Best Health Insurance Companies for Individuals: 2025 Top Rated

Why Finding the Right Individual Health Insurance Matters More Than Ever

Best health insurance companies for individuals vary widely in coverage, cost, and customer service—making the right choice crucial for your health and wallet. With individual health-insurance premiums averaging $456 per month nationally and 9 out of 10 people qualifying for financial help through subsidies, selecting the wrong plan could cost you thousands.

Top Individual Health Insurance Options (2025):

1. Largest national carrier – holds more than 15% market share, offers expansive provider networks.

2. Multistate insurer with strong local presence – pays over 97% of claims at in-network levels.

3. Integrated health-system insurer – combines hospitals, doctors, and coverage for seamless care coordination.

4. Established carrier focused on telehealth – provides comprehensive benefit designs plus 24/7 virtual access.

5. Digital-first newcomer – emphasizes intuitive mobile tools, concierge style support, and round-the-clock virtual care.

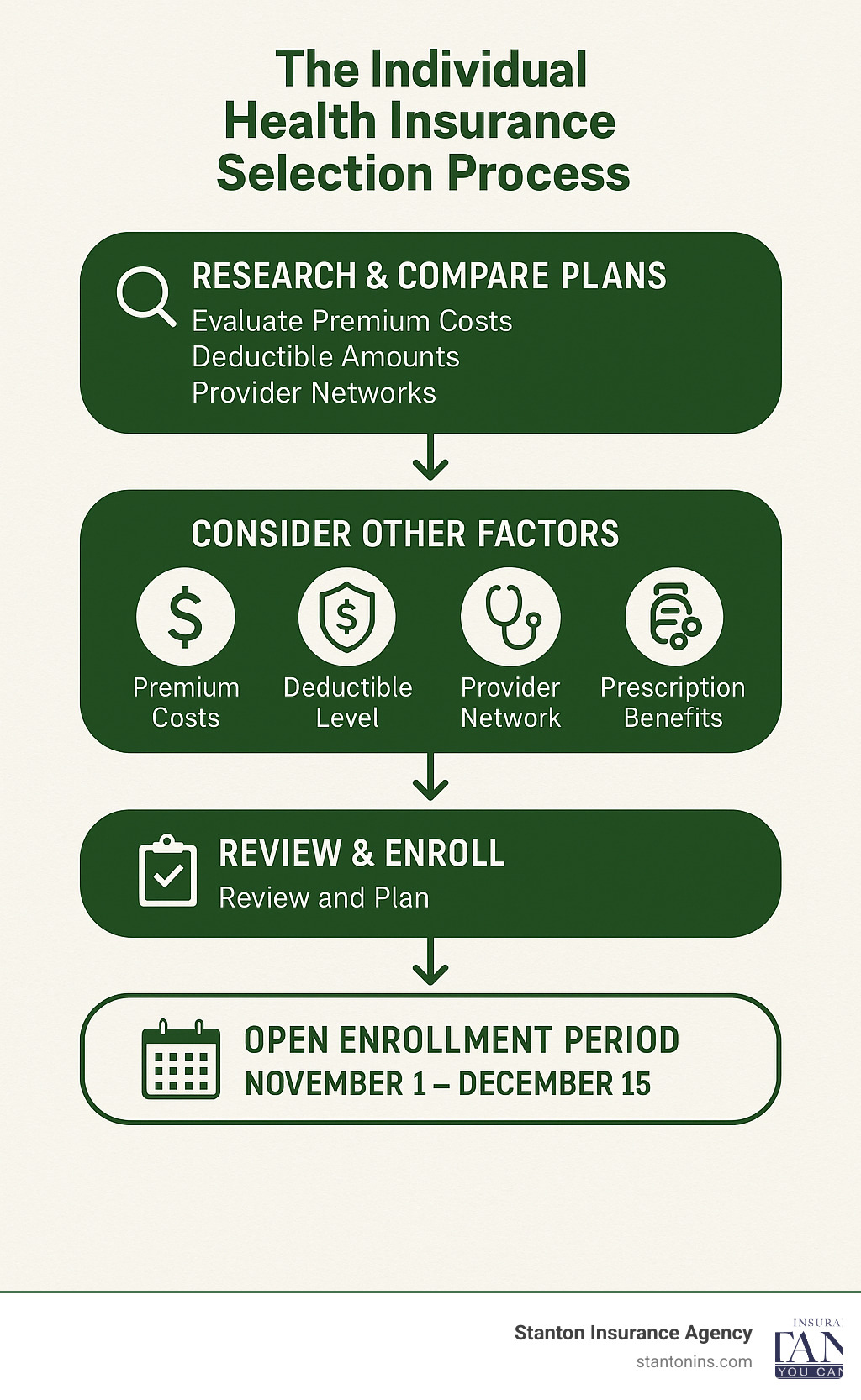

Individual health insurance differs significantly from employer-sponsored plans. You’ll pay the full premium yourself, but you gain complete control over your coverage choices. The key factors to compare include premium costs, deductibles, provider networks, prescription coverage, and digital tools like telehealth access.

Open enrollment runs from November 1 to December 15 each year, though qualifying life events can trigger special enrollment periods. Most plans now include $0 preventive care, virtual urgent care options, and wellness rewards programs.

I’m Geoff Stanton, President of Stanton Insurance Agency, with over 25 years of experience helping Massachusetts and New Hampshire residents steer health-insurance choices. Through my work with individuals and families seeking the best health insurance companies for individuals, I’ve seen how the right plan can provide both peace of mind and significant cost savings.

Best Health Insurance Companies for Individuals: 2025 Winners

When you’re shopping for individual health insurance, the sheer number of options can feel overwhelming. After diving deep into market data, customer satisfaction ratings, and plan features, certain characteristics consistently emerge among companies that deliver what solo coverage seekers need most: reliable networks, fair pricing, and tools that actually make your life easier.

