Winter home insurance claims: Top 3 Perils

Why Winter Weather Creates the Most Home Insurance Claims

Winter home insurance claims spike dramatically when temperatures drop, making it the most challenging season for homeowners. Based on the number of claims insurance companies receive by season, winter is statistically the hardest on homes nationwide.

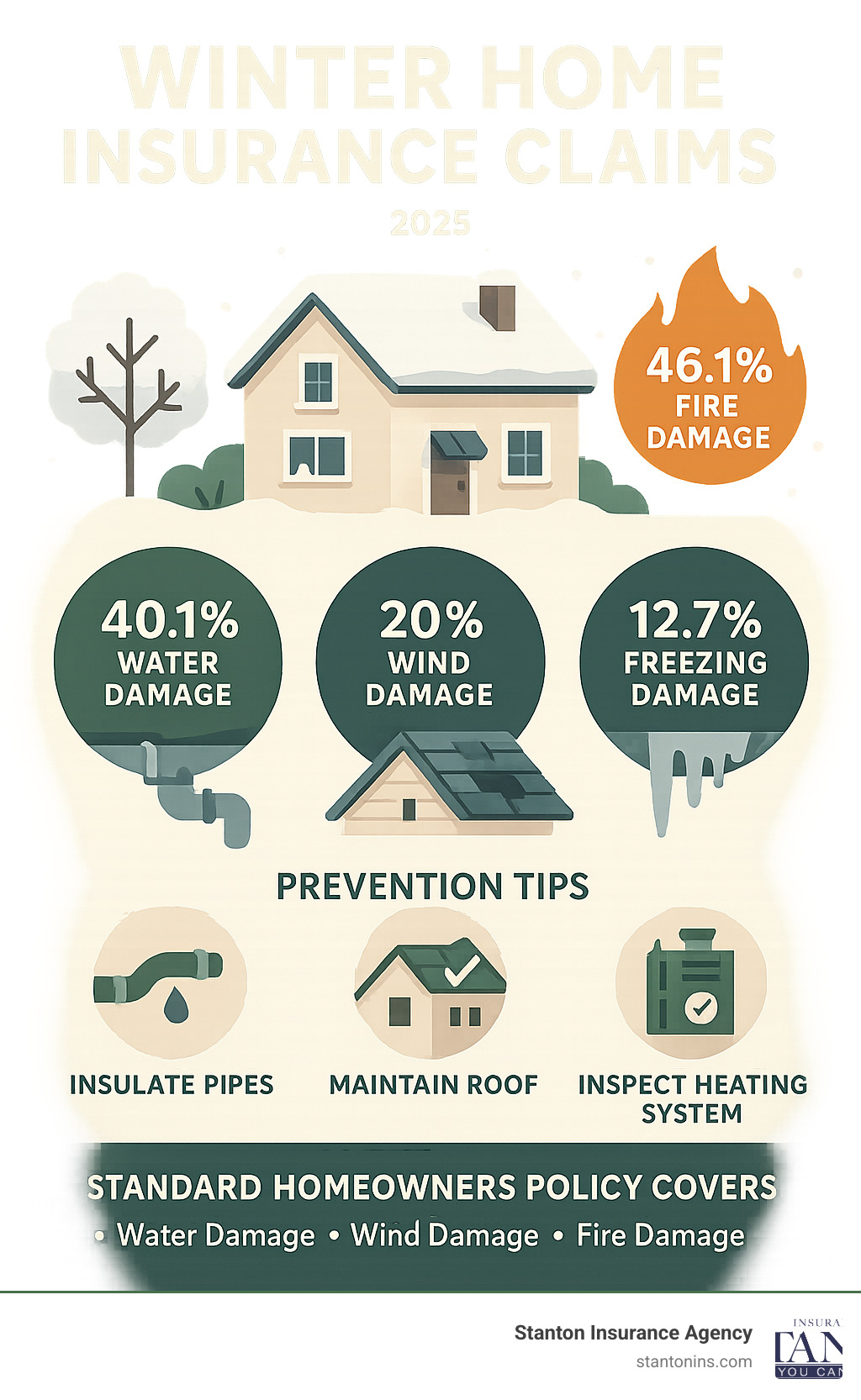

Most Common Winter Home Insurance Claims:

- Water damage – 40.1% of winter claims (frozen/burst pipes)

- Wind damage – 20% of winter claims (roof, siding damage)

- Freezing damage – 12.7% of winter claims

- Fire damage – 46.1% of total winter loss dollars (heating equipment)

- Ice dams – Water backing up under shingles

- Roof collapse – From snow/ice weight (10 inches of snow = 5 lbs per sq ft)

Winter storms have caused billions in insured losses over recent years, with 2022 alone seeing nearly $6 billion in damage. The December 2022 winter storm became the third-costliest on record at $3.5 billion in losses.

