Boat insurance State Farm: Best Policies 2025

Why Boat Insurance Matters for New England Boaters

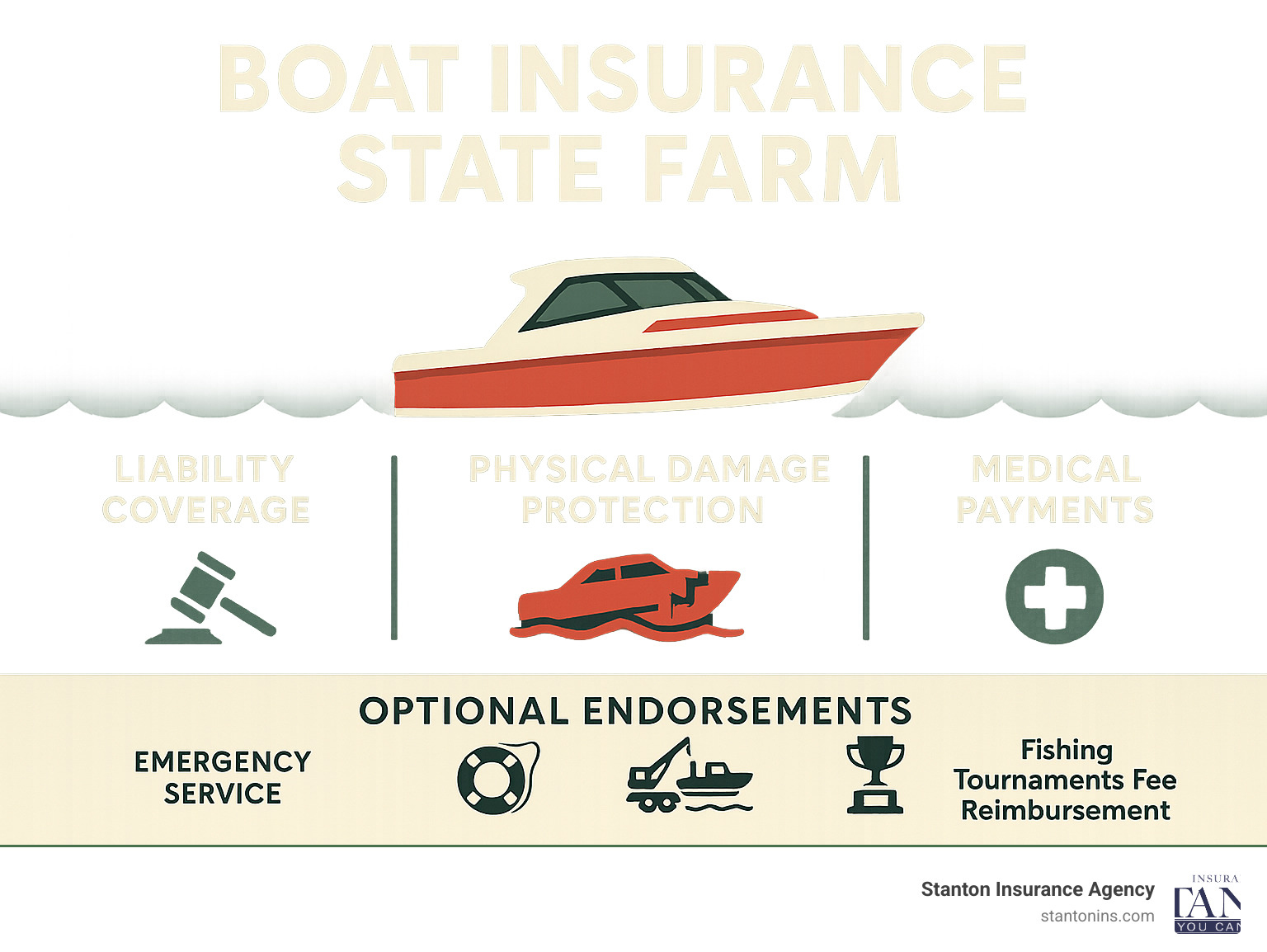

Boat insurance state farm policies provide comprehensive protection for watercraft owners across Massachusetts and New Hampshire waters. State Farm offers coverage for various boat types including sailboats, fishing boats, jet skis, and pontoons, with core protections against sinking, fire, storms, theft, and collisions.

