Boat Insurance: Secure Your Peace of Mind 2025

Why Boat Insurance is Essential for New England Boaters

Boat insurance protects your watercraft, passengers, and assets from unexpected damages, accidents, and liability claims. For the millions of recreational boaters in the U.S., proper coverage is crucial for peace of mind while enjoying New England’s beautiful waterways.

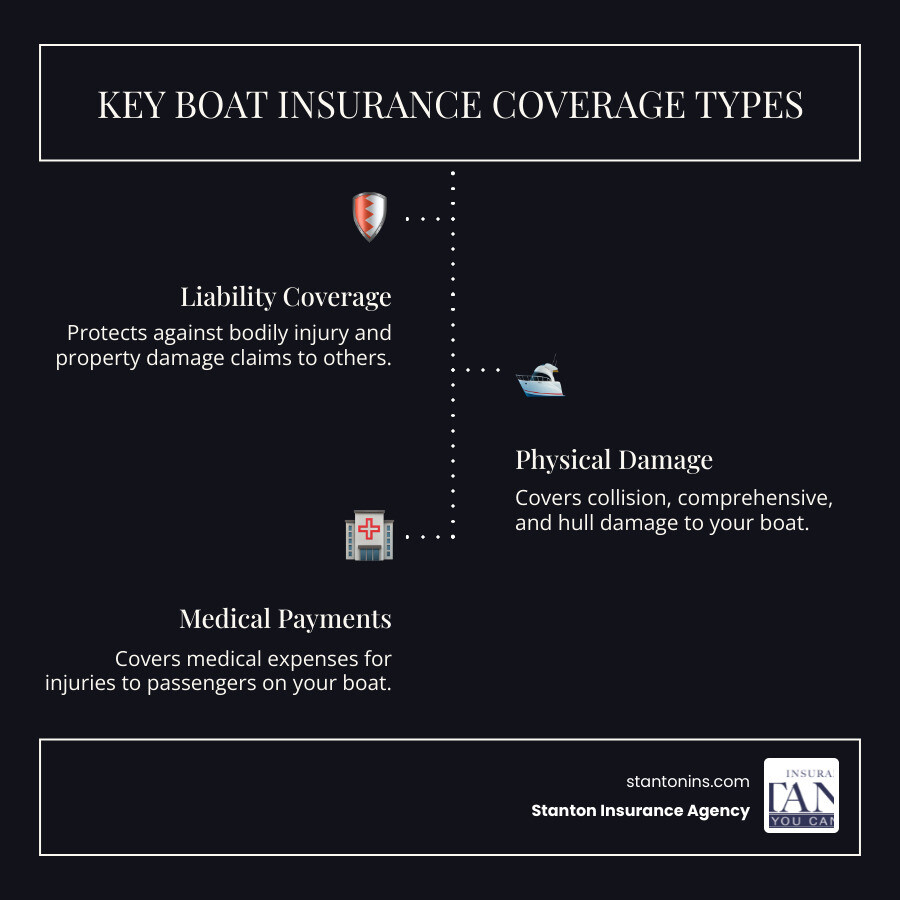

Key Boat Insurance Coverage Types:

- Liability Coverage – Protects against bodily injury and property damage claims.

- Physical Damage Coverage – Covers collision, comprehensive, and hull damage.

- Medical Payments – Covers injuries to passengers on your boat.

- Personal Property – Protects fishing equipment, electronics, and personal items.

- Emergency Services – Includes on-water towing and assistance.

Whether cruising Lake Winnipesaukee or sailing Maine’s coast, boat insurance provides essential financial protection. While not legally required in Massachusetts or New Hampshire, many marinas and lenders demand proof of coverage for docking or financing.

Homeowners insurance offers very limited boat coverage, typically just $1,000 to $1,500 for small watercraft stored at home. This leaves significant gaps for on-water incidents, theft, and higher-value boats.

Annual boat insurance costs typically range from $100 to over $500, depending on your boat’s type, value, and usage. Discounts are often available for completing safety courses, bundling policies, and maintaining a clean boating record.

I’m Geoff Stanton, President of Stanton Insurance Agency. For over two decades, I’ve helped New England families protect their boats. With our deep understanding of boat insurance needs in Massachusetts and New Hampshire, we’ll help you find the right coverage for your boating lifestyle.

Common Boat Insurance vocab:

Boating in New England offers unparalleled beauty, but your boat needs protection. Let’s dive deeper into why boat insurance is a necessity for local boaters.

Is Boat Insurance Legally Required in MA and NH?

While states like Massachusetts and New Hampshire don’t legally mandate boat insurance like they do for cars, that doesn’t mean you can go without it. The practical requirements of boating often make coverage essential.

If you finance your boat, your lender will almost certainly require you to carry comprehensive and collision coverage to protect their investment. Similarly, most marinas and storage facilities require proof of liability coverage before you can dock or store your boat. They need to ensure that if your boat causes damage to their property or another vessel, an insurance policy is in place to cover the costs.

So, while you won’t be pulled over by marine patrol for not having a policy, the real-world requirements of lenders and marinas make boat insurance a practical necessity.