What makes winter so destructive? Cold temperatures cause pipes to freeze and burst, while heavy snow and ice can exceed your roof’s weight capacity. Meanwhile, increased heating system use raises fire risks significantly – fires account for nearly half of all winter insurance loss dollars despite being less frequent than other claims.

Understanding which damages your policy covers versus excludes can save you thousands. Standard homeowner’s insurance typically covers wind damage, roof collapse from snow weight, and water damage from burst pipes – but not flood damage from snowmelt or damage from poor maintenance.

As a fourth-generation owner of Stanton Insurance with over 20 years in the industry, I’ve helped countless Massachusetts and New Hampshire homeowners steer winter home insurance claims and prevent costly damage through proper preparation. My experience in our claims department has shown me how the right knowledge can protect both your home and your wallet when winter weather strikes.

Important Winter home insurance claims terms:

The Cold Hard Facts: Most Common Winter Home Insurance Claims

When the temperature drops and snow starts flying, your home faces its biggest challenges of the year. Winter home insurance claims don’t just happen more often during the cold months—they tend to be more expensive and disruptive too.

Think about it: your house is basically fighting a battle against freezing temperatures, howling winds, and tons of snow and ice. Sometimes winter wins, and that’s when you need to understand exactly what you’re up against.

Water Damage and Frozen Pipes: The #1 Culprit

Here’s a sobering fact: water damage makes up over 40% of all winter claims. That’s nearly half of every claim we process during the cold months, and the main villain is almost always frozen and burst pipes.

When water freezes, it doesn’t just sit there quietly. It expands with incredible force, putting massive pressure on your plumbing system. A single burst pipe can release hundreds of gallons of water into your home, destroying floors, walls, furniture, and electrical systems in the process.

The most vulnerable spots in your home are the usual suspects: basements, crawl spaces, and attics where heating doesn’t reach. Vacation homes or properties left empty without proper heating face even higher risks. If you live in a condo or townhouse, the rules can get tricky—check out our guide on whether condo insurance covers water damage to understand your specific situation.

Frozen pipe damage alone accounts for 12.7% of all winter homeowner claims, with some reaching $18,000 or more. I’ve seen how quickly a tiny crack can turn into a indoor flood, creating weeks of headaches for families.

Wind, Snow, and Ice: The Weight of Winter

New England winters bring more than just pretty snow scenes—they deliver powerful storms that can seriously damage your home’s exterior.

Wind damage hits hard during winter storms, making up about 20% of all cold-weather claims. Those nor’easters we know so well in Massachusetts and New Hampshire pack winds strong enough to rip shingles right off your roof, damage siding, and send trees crashing into homes and garages.

But here’s something that surprises many homeowners: that beautiful snow can literally crush your roof. Just ten inches of fresh, fluffy snow weighs about five pounds per square foot. Your roof can probably handle four feet of fresh snow, but here’s where it gets tricky—packed snow weighs much more.

Two feet of old, settled snow can push your roof past its weight limit. Add some ice to the mix (remember, one inch of ice equals a whole foot of fresh snow in weight), and you’re looking at potential structural damage or even a complete roof collapse.

Ice dams create their own special kind of trouble. When your attic heat melts roof snow, that water runs down and refreezes at the colder edges, creating a dam. Water backs up under your shingles and into your home, damaging ceilings, walls, and insulation. Learn more about ice dams and why professional roof ice dam removal might be necessary to prevent serious water damage.

Fire Hazards: The Most Costly Winter Threat

Here’s the scary truth about winter fires: while they happen less often than water damage, they account for a massive 46.1% of all winter insurance loss dollars. Compare that to just 18.4% during the rest of the year combined—winter fires are devastating.

Why do fires spike in winter? Your heating system works overtime, space heaters get plugged in everywhere, and chimneys that haven’t been properly maintained become fire hazards. Between 2014 and 2018, space heaters caused 44% of home fires, while fireplaces and chimneys were responsible for another 29%.

The good news is that most winter fires are completely preventable. Following basic home heating safety tips and staying on top of maintenance—like following our chimney fire prevention tips—can save you from this devastating type of loss.

After helping families deal with winter home insurance claims for over 20 years, I can tell you that preparation really does make all the difference. Understanding these risks is your first step toward protecting your home and family this winter.