Key State Farm Boat Insurance Features:

- Physical damage coverage for hull, motor, and equipment

- Liability protection up to $1 million for larger vessels

- Medical payments for injuries regardless of fault

- Optional endorsements like emergency service and fishing tournament fee reimbursement

- Replacement cost or actual cash value settlement options

- Discounts available for boating safety course completion

Did you know that boat insurance is one of the earliest known forms of insurance? Ancient sailors understood the unpredictable nature of water, and today’s boaters face similar risks on Lake Winnipesaukee or Cape Cod Bay. Whether you’re dealing with a sudden storm or an unexpected collision, proper coverage protects both your investment and your financial future.

State Farm has been insuring customers since 1922 and operates through over 19,000 agents nationwide. Their boat insurance state farm policies can be customized with optional coverages like wreck removal, boat trailer protection, and even coverage for incidental commercial fishing activities.

I’m Geoff Stanton, a fourth-generation insurance professional and Certified Insurance Counselor who has helped New England families protect their boats and other valuables for over two decades. At Stanton Insurance Agency, we regularly help clients evaluate boat insurance state farm policies to find the best coverage for their specific needs.

Boat insurance state farm terms at a glance:

What Does State Farm Boat Insurance Cover?

Picture this: you’re cruising across Lake Winnipesaukee on a perfect summer morning when suddenly you hear that dreaded scraping sound against your hull. Or maybe you’re docked at your favorite marina when a sudden thunderstorm rolls in with hail the size of golf balls. These are the moments when you’ll be grateful for comprehensive boat insurance coverage.

The good news is that boat insurance policies are designed to handle life’s curveballs on the water. Whether you’re dealing with sinking, fire, storms, theft, or collisions, the right coverage acts like a reliable first mate—always there when you need it most. The key is understanding exactly what protection you’re getting and making sure it matches your boating lifestyle.

Types of Boats State Farm Insures

From our experience helping New England boaters for over two decades, we’ve learned that no two vessels are exactly alike. Some folks love the tranquility of sailing across Massachusetts Bay, while others prefer the thrill of jet skiing through New Hampshire’s pristine lakes. The beauty of modern boat insurance is its flexibility to cover this incredible variety.

Most insurers today recognize that boating comes in many forms. Runabouts and cabin cruisers are perfect for family day trips and weekend getaways. Sailboats and yachts offer that classic maritime experience that never gets old. Bass boats and fishing boats are built for serious anglers who know that the best fishing spots aren’t always the easiest to reach.

Pontoon boats have become incredibly popular for their stability and social atmosphere—they’re like floating living rooms. Jet skis and other personal watercraft deliver pure adrenaline and are surprisingly affordable to insure. Even houseboats and simple kayaks and canoes can find coverage options that make sense.

What matters most is finding an insurer who understands your specific type of vessel and how you use it. More information about insurance for boats can help you explore your options in greater detail.

Core Coverages Included in a Standard Policy

Every solid boat insurance policy starts with four essential building blocks. Think of these as the foundation that keeps you financially secure when things go wrong on the water.

Physical damage coverage is probably what most people think about first—and for good reason. This protection handles the cost to repair or replace your boat, motor, and permanently attached equipment when covered incidents occur. Whether it’s storm damage, theft, or that unfortunate encounter with a hidden rock, physical damage coverage gets your vessel back in working order. This often extends to your trailer too, which is important since many boat mishaps actually happen on land during transport.

Liability coverage is where things get serious from a financial perspective. If you accidentally cause an accident that injures someone or damages their property, this coverage steps in to handle medical bills, property repairs, legal fees, and potential settlements. We’ve seen how quickly costs can spiral when someone gets hurt or when expensive waterfront property gets damaged. Good liability coverage is like having a financial safety net that prevents one bad day from becoming a lifetime of debt.

Medical payments coverage takes care of injuries to you and your passengers, regardless of who caused the accident. This is particularly valuable because it provides immediate help with medical expenses without waiting to determine fault. Whether it’s a broken bone from a hard landing after hitting a wake or cuts from broken glass, medical payments coverage ensures people get the care they need right away.

Uninsured and underinsured watercraft coverage protects you when the other boater doesn’t have adequate insurance. Unfortunately, not everyone on the water carries proper coverage, and this protection ensures you’re not left paying for someone else’s mistake. Given how expensive boats and medical care can be, this coverage has become increasingly important in busy waterways.