Does Homeowners Insurance Cover My Boat?

It’s a common misconception that a homeowners policy will adequately protect your boat. In reality, most homeowners policies provide extremely limited coverage, typically capped at $1,000 to $1,500 for small watercraft like canoes or kayaks.

This minimal coverage usually only applies while the boat is on your property. The moment you launch it, you’re likely unprotected. Furthermore, these policies have strict limits on boat size, horsepower, and value, and they rarely provide any liability coverage for incidents that happen on the water. Relying on homeowners insurance is a significant risk; dedicated boat insurance is designed to provide the specific protection you need for theft, accidents, and on-water liability.

Understanding Your Comprehensive Boat Insurance Coverage

A boat insurance policy should be customized with coverage limits and deductibles that match your specific needs. A deductible is the amount you pay out-of-pocket before your insurance coverage begins. A higher deductible usually means a lower premium.

Coverage limits are the maximum amount your insurer will pay for a claim. Getting this balance right is key to protecting your boat and your finances. Learn more about marine insurance to explore your options.

Core Coverage Types

These three coverages form the foundation of most boat insurance policies:

Liability coverage is your financial shield if you’re at fault for bodily injury or property damage to others. It covers their repair costs and medical bills, protecting your personal assets from lawsuits.

Collision coverage pays for physical damage to your own boat from a collision with another boat, a dock, or a submerged object. It helps get your boat repaired and back on the water.

Comprehensive coverage protects against non-collision incidents like fire, storms, theft, and vandalism. This is especially valuable in New England, where weather can change in an instant.

| Coverage Type | What it Covers | Real-World Examples |

|---|---|---|

| Liability | Bodily injury and property damage to others if you’re at fault | You accidentally collide with another boat, causing damage and injuring passengers. Liability helps pay for their repairs and medical bills. |

| Collision | Physical damage to your boat from collisions with other boats or objects | Your boat hits a dock or a submerged rock. Collision coverage helps pay to repair or replace your boat. |

| Comprehensive | Non-collision incidents such as fire, storms, vandalism, and theft | A fire at the marina, hail damage from a thunderstorm, or theft of your boat from its mooring. Comprehensive helps pay for these losses. |

How Your Boat’s Value is Determined: Agreed Value vs. Actual Cash Value

The way your boat’s value is determined affects your payout after a loss.

Agreed Hull Value is often the best choice. You and your insurer agree on the boat’s value when the policy starts. If your boat is a total loss, you receive that exact amount, with no deduction for depreciation. Many of these policies also offer “new for old” coverage on partial losses, replacing old equipment with new.

Actual Cash Value (ACV) policies are typically cheaper but pay less at claim time. Your payout is based on the boat’s market value at the time of the loss, which includes depreciation. An older piece of equipment would be replaced based on its depreciated value, not the cost of a new one.

We generally recommend Agreed Hull Value for most boaters to ensure predictable payouts. Learn more about insurance for older boats if you have a vintage vessel.

Popular Add-On Coverages for Your Boat Insurance Policy

Customize your policy with optional coverages that match your boating style:

- On-Water Towing: Provides assistance for fuel delivery, jump starts, and tows back to the marina. It’s an inexpensive add-on that can save you from a costly emergency tow.

- Roadside Assistance: Protects you if your towing vehicle breaks down while hauling your boat.

- Trailer Coverage: Provides physical damage coverage for your boat trailer.

- Personal Effects & Fishing Equipment: Protects your gear, clothing, coolers, and specialized fishing equipment, often with replacement cost protection.

- Uninsured/Underinsured Boater: Covers you if an uninsured boater damages your vessel or injures your passengers.

- Fuel Spill Liability: Helps cover cleanup costs and fines from an accidental fuel spill.

- Wreckage Removal: Pays for the costly process of removing your boat if it sinks and becomes a hazard.

- Ice and Freezing Damage: Crucial for New England boaters, this covers damage from freezing, but most insurers require professional winterization.

- Mechanical Breakdown: Can protect against sudden engine failures on older boats, which are not covered by standard wear and tear exclusions.

The Cost of Coverage: Premiums, Deductibles, and Discounts

The cost of boat insurance varies, with premiums typically ranging from $100 to over $500 annually. A common estimate is about 1.5% of your boat’s value per year. For example, a $20,000 pontoon boat might cost around $300 to insure.

Several factors influence your final premium:

- Boat Type: A high-speed personal watercraft has different risks than a slow-moving pontoon boat.

- Length & Horsepower: Larger, more powerful boats generally cost more to insure.

- Cruising Area: Boating on calm inland lakes is typically less risky than navigating coastal waters.

- Storage Location: Secure marinas may lead to lower rates than backyard storage.

- Boating Experience & History: A clean boating and driving record can lower your premium.

Your deductible—the amount you pay out-of-pocket on a claim—also affects your premium. A higher deductible will lower your annual cost.

How to Get Discounts on Your Boat Insurance

We can help you find discounts to reduce your boat insurance premium without sacrificing coverage:

- Multi-Policy Discount: Bundle your boat insurance with your home or auto policy for significant savings.

- Multi-Boat Discount: Insure more than one watercraft on the same policy.

