Personal liability insurance definition 2025: Secure Your Assets

Understanding Personal Liability Insurance Fundamentals

Personal liability insurance definition: Personal liability insurance is a type of coverage that protects you financially if you’re found legally responsible for causing bodily injury to someone else or damaging their property. It’s designed to cover legal costs, medical bills, and settlement payments that could otherwise devastate your personal finances.

Key Components:

- Coverage: Bodily injury and property damage claims against you

- Legal protection: Defense costs and attorney fees

- Policy limits: Typically $100,000 to $500,000 in standard policies

- Scope: Protects you at home and away from home

- Exclusions: Auto accidents, intentional acts, business activities

Think of it as your financial safety net for life’s unexpected moments. A guest slips on your icy walkway and breaks their arm. Your dog bites the mail carrier. Your teenager accidentally damages a friend’s expensive electronics. Without proper coverage, these everyday accidents could result in costly lawsuits that threaten your home, savings, and future earnings.

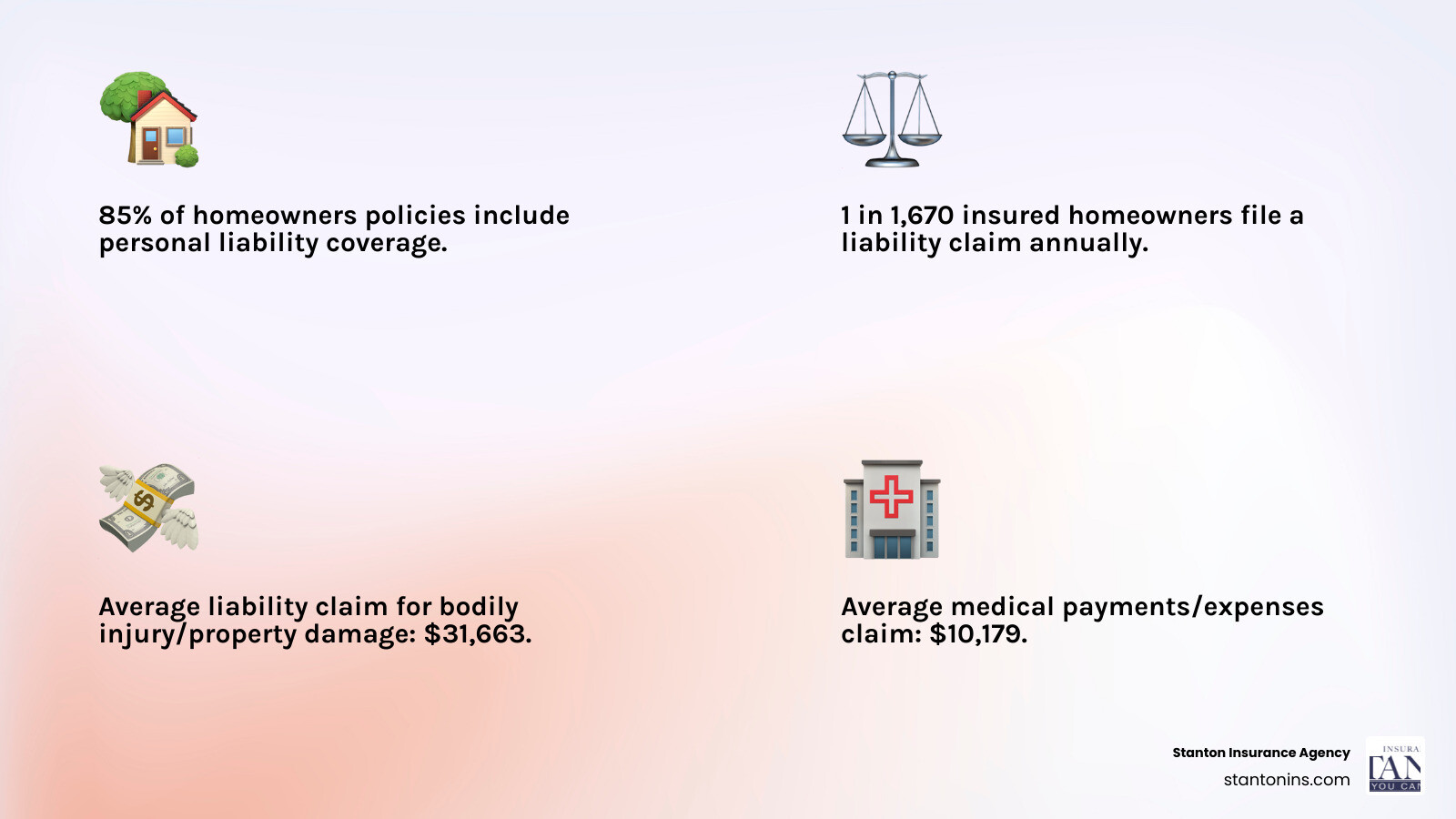

The statistics paint a sobering picture: 85% of homeowners insurance policies include personal liability coverage, and the average liability claim for bodily injury or property damage costs tens of thousands of dollars. Even more concerning, 1 in 1,670 insured homeowners file a liability claim related to lawsuits for bodily injury or property damage every year.