These four core coverages work together to create a comprehensive safety net. At Stanton Insurance Agency, we help boaters understand how these pieces fit together and determine the right coverage limits for their specific situation and budget.

Optional Coverages and Policy Customization

Every boater has their own story on the water. Maybe you’re the type who loves early morning fishing trips on Lake Winnipesaukee, or perhaps you prefer leisurely sunset cruises along the Massachusetts coast. Your boat insurance policy should tell your story too, which is why customization options matter so much.

The beauty of working with an established insurer is their understanding that one size definitely doesn’t fit all when it comes to boat coverage. Beyond the essential protections we’ve already discussed, optional endorsements let you build a policy that truly matches how you use your vessel. Think of these add-ons as the difference between a basic boat and one that’s perfectly equipped for your trips.

Popular Optional Endorsements for your boat insurance state farm policy

Picture this: you’re halfway across the lake when your engine decides to take an unscheduled break. Without Emergency On-Water Service coverage, you might find yourself paddling back to shore with a dinner plate (yes, we’ve heard that story!). This endorsement provides coverage for towing your disabled boat, on-the-spot labor, and even emergency delivery of fuel, oil, or a battery. It’s essentially roadside assistance for the water, and trust me, it’s worth every penny when you need it.

Wreck Removal coverage addresses one of those scenarios nobody wants to think about but everyone should plan for. If your boat becomes a total loss and authorities require its removal, this endorsement covers those often substantial costs. Marine salvage operations aren’t cheap, and this protection ensures you won’t be left scrambling to pay for wreck removal out of pocket.

Your boat trailer works hard, traveling thousands of miles each season between your driveway, the boat ramp, and storage. While your auto policy’s liability coverage extends to your trailer while towing, it won’t cover physical damage to the trailer itself. Boat Trailer Coverage fills this gap, protecting against collision, theft, fire, and other covered perils. Given how much time trailers spend on busy highways, this practical addition makes a lot of sense. More info about Boat trailer safety.

For serious anglers, Fishing Tournament Fee Reimbursement is a thoughtful touch that recognizes the investment competitive fishers make. If a covered loss prevents you from participating in a tournament, this coverage reimburses your non-refundable entry fees. It’s not a huge expense, but it shows understanding of what matters to dedicated fishing enthusiasts.

Personal Effects coverage protects all those valuable items that make your boating experience complete but aren’t permanently attached to your vessel. Your expensive fishing rods, water skis, coolers, electronics, and safety equipment all deserve protection against theft or damage. This endorsement ensures your gear is covered alongside your boat.

Replacement Cost vs. Actual Cash Value (ACV)

One of the most important decisions you’ll make involves how your boat will be valued in the event of a loss. This choice significantly impacts both your premium and your potential payout, so it’s worth understanding the difference. More info about Boat Insurance for Older Boats.

| Feature | Replacement Cost (RC) | Actual Cash Value (ACV) |

|---|---|---|

| Payout Basis | Pays to repair or replace your boat with a new one of similar kind and quality. | Pays the market value of your boat at the time of the loss, accounting for depreciation. |

| Best For | Newer boats, where owners want to avoid out-of-pocket costs for depreciation. | Older boats, or for owners seeking a lower premium. |

| Premium Cost | Higher | Lower |

| Total Loss | Often settled on an “agreed value” basis, where you receive the full insured amount. | You receive the depreciated value, which may be less than what you paid for the boat. |

Replacement Cost coverage means you won’t have to worry about depreciation eating into your settlement. If your three-year-old boat suffers a total loss, you’ll receive enough to buy a comparable new vessel, not just what your used boat was worth. This peace of mind comes with a higher premium, but for newer boats, it’s often worth the extra cost.

Actual Cash Value takes depreciation into account, paying out based on your boat’s current market value rather than replacement cost. This option typically costs less in premiums and can make perfect sense for older vessels where the gap between replacement cost and actual value has widened significantly.

For total losses, many policies offer an “agreed value” option where you and the insurer establish your boat’s value when the policy begins. This removes guesswork and ensures you know exactly what you’ll receive if the worst happens. We often recommend this approach for our clients because it eliminates disputes and provides certainty when you need it most.