Understanding Your Policy: What’s Covered and What’s Not

When winter storms hit Massachusetts and New Hampshire, knowing what your homeowner’s insurance covers can mean the difference between a manageable situation and a financial disaster. A standard policy protects you from sudden, accidental damage, but coverage isn’t absolute. The key is understanding your policy before you need it.

Covered Perils: When Your Home Insurance Steps In

The good news is that most standard home insurance policies (like the HO-3 form) provide “open peril” coverage for your home’s structure. This means you’re covered for any cause of damage unless it’s specifically excluded in your policy.

When it comes to winter home insurance claims, your policy typically covers damage from wind, fire, and lightning. Those powerful nor’easters that knock down power lines and tear off shingles? Covered. Roof collapse from the weight of ice and snow is also protected under most policies, a relief considering how quickly snow can accumulate on New England roofs.

Water damage from a sudden and accidental burst pipe falls under coverage too, which is crucial since this represents over 40% of all winter claims. Damage from falling objects like tree branches weighted down with ice is another covered peril we see frequently in our region.

Hail damage to roofs and siding is also typically covered. We recommend prompt inspection and filing, as some homeowners don’t notice hail damage for months until their roof starts leaking.

If a covered event makes your home uninhabitable, your policy’s Additional Living Expenses (ALE) coverage helps pay for temporary housing and related costs while repairs are made. To learn more about how all these pieces fit together, see our ultimate guide to home insurance.

Common Exclusions and Pitfalls in Winter Home Insurance Claims

Not all winter damage is covered. Understanding these exclusions can save you from an unpleasant surprise when dealing with property damage.

Flooding is a major exclusion that catches many homeowners off guard. Damage from surface water – such as melting snow seeping into your basement – is considered flooding and is not covered by standard home insurance. You need a separate policy from the National Flood Insurance Program (NFIP) for this protection. Understanding why flood insurance is important is key for comprehensive protection, especially with our region’s changing weather patterns.

Negligence or lack of maintenance can also lead to claim denials. Insurance companies expect you to take “reasonable care” of your property. If your pipes freeze because you intentionally turned the heat off while on vacation, the claim will likely be denied. We typically recommend keeping your thermostat no lower than 55-65 degrees Fahrenheit, even when you’re away. For extended absences, consider shutting off the water supply and draining your pipes entirely.

Wear and tear issues won’t be covered either. An old, poorly maintained roof that leaks during a normal snowmelt event would be denied coverage since the root cause is gradual deterioration, not a sudden, covered peril. Similarly, damage from pre-existing conditions – like water damage from a window that wasn’t properly sealed over time – typically falls outside coverage.

Policy Add-Ons for Improved Winter Protection

Smart homeowners often improve their policies with endorsements that fill potential coverage gaps, especially for winter home insurance claims. These add-ons provide valuable peace of mind during our harsh New England winters.

Water backup and sump pump overflow coverage protects you when water backs up through sewers or drains, or when your sump pump fails – common issues during rapid snowmelts in our area. Equipment breakdown coverage helps cover the cost to repair or replace essential home systems like your furnace or boiler when they suffer mechanical or electrical breakdowns.

Service line coverage protects you from the potentially high cost of repairing or replacing underground utility lines you’re responsible for, such as water or sewer pipes that frost heaves or ground movement can damage. Food spoilage coverage might seem minor, but it covers spoiled food due to power outages during winter storms – a nice perk when you’re already dealing with storm damage.

Finally, we often recommend increasing standard liability coverage to at least $300,000. This is crucial if someone slips and falls on your icy walkway, as your personal liability coverage protects you against lawsuits when expenses exceed typical medical payment limits (which usually range between $1,000 and $5,000).

Proactive Protection: How to Prevent Costly Winter Damage

The best way to handle a winter home insurance claim is to prevent it from ever happening. A bit of proactive maintenance can save you thousands of dollars and a major headache. For a full overview, see our guide on how to prepare your home for winter.

Your Pre-Winter Home Maintenance Checklist

Before the first deep freeze hits, it’s time to give your home some TLC. Think of it as insurance for your insurance – these simple steps can prevent those dreaded winter home insurance claims that nobody wants to deal with during the holidays.

Start with your gutters and downspouts – they’re your home’s drainage system. Clear out all those fall leaves and debris before the first snowfall. When gutters are clogged, melting snow has nowhere to go, creating the perfect conditions for ice dams.

Next, take a good look at your roof. Walk around your property and scan for loose or missing shingles, cracks, or damaged seals around the chimney and skylights. It’s much easier (and cheaper) to fix a few shingles in November than to deal with water damage in January.