As Geoff Stanton, President of Stanton Insurance Agency and a Certified Insurance Counselor with over 25 years in the industry, I’ve helped countless Massachusetts and New Hampshire families steer the complexities of personal liability insurance definition and find the right protection for their unique situations. My experience has shown me that understanding this coverage is crucial for protecting your family’s financial well-being.

The Core Personal Liability Insurance Definition and How It Works

Personal liability coverage is woven into the fabric of most homeowners, renters, and condo insurance policies like a protective thread you hope you’ll never need to pull. This coverage is specifically designed to handle the financial fallout when life throws you a curveball – those moments when you or a member of your household accidentally cause bodily injury to someone else or damage their property.

The numbers tell a compelling story. According to the Insurance Information Institute (III), 85% of homeowners policies include this vital protection. When an incident occurs and you’re found at fault, this coverage becomes your financial lifeline, paying for everything from the injured party’s medical bills to your legal defense fees, up to your policy’s limit.

Think of it this way: if you’re ever held legally responsible for an accident that harms another person or their belongings, your personal liability insurance definition comes to life as a financial shield. It steps between you and potentially devastating lawsuit costs, protecting your hard-earned assets and future earnings from being wiped out by a single unfortunate event.

You might hear this coverage called “comprehensive personal liability (CPL) insurance” or referred to as “third-party insurance” – meaning it covers damages you cause to others, not to yourself or your own property. In our increasingly lawsuit-happy society, this protection has become absolutely essential. The average liability claim for bodily injury or property damage can reach tens of thousands of dollars, while liability claims for medical payments and related expenses can also be substantial. These aren’t small amounts that most families can easily absorb without serious financial strain.

How a Claim Works

When someone gets hurt or their property gets damaged, and they believe you’re responsible, the claim process begins. It typically starts when a third party files a claim against you, alleging that you or someone in your household caused their injury or property damage.

Your insurance company then becomes your advocate, launching a thorough investigation to determine what really happened. They’ll gather evidence, interview witnesses, and assess the full extent of the damages. This investigation protects you from fraudulent or exaggerated claims while ensuring legitimate ones are handled fairly.

If the investigation determines you’re legally liable, your personal liability policy springs into action. It covers the medical bills for the injured party, any lost wages if they can’t work, property repair or replacement costs for damaged items, and crucially, your legal defense costs – including attorney fees and court costs, even if the claim turns out to be baseless.

Here’s a real-world example that hits close to home for us New England folks: imagine it’s February in New Hampshire, and despite your best efforts to keep your walkway clear, a guest slips on a patch of ice and breaks their arm. The medical bills and lost wages total $50,000, and they decide to sue. Your personal liability coverage would handle these costs completely, preventing you from having to dip into your savings or risk your home equity.

This seamless process allows families to weather unexpected storms without financial devastation. To dive deeper into how this protection works specifically within your home insurance policy, I encourage you to explore our comprehensive guide on What is Personal Liability in Home Insurance?.

What Personal Liability Insurance Covers (and What It Doesn’t)

Understanding what your personal liability insurance definition includes—and what it doesn’t—can mean the difference between financial security and a devastating lawsuit. While this coverage offers broad protection, it’s not unlimited. The average liability claim for bodily injury or property damage can cost tens of thousands of dollars, which shows just how important it is to know exactly when your coverage will step in to help.

Think of personal liability insurance as your financial bodyguard. It’s there to protect you from most everyday accidents and mishaps, but it has clear boundaries about what fights it will and won’t take on for you.

Common Covered Events

Your personal liability coverage shines when life throws you those curveball moments that no one sees coming. Bodily injury to others is the big one here—if someone gets hurt on your property or because of something you did, your policy has your back. Maybe your mail carrier slips on your icy front steps in New Hampshire, or a dinner guest trips over your dog and breaks their wrist. These accidents happen, and when they do, your coverage handles the medical bills, lost wages, and potential lawsuits that follow. Our Bodily Injury Liability guide explains this protection in more detail.

Property damage you cause is another major area where this coverage proves its worth. Your teenager’s baseball goes through the neighbor’s expensive window. Your tree falls and crushes their fence during a storm. Even if you accidentally damage something valuable at a friend’s house, your personal liability protection typically covers the repair or replacement costs. For a deeper dive into this coverage, check out our Property Damage Liability page.