Getting a Quote and Handling Claims with State Farm

Getting your boat insurance state farm policy started is easier than docking on a calm day. With over 19,000 agents across the country, you’re likely to find someone nearby who can walk you through the process with a friendly smile and local knowledge. We’ve found that being prepared with the right information makes everything flow smoothly – like having your fenders ready before you pull into the marina.

Information Needed for a Quote

Think of gathering quote information like preparing for a day on the water – the more organized you are, the better the experience. When you call for your boat insurance state farm quote, having these details at your fingertips will help your agent craft the perfect policy for your needs.

Your personal information forms the foundation of any quote. This includes your name, address, and date of birth, plus your boating experience. Have you owned boats before? Any accidents or violations? Don’t worry – we all have stories, and agents have heard them all. Your experience level helps determine your premium, so honesty really is the best policy here.

The boat details are where things get interesting. You’ll need your vessel’s year, make, model, length, and horsepower. Don’t forget the Hull Identification Number (HIN) – it’s like your boat’s fingerprint. Whether you’re insuring a sleek sailboat or a sturdy fishing vessel, these specifications help determine your coverage needs and cost of boat insurance.

Usage information tells the story of how you’ll actually use your boat. Will you be cruising the coastal waters of Massachusetts or exploring New Hampshire’s pristine lakes? Are you a weekend warrior or someone who lives on the water? Any commercial use, even occasional fishing charters, needs to be mentioned upfront.

Here’s a tip that can save you money: safety certifications often lead to discounts. If you’ve completed a boating safety course, have that certificate handy. It shows you’re serious about safe boating, and insurers love responsible boat owners.

How State Farm Handles Claims

Nobody wants to think about accidents, but when they happen, you want a claims process that’s as reliable as a well-maintained engine. The good news is that filing a claim is straightforward – you can file a claim with State Farm online, through their mobile app, or by calling your local agent.

Once you report what happened, a claims adjuster gets assigned to your case. Think of them as your advocate – they’ll assess the damage, review your policy coverage, and work to determine a fair settlement. The process typically moves quickly, especially for straightforward claims like storm damage or theft.

What we really appreciate about the claims process is the transparency. The adjuster will explain what’s covered under your policy and walk you through the settlement calculation. For total losses, many policies include “agreed value” settlements, which means you’ll receive the full amount you and the insurer agreed upon when you bought the policy – no surprises or lengthy negotiations.

The goal is always to get you back on the water as soon as possible. Whether that means arranging repairs at a marina near you or cutting a check for a total loss, the process is designed to minimize your time away from what you love most – being out on the water.

Frequently Asked Questions about Boat Insurance State Farm

Do I need boat insurance in Massachusetts or New Hampshire?

This is probably the most common question we hear from New England boaters, and honestly, it’s a smart one to ask. The legal requirements vary between our neighboring states, which can create some confusion for folks who boat in both areas.

Massachusetts takes a fairly relaxed approach to boat insurance requirements. For most recreational boats, the state doesn’t mandate liability insurance coverage. You can legally take your pontoon out on the lake or cruise the Cape Cod waters without insurance – though we’ll explain why that might not be the wisest choice.

New Hampshire has stricter rules. If you’re operating a boat with an engine over 25 horsepower, you’re generally required to carry liability insurance. This makes sense when you consider the power and potential damage these larger vessels can cause.

Here’s the thing though – regardless of what the law requires, having boat insurance is almost always a smart financial decision. We’ve seen too many clients face devastating repair bills or liability claims that could have been easily covered by insurance. A simple collision with another boat, a fire at the marina, or even someone getting injured while boarding your vessel can lead to costs that far exceed your annual premium. More info about Do I Need Boat Insurance?.

Think of it this way: you wouldn’t drive your car without insurance, even if it wasn’t required. Your boat deserves the same protection, especially considering how expensive marine repairs can be.

Are there discounts available for boat insurance?

Absolutely! One of the great things about working with established insurers is their variety of discount programs. These companies understand that responsible boaters deserve rewards for their good habits, and they’re willing to put their money where their mouth is.

The multi-policy discount is probably the most popular option we see. If you bundle your boat coverage with your existing auto or home insurance, you can often save significantly on all your policies. It’s one of those rare situations where getting more coverage actually costs you less overall.