Those beautiful old oak trees that provide summer shade can become winter hazards. Trim any dead or overhanging branches that could come crashing down under heavy snow or ice. Trust me, your roof will thank you.

Your heating system deserves an annual check-up too. Have a professional inspect your furnace or boiler before you really need it. This isn’t just about staying warm – it’s about preventing fires, which account for nearly half of all winter loss dollars. While you’re at it, don’t forget about your chimney.

Sealing air leaks around windows and doors does double duty – it keeps your energy bills down and prevents cold drafts that can freeze pipes in wall cavities. You can also insulate windows for winter for extra protection.

Don’t forget about outdoor plumbing – empty those garden hoses, winterize sprinkler systems, and drain or insulate outside faucets. And secure or store outdoor items like grills and furniture that could become projectiles in a windstorm.

Preventing the Top 3 Winter Woes: Pipes, Ice Dams, and Slips

Let’s talk about the big three – the winter problems that keep me busy in our claims department.

Frozen pipes are the number one cause of winter home insurance claims, but they’re also the most preventable. Insulate any exposed pipes in unheated areas like basements, crawl spaces, attics, and garages, especially those near exterior walls. When temperatures plummet, let cold water drip slowly from faucets connected to vulnerable pipes – moving water is much harder to freeze. Open cabinet doors under sinks to let warm air circulate around pipes. If you’re heading south for a few weeks, shut off the main water supply and drain your pipes entirely.

Ice dams might look pretty, but they’re trouble. The best defense is proper attic insulation and ventilation, which keeps your roof surface cold and prevents that destructive melt-freeze cycle. After heavy snowfall, use a roof rake to clear snow around gutters – your back might not love you, but your wallet will.

Finally, slips and falls on your property can lead to liability claims. Keep walkways, driveways, and stairs clear of snow and ice. Shovel frequently and use sand or pet-friendly ice melt for traction. Your liability coverage protects you if someone gets hurt, but prevention is always better than dealing with a claim and potential lawsuit.

These simple steps might seem like common sense, but you’d be surprised how many claims we see that could have been prevented with just a little preparation. A weekend of winter prep can save you months of headaches later.

After the Storm: A Step-by-Step Guide to Filing a Claim

Even with the best preparation, damage can happen. If you need to file a claim, acting quickly and methodically is key.

Immediate Steps After Finding Winter Damage

When you find winter damage to your home, your heart might sink, but taking the right steps immediately can make all the difference in your claim outcome.

Safety comes first, always. If you see major structural damage, smell gas, or notice electrical hazards, get everyone out and call 911. Don’t take chances with your family’s wellbeing – damaged property can be replaced, but people can’t.

Once you’ve confirmed it’s safe, your next priority is preventing further damage. This is actually required by your insurance policy, and it can save you thousands. For a burst pipe, locate and shut off the main water valve immediately. If your roof is damaged, carefully place a tarp over the affected area if you can do so safely. Broken windows should be covered with plywood or plastic sheeting.

Here’s something many homeowners don’t realize: document everything before you touch anything. I can’t stress this enough – take photos and videos from multiple angles before you start cleaning up. Capture both close-up shots of specific damage and wide shots showing the overall scope. Make a detailed written list of every damaged item, including approximate ages and values. Keep every single receipt for materials you buy for temporary repairs.

This documentation becomes the foundation of your winter home insurance claim. The more thorough you are now, the smoother your claim process will be later.

Filing Your Claim and Working with an Adjuster

Don’t wait to contact your insurance agent – call us as soon as you’ve handled the immediate safety concerns. We’re here to walk you through exactly what happens next and help you understand what paperwork you’ll need. Filing a claim can feel overwhelming, but we’ll guide you through every step.

Your insurance company will assign an adjuster to your case. This person’s job is to inspect the damage and calculate what your policy will pay based on your coverage and policy limits. Don’t make any permanent repairs until the adjuster has seen the damage – this is crucial. Temporary fixes to prevent further damage are fine and expected, but hold off on the big repairs until you get the green light.

The adjuster will want to see your documentation, so having those photos and receipts organized will speed up the process. If your home becomes unlivable, let us know right away – your policy likely includes coverage for temporary living expenses, and we can help you understand what’s covered.

To File or Not to File? Making the Right Financial Decision

Here’s where many homeowners make costly mistakes. Not every bit of damage should become an insurance claim, and making the wrong choice can hurt you financially in the long run.

Check your deductible first. If your damage costs $1,200 to repair but your deductible is $1,000, your insurance will only pay $200. In cases like this, paying out of pocket often makes more sense than filing a claim.

