owned by individuals. | Can cover properties held in an LLC, trust, or corporation; Essential for separating personal and business assets. |

Getting this choice wrong can be devastating. I’ve seen landlords think they’re fully protected with a personal umbrella policy, only to find during a claim that their “business” rental activities aren’t covered. The key is matching your umbrella policy to your ownership structure and business setup. When in doubt, it’s always better to err on the side of commercial coverage—your future self will thank you.

Who Needs an Umbrella Policy for Their Rentals?

While any landlord can benefit from the added protection, umbrella policies for rental properties become virtually essential for certain investors. The reality is that some landlords face significantly higher risks than others, and understanding where you fall on that spectrum can help you make the right decision.

If you own multiple properties, you’re playing a numbers game where each additional rental increases your exposure to potential claims. More tenants, more visitors, and more opportunities for something to go wrong. It’s simple math – and the stakes get higher with each property you add to your portfolio.

High net worth landlords face the greatest risk because they have the most to lose. In high-value real estate markets like many areas in Massachusetts and New Hampshire, landlords can quickly become “high net worth” individuals based on property equity alone, making them attractive targets for lawsuits. If you’ve built substantial personal assets through your rental investments – savings accounts, retirement funds, or equity in other properties – these assets become targets in a major lawsuit. Courts often look at what defendants can afford to pay when determining awards.

Properties with high-risk features also demand umbrella coverage. Swimming pools, trampolines, playground equipment, or even just older buildings with potential hazards like lead paint or asbestos dramatically increase your liability exposure. A single drowning incident or catastrophic injury can result in multi-million dollar judgments that would devastate an unprotected landlord.

Consider what happens without umbrella coverage. When a claim exceeds your underlying landlord insurance limits, you become personally responsible for every dollar above that limit. Your personal savings, investment accounts, and even your primary residence could be at risk. I’ve seen landlords lose decades of hard work because they thought their standard policy was enough.

The beauty of umbrella policies lies in their simplicity and comprehensive nature. A single policy can provide excess liability coverage over all your rental properties, plus your primary home and auto policies. This means you don’t need separate umbrellas for each property – one policy creates a unified shield over your entire financial landscape.

For landlords just starting out with one or two properties, the decision often comes down to your personal risk tolerance and asset level. But if you’re building a serious rental business, or if you already have significant wealth to protect, the question isn’t if you need an umbrella policy – it’s how much coverage makes sense for your situation.

The peace of mind alone is worth the modest annual premium. Knowing that you’re protected against even the most catastrophic claims lets you focus on growing your rental business instead of worrying about worst-case scenarios.

Frequently Asked Questions about Umbrella Policies for Rental Properties

As landlords explore umbrella policies for rental properties, they naturally have questions about coverage amounts, ownership structures, and how these policies work in practice. Let me address the most common concerns I hear from property owners.

How much umbrella insurance should a landlord have?

Most landlords start with $1 million in coverage, which provides substantial protection beyond standard policy limits. But here’s the thing – the right amount really depends on what you have to lose.

I always tell my clients to think about their total net worth. Add up your property equity, savings, investments, and other assets. That’s what you’re protecting. If you’ve built up $2 million in wealth through your rental properties and other investments, you’ll want at least $2 million in umbrella coverage.

Your risk profile matters too. A landlord with multiple properties in Massachusetts, especially those with swimming pools or other attractive nuisances, faces higher exposure than someone with a single duplex. Properties in lawsuit-friendly areas or those with high foot traffic might warrant even higher limits – $3 million or $5 million isn’t uncommon for larger portfolios.

The beauty is that additional coverage is surprisingly affordable. Each extra million typically costs just $50 to $75 more per year, making it easy to err on the side of caution.

Can an umbrella policy cover rental properties held in an LLC?

Absolutely, but this is where many landlords make a costly mistake. If your rental properties are owned by an LLC or other business entity, you must have a commercial umbrella policy, not a personal one.

Here’s why this matters so much: personal umbrella policies almost always include a “business pursuits” exclusion. This means any liability from your rental business won’t be covered – exactly when you need it most. It’s like having an umbrella with a giant hole in it right where the rain is falling.

A commercial umbrella policy is designed specifically to work with your business structure. It extends coverage over your commercial general liability policy and properly protects your LLC-owned properties. This isn’t just about coverage – it’s about preserving the asset protection benefits you created by forming an LLC in the first place.

Getting this wrong can leave you personally exposed despite thinking you’re protected. It’s crucial to match your insurance structure to your ownership structure.

Does an umbrella policy cover multiple rental properties?

Yes, and this is one of the most valuable features of umbrella policies for rental properties. A single umbrella policy can provide excess liability coverage for your entire rental portfolio, plus your personal assets like your home and car.

Think of it as a giant safety net stretched over all your insurable assets. Whether an incident happens at your primary residence, your first rental property, or your tenth, the umbrella policy provides that extra layer of protection once your underlying policy limits are exhausted.

The key requirement is that each property must have its own underlying landlord insurance policy with adequate liability limits, typically $300,000 to $500,000 per property. Your umbrella carrier will also require your personal home and auto policies to have high liability limits—often the maximum offered by the primary insurer. This is a standard requirement for obtaining an umbrella policy in Massachusetts and New Hampshire. As long as you meet these requirements, one umbrella policy can cover your entire empire.

This approach simplifies your insurance management while providing comprehensive protection. Instead of juggling multiple umbrella policies or worrying about coverage gaps, you have one unified layer of protection against catastrophic claims, no matter where they originate.

Secure Your Legacy with the Right Protection

Your rental properties represent a significant investment of time, money, and effort. Leaving them exposed to a catastrophic lawsuit is a risk you don’t have to take. An umbrella policy is an affordable and powerful tool that acts as the final, most crucial layer of defense for your assets, providing financial security and invaluable peace of mind.

Think about it this way: you’ve worked hard to build your rental portfolio. Maybe you started with a duplex, then added a few more properties over the years. Each one represents not just monthly income, but a piece of your financial future. Without proper protection, a single lawsuit could threaten everything you’ve built.

While LLCs and other asset protection strategies are vital, insurance – particularly a robust umbrella policy for rental properties – ensures that legal judgments don’t decimate your hard-earned wealth. It’s about building a comprehensive shield around your entire “rental empire,” not just individual properties.

The beauty of umbrella coverage is that it works seamlessly with your existing insurance. Your landlord policy handles the day-to-day claims, while your umbrella policy stands ready for those rare but potentially devastating situations. Together, they create a fortress of protection around your investments.

To ensure your rental empire is properly shielded, work with an experienced agent who understands the unique challenges landlords face. The team at Stanton Insurance Agency can help you assess your unique risks and tailor a comprehensive protection plan, whether you’re a first-time landlord with one property or manage a large portfolio across Massachusetts or New Hampshire.

We’ve seen how the right insurance strategy can mean the difference between a manageable claim and financial disaster. Don’t leave your legacy to chance – let us help you steer the complexities of insurance and find the right solutions for your specific needs. Explore our multi-family insurance options to get started.