Boating safety course completion is another fantastic way to reduce your premium. These courses don’t just make you a safer boater – they also demonstrate to insurers that you’re serious about responsible operation. Most approved courses can be completed online or over a weekend, making them both convenient and financially beneficial.

If you’ve maintained a claim-free history, many insurers will reward your careful boating with lower rates. It’s their way of recognizing that you’re less likely to cost them money in the future.

For us New Englanders, the lay-up period discount can be particularly valuable. Since most of us store our boats during the harsh winter months, insurers often reduce your premium during this time when your boat isn’t actively being used.

The key is to ask about all available discounts when you’re shopping for coverage. Every insurer has different programs, and you might be surprised by how much you can save.

What are some key boating safety tips?

Safety on the water isn’t just about following rules – it’s about ensuring that every trip ends with everyone returning home safely. The best boat insurance policy in the world can’t replace proper safety practices, though following these guidelines might even help lower your rates.

Always wear a life jacket – this might sound obvious, but you’d be amazed how many experienced boaters skip this basic safety measure. Water conditions can change instantly, and even strong swimmers can find themselves in trouble. Make sure you have properly fitting life jackets for everyone on board, and actually wear them.

Never operate under the influence of alcohol or drugs. The water might seem more relaxed than the highway, but impaired boating is just as dangerous as impaired driving. Your reaction time, judgment, and coordination are all compromised, putting everyone at risk.

Check weather conditions before heading out, and keep monitoring them throughout your trip. New England weather can be particularly unpredictable, with sudden storms rolling in off the Atlantic. If there’s any doubt about conditions, it’s better to stay at the dock.

Your boat should always carry essential safety equipment including a fire extinguisher, flares, first-aid kit, horn or whistle, proper navigation lights, and a reliable anchor. More importantly, make sure you know how to use all of this equipment before you need it in an emergency.

Take a boating safety course if you haven’t already. Beyond the potential insurance discounts, these courses teach crucial skills like navigation rules, emergency procedures, and proper boat handling. The knowledge you gain could prevent accidents and save lives.

Don’t forget about proper trailer safety either. Many boating accidents actually happen on the road, not on the water. Ensure your trailer is properly maintained, your boat is securely fastened, and your towing vehicle is up to the task. More info about Boat trailer safety.

Following these boating safety tips creates a foundation for enjoyable, worry-free time on the water. Safe boaters are happy boaters, and they often pay less for insurance too.

Conclusion

Choosing the right boat insurance is like selecting the perfect life jacket – it needs to fit your specific situation and provide reliable protection when you need it most. A boat insurance state farm policy offers that strong foundation of coverage, combined with the flexibility to add endorsements that match your unique boating lifestyle on New England’s beautiful waters and beyond.

Throughout this guide, we’ve explored everything from understanding core coverages like liability and physical damage protection to navigating the claims process with confidence. We’ve seen how optional endorsements can transform a standard policy into something perfectly custom for your needs – whether that’s emergency on-water service for those “uh-oh” moments or fishing tournament fee reimbursement for serious anglers.

The beauty of being informed is that it empowers you to make smart decisions. You now understand the difference between replacement cost and actual cash value coverage, know what information you’ll need for a quote, and have a clear picture of how claims are handled. This knowledge lets you protect your vessel properly and enjoy your time on the water with true peace of mind.

We’ve also covered the practical stuff that matters to New England boaters – from understanding insurance requirements in Massachusetts and New Hampshire to finding money-saving discounts and essential safety tips. Following proper safety practices doesn’t just keep you and your passengers safe; it can also help lower your insurance costs.

Every boater’s situation is unique. What works perfectly for a weekend pontoon enthusiast might not suit someone who takes their cabin cruiser on extended coastal trips. That’s why having expert guidance makes such a difference in finding coverage that truly fits your needs and budget.

For personalized advice and to explore your options for a comprehensive boat insurance state farm policy, the experts at Stanton Insurance Agency are here to help. We’ve been providing trusted protection for New England families for generations, and we understand the specific challenges and joys of boating in our region.

We can help you compare policies, explain coverage options in plain English, and find the perfect fit for your situation. After all, the best insurance policy is one you understand completely and feel confident about. Contact us today for a comprehensive boat insurance quote and let’s get you properly protected so you can focus on what matters most – enjoying your time on the water.