One of the most valuable aspects of your coverage is legal defense costs. Even if you did nothing wrong, defending yourself in court can cost tens of thousands of dollars. Your insurance company will provide and pay for your attorney, court costs, and all related legal expenses—even if the lawsuit against you is completely baseless.

Medical payments to others offers a nice touch of goodwill coverage. If someone gets a minor injury on your property, this part of your policy can pay for small medical expenses regardless of who was at fault. It’s like a peace offering that often prevents small incidents from becoming big lawsuits.

What many people don’t realize is that your personal liability coverage follows you beyond your front door. Accidents caused by you or your family members away from home are typically covered too. Your child breaks something expensive at the mall, or you accidentally injure someone while playing weekend softball—your coverage often applies no matter where you are in the world.

Common Exclusions

Now for the reality check—personal liability insurance doesn’t cover everything, and some exclusions might surprise you. Car accidents are the big one that trips people up. If you’re in a fender-bender, that’s what your auto insurance is for, not your homeowner’s liability coverage.

Intentional acts of harm are completely off the table. Insurance protects you from accidents, not from deliberately hurting someone or damaging their property. If you punch your neighbor during an argument, you’re on your own financially.

Business or professional activities need their own special coverage. Running a home-based business, seeing clients in your home office, or even having a side hustle means you need commercial insurance. Your personal liability policy wasn’t designed to handle business risks.

Here’s something that confuses many people: injuries to you or household members aren’t covered by personal liability insurance. This coverage only protects you when you hurt other people. For your own injuries, you’ll need to rely on your health insurance.

Similarly, damage to your own property doesn’t fall under personal liability coverage. This protection is specifically for when you damage someone else’s stuff, not your own belongings.

Understanding these boundaries helps you make informed decisions about additional coverage you might need. The key is knowing where your protection starts and stops, so you can plan accordingly and avoid any unpleasant surprises when you need your coverage most.

How Much Coverage Do You Need?

Figuring out how much personal liability coverage you need can feel overwhelming, but it doesn’t have to be. Think of it this way: you’re essentially buying peace of mind, and the right amount depends on what you have to lose.

Most standard homeowners policies start with $100,000 in liability coverage, with popular options at $300,000 or $500,000. While these numbers might sound impressive, a single serious accident could easily blow past these limits. I’ve seen cases where a guest’s slip and fall resulted in a lawsuit exceeding half a million dollars – and that’s not even counting the legal fees.

Here’s a simple approach I share with my clients in Massachusetts and New Hampshire: aim for coverage that at least matches your net worth. Take a moment to add up your home equity, savings accounts, investments, and other valuable assets, then subtract what you owe. If that number comes to $400,000, you’ll want at least $400,000 in liability protection. This strategy helps ensure that even if you face a significant judgment, your financial foundation stays solid.

But there’s another angle to consider. Do you have what insurance folks call “attractive nuisances” on your property? A swimming pool, trampoline, or large dog can be wonderful additions to family life, but they also increase your risk of someone getting hurt. If you have these features, bumping up your liability limits is smart planning, not paranoia.

The good news is that increasing your personal liability coverage is often surprisingly affordable. It’s typically one of the least expensive parts of your home insurance policy, so jumping from $300,000 to $500,000 in coverage might cost less than your monthly coffee budget.

The Role of Umbrella Insurance

Sometimes, even the highest standard policy limits aren’t enough – especially if you have significant assets or simply want the ultimate peace of mind. That’s where personal umbrella insurance becomes your financial superhero.

An umbrella policy provides an extra layer of protection, typically starting at $1 million and going up from there. It kicks in after your underlying home or auto policy limits are exhausted. Picture this: your homeowners policy covers the first $300,000 of a lawsuit, and your umbrella policy handles everything above that. If you face an $800,000 judgment, you’re completely covered instead of scrambling to find $500,000 out of pocket.

What makes umbrella coverage even more valuable is its broader scope. While your standard policy might exclude certain situations, umbrella insurance often covers claims like libel and slander if someone sues you for damaging their reputation. It can also provide protection for false arrest accusations and sometimes even liability for rental properties you own.

Think of umbrella insurance as your comprehensive financial safety net. It’s particularly smart for anyone who owns multiple properties, has substantial investments, or engages in activities that might increase lawsuit risk. When you understand the personal liability insurance definition as your first line of defense, an umbrella policy becomes your fortress wall – ensuring that even the most catastrophic claim won’t derail your financial future.

The beauty of this layered approach is that it prepares you for both everyday accidents and those nightmare scenarios that keep people awake at night. For more details on how this improved protection works, check out our guide on What is Personal Umbrella Insurance?.