Your claims history matters more than you might think. Insurance companies track how often you file claims, and too many in a short period can lead to higher premiums or even policy cancellation. We’ve seen homeowners get non-renewed after filing several small claims within a few years. Save your insurance for the big losses – that’s what it’s really designed for.

Before you decide, give us a call. We can discuss how a claim might affect your specific policy and help you make the smartest financial choice. Sometimes paying a $800 repair yourself is much wiser than filing a claim that could raise your premiums for years. For more ways to keep your costs down, check out our guide on saving on home insurance.

We’re on your side. Our job isn’t just to sell you a policy – it’s to help you make the best decisions for your situation when winter weather strikes.

Frequently Asked Questions about Winter Home Insurance Claims

When winter weather strikes and you’re dealing with damage to your home, questions come up fast. Here are the most common concerns we hear from homeowners about winter home insurance claims – and the answers that can help you move forward with confidence.

Does my insurance cover a neighbor’s tree falling on my house?

Yes, your own homeowner’s insurance policy will cover the damage to your property in almost all cases, regardless of who owns the tree. This might seem backwards, but it actually works in your favor – you don’t have to wait for your neighbor’s insurance company to investigate or potentially deny the claim.

Your policy covers damage from falling objects, so you’ll be protected right away. Behind the scenes, your insurance company may try to recover the costs from your neighbor’s insurer if they can prove negligence (like if your neighbor knew the tree was dead or diseased and ignored it). But that’s their problem to sort out, not yours.

The key thing to remember? You’ll get coverage first, then the insurance companies can figure out who ultimately pays.

Is damage from an ice dam covered by my policy?

Generally, yes – but there’s an important distinction to understand. The water damage to your home’s interior from an ice dam (think damaged ceilings, walls, and insulation) is typically covered by a standard home insurance policy. This is the expensive part anyway, so that’s good news.

However, the cost to actually remove the ice dam itself may not be covered. Think of it this way: your policy covers the damage the ice dam causes, but not necessarily the cost of fixing the ice dam problem.

Here’s something to keep in mind – because ice dams are often linked to maintenance issues like poor attic insulation or clogged gutters, repeated winter home insurance claims for ice dam damage could flag your policy for review. This is why we always emphasize prevention when it comes to ice dams.

What happens if my pipes freeze because the power went out?

This is usually a covered event, and here’s why: a power outage is considered sudden and accidental – something completely beyond your control. Mother Nature knocked out your power, your heat went off, and your pipes froze as a result.

As long as you didn’t contribute to the problem (for example, by turning off your thermostat and leaving your home unheated during the outage), the resulting water damage from burst pipes should be covered by your policy. Your dwelling coverage typically handles these situations.

The insurance company understands that you can’t control when a winter storm knocks out power lines. What they do expect is that you were maintaining reasonable heat in your home before the outage occurred.

If you’re ever unsure about whether your specific situation would be covered, give us a call. We’d rather help you understand your coverage before you need it than have you find gaps after damage occurs. Every situation is a bit different, and we’re here to help you steer the details of your particular policy.

Stay Protected This Winter

Winter in New England brings both breathtaking beauty and serious challenges for homeowners. Those picture-perfect snow-covered landscapes can quickly turn into costly headaches if you’re not properly prepared.

The good news? You now have the knowledge to protect yourself. By understanding the most common winter home insurance claims – from burst pipes to ice dams to heating system fires – you can spot potential problems before they become expensive disasters.

Your winter protection strategy should include three key elements: understanding exactly what your policy covers (and what it doesn’t), taking proactive steps to winterize your home, and knowing how to respond quickly if damage does occur. The best winter home insurance claims are the ones that never happen in the first place.

Don’t wait until you’re dealing with frozen pipes at 2 AM or watching water drip through your ceiling from an ice dam. A comprehensive policy review now, before winter arrives, gives you the peace of mind to actually enjoy those snowy New England evenings by the fireplace.

Prevention is always less expensive than repair. Whether it’s adding water backup coverage, insulating vulnerable pipes, or simply keeping your gutters clean, small actions today can save you thousands of dollars and countless hours of frustration later.

The team at Stanton Insurance Agency understands the unique challenges that Massachusetts and New Hampshire winters bring to homeowners. We’ve helped countless families steer winter home insurance claims and, more importantly, avoid them altogether through proper preparation and coverage.

Ready to make sure you’re protected before the next storm hits? Contact us today for a comprehensive review of your home insurance policy. Because when it comes to winter weather, being prepared isn’t just smart – it’s essential.