- Safety Course Completion: Approved boating safety courses can lead to a valuable discount.

- Protective Devices: GPS tracking systems and alarms may qualify you for lower rates.

- Diesel Engine: These are often considered a lower fire risk, which can result in savings.

- Good Driving Record: A clean record on land can translate to lower boat insurance rates.

- Diminishing Deductible: For each claim-free year, your deductible may decrease, potentially to zero.

Earn Savings with Boating Safety Courses

Completing a recognized boating safety course is one of the best ways to lower your boat insurance premiums while becoming a safer operator. Insurance companies reward boaters who are committed to safety on the water.

Excellent programs are offered by organizations like the U.S. Coast Guard Auxiliary, the U.S. Power Squadrons, and the American Sailing Association. These courses cover navigation rules, emergency procedures, and proper boat handling. Once you complete a course, provide us with the certificate to apply a discount to your policy. It’s a small investment of time that pays off in both safety and savings.

From Quote to Claim: Managing Your Policy

At Stanton Insurance Agency, we make the boat insurance process—from quote to claim—as straightforward as possible. Here’s what you can expect.

What Information Do I Need for a Quote?

To provide an accurate quote, we need to get to know you and your vessel. Please have the following information ready:

- Personal Details: Your name, address, date of birth, and boating history. Mention any safety courses you’ve completed for potential discounts.

- Boat Details: The year, make, model, and Hull ID Number (HIN).

- Vessel Specifications: The boat’s length, material (fiberglass, aluminum), engine horsepower, and number of engines.

- Usage Information: The boat’s top speed, purchase price or current value, typical cruising waters (inland or coastal), and storage location.

Providing accurate information upfront ensures you get a precise quote with no surprises.

How to File a Boat Insurance Claim

Knowing the right steps to take after an incident can make a stressful situation more manageable.

- Ensure Safety First: Check on all passengers and address any injuries. Take reasonable steps to prevent further damage to your boat, such as pumping out water.

- Contact Us Immediately: As soon as it’s safe, call us. We are your advocates and will guide you through the claims process.

- Document Everything: Take plenty of photos and videos of the damage to all property involved and the overall scene.

- File an Official Report: For significant incidents like collisions or theft, contact the local police or Coast Guard to file a report.

- Gather Witness Information: If anyone saw what happened, get their names and contact information.

- Keep Detailed Records: Keep all receipts for emergency repairs and a log of all communications.

Most insurers offer 24/7 claims hotlines, and our goal is to help you get back on the water as quickly as possible.

Frequently Asked Questions about Boat Insurance

Here are answers to the most common questions we hear about boat insurance.

What types of boats and watercraft can be insured?

Most recreational vessels can be insured, including powerboats, sailboats, pontoon boats, fishing boats, cabin cruisers, and personal watercraft (PWC) like Jet Skis. Coverage is widely available for boats up to 50 feet in length and valued at $500,000 or more. Some vessels, like homemade boats or those with a prior total loss history, can be more difficult to insure.

Does boat insurance cover emergency services like towing?

While not standard, on-water towing is a widely available and highly recommended add-on. This inexpensive coverage can assist with fuel delivery, jump starts, or a tow back to the marina, saving you from a large, unexpected bill.

Does my policy cover damage from ice and freezing?

This is a critical question for New England boaters. Standard policies often exclude damage from ice and freezing. However, you can purchase this coverage as an add-on. To be eligible, most insurers require proof that your boat was professionally winterized by a qualified marine facility.

Can multiple boats be covered under one policy?

Yes. If you own multiple boats kept in the same state, you can typically cover them under a single policy. This simplifies your insurance management and may qualify you for a multi-boat discount.

Does boat insurance cover theft?

Yes, a comprehensive boat insurance policy typically covers theft of the boat itself, as well as stolen items like electronics or fishing gear. How you are reimbursed depends on whether you have an “Agreed Value” policy (which may pay for a new replacement) or an “Actual Cash Value” policy (which pays the depreciated value).

How do deductibles and coverage limits work in boat insurance?

- Deductible: This is the amount you pay out-of-pocket on a claim before your insurance pays the rest. A higher deductible generally results in a lower premium.

- Coverage Limit: This is the maximum amount your insurer will pay for a covered loss. Limits for liability can range from $100,000 to over $1,000,000, while the limit for your boat’s physical damage is tied to its agreed or actual cash value.

Secure Your Peace of Mind on the Water

Heading out on New England’s waters should be about enjoyment and relaxation, not worrying about the unexpected. Boat insurance provides an essential financial safety net, protecting your investment, your passengers, and your financial well-being.

While state law may not require it, marina and lender agreements often do. More importantly, a dedicated boat policy closes the significant coverage gaps left by homeowners insurance.

At Stanton Insurance Agency, we specialize in customizing policies for the unique needs of New England boaters. We understand the local challenges, from harsh winters to busy summer waterways. Our experienced team will guide you through selecting the right coverage limits, deductibles, and discounts to create a policy that fits your lifestyle and budget.

Don’t let insurance uncertainties cast a shadow over your time on the water. Let us handle the details so you can focus on making memories.