Frequently Asked Questions about Personal Liability Insurance

Over my 25 years helping Massachusetts and New Hampshire families steer insurance decisions, I’ve noticed that certain questions about personal liability coverage come up again and again. Let me share the answers to the most common ones – they might clear up some confusion you’ve been having too.

What is the difference between personal liability and property liability insurance?

This is one of those questions that trips people up because the terms sound so similar! Here’s the simple breakdown: personal liability insurance definition encompasses a broad range of coverage for when you’re responsible for injuring another person or damaging their property. Think of it as your complete protection package.

Personal liability covers both sides of the coin. If your dog bites the mail carrier, that’s bodily injury coverage kicking in. If your teenager’s baseball goes through the neighbor’s expensive stained glass window, that’s the property damage side working for you. It’s comprehensive protection for the accidents that happen in everyday life.

Property liability (often called property damage liability) is more specific – it’s just the property damage piece of the puzzle. You’ll usually hear this term when talking about auto insurance, where it covers damage your car causes to someone else’s vehicle or fence.

Here’s the key point: property damage liability is actually a component of your broader personal liability coverage. So while personal liability includes both bodily injury and property damage, property damage liability focuses solely on the “stuff” you might accidentally break or damage.

Can personal liability insurance be purchased as a standalone policy?

Absolutely, though most people don’t need to go this route. Personal liability coverage typically comes bundled with your homeowners, condo, or renters policy – it’s baked right into the protection you already have for your living situation.

But life isn’t always that straightforward, is it? Maybe you’re living with family members and don’t need a full renters policy. Perhaps you travel frequently for work and want worldwide liability protection that goes beyond what a standard policy offers. In these unique situations, you can purchase what’s called a Comprehensive Personal Liability (CPL) policy.

These standalone policies are designed for people who don’t fit the traditional homeowner or renter mold but still want solid liability protection. They’re not as common, but they fill an important gap for certain situations. If you think this might be right for your circumstances, we’d be happy to explore these options with you and see what makes the most sense.

Does personal liability cover incidents that happen away from my home?

This is probably the biggest surprise for most people – yes, your personal liability coverage often follows you anywhere in the world! Many folks assume they’re only protected on their own property, but that’s simply not the case with most policies.

Your coverage travels with you and your household members, providing what we call “worldwide protection.” This means you’re covered for accidents that happen at the local park, on vacation, or even in another country.

Let me give you some real-world examples of when this away-from-home coverage kicks in. If you’re playing basketball at the community center and accidentally injure another player, your personal liability insurance would typically respond. If your child is at a friend’s birthday party and accidentally breaks an expensive vase, you’re likely covered. Even if you’re walking your dog through downtown Portsmouth and they bite someone, your policy would usually handle the resulting claim.

The same protection that shields you at home extends to hotel rooms you’re staying in, rental properties you visit, and public spaces where you spend time. It’s one of the most valuable aspects of personal liability coverage, ensuring that life’s unexpected moments don’t derail your financial security, no matter where they happen.

This worldwide aspect really demonstrates why understanding the complete personal liability insurance definition is so important – it’s far more comprehensive than most people realize.

Conclusion

Understanding the personal liability insurance definition is the first step toward securing your financial future. This coverage isn’t a luxury you can put off until later—it’s fundamental protection against the everyday risks that could otherwise turn your life upside down financially.

Think about it: a single slip on your icy walkway, one unfortunate incident with your family dog, or an accident caused by your teenager could result in a lawsuit that threatens everything you’ve worked so hard to build. Your home equity, your savings, your investments—all of it could be at risk without proper liability protection.

Personal liability insurance provides genuine peace of mind by creating a financial shield around your hard-earned assets. It covers not just the obvious costs like medical bills and property repairs, but also those expensive legal defense fees that can pile up even when you’re not at fault. The average liability claim can run into the tens of thousands of dollars, and catastrophic incidents can reach into the millions.

At Stanton Insurance Agency, we’ve spent over 25 years helping families throughout Massachusetts and New Hampshire steer these important decisions. We understand that every situation is unique—from the young couple renting their first apartment to the established family with significant assets to protect. Our approach is simple: we listen to your concerns, assess your specific risks, and help you find coverage that fits both your needs and your budget.

Don’t let a single accident jeopardize your family’s financial security. The cost of adequate personal liability coverage is surprisingly affordable, especially when you consider what’s at stake. For those with substantial assets or higher-risk situations, exploring options for a comprehensive personal umbrella insurance policy can provide that extra layer of protection that helps you sleep better at night.

We’re here to answer your questions, explain your options, and guide you toward the peace of mind that comes with knowing you’re properly protected. After all, life is unpredictable enough—your insurance coverage shouldn’t be.