Market leaders typically hold significant market share because they’ve proven their ability to serve individual members effectively. Companies with comprehensive coverage options include everything from short-term plans for coverage gaps to full ACA-compliant marketplace plans that qualify for subsidies. Look for insurers offering 24/7 virtual care access through mobile apps, which is a game-changer when you’re managing your own healthcare decisions.

Regional carriers often earn strong positions in their service areas with impressive track records. In states like Colorado, top-performing insurers pay 97.7% of claims at in-network benefit levels—that’s the kind of reliability you want when you’re paying your own premiums. Some members qualify for plans as low as $1 per month after subsidies, making quality coverage surprisingly affordable.

The integrated care approach eliminates many of the headaches that come with traditional insurance. When an insurer also runs hospitals and employs doctors, you get seamless care coordination and fewer billing surprises. Quality credentials matter—look for insurers whose networks include physicians recognized by local medical publications and professional organizations.

Innovation-focused insurers may hold smaller market shares but often punch above their weight with new approaches. Their focus on telehealth integration and preventive care includes $0 virtual care options and comprehensive prescription coverage—some commonly used drugs come at no cost to members.

Digital-first companies represent the future of health insurance with their technology-focused philosophy. While smaller in market share, the best have earned recognition for their intuitive mobile apps, round-the-clock virtual care access, and concierge-style customer service that pairs you with registered nurses who actually know your situation.

Why these characteristics define the best health insurance companies for individuals in 2025

The best health insurance companies for individuals didn’t earn their reputations by accident. They’ve proven themselves through consistent performance in the areas that matter most when you’re flying solo: customer satisfaction scores, financial strength ratings, and how quickly they process claims.

Massive networks mean you’re far more likely to find in-network providers whether you’re at home or traveling for work. Broad plan selections work for everyone from healthy twenty-somethings to people managing chronic conditions—no one-size-fits-all approach here.

Regional expertise brings something special to the table: deep local market knowledge. The best insurers understand regional healthcare networks and have built relationships with providers that translate into better experiences for you. Smart rewards programs sweeten the deal by offering up to $325 in gift cards for completing simple health activities like annual checkups.

Integrated models cut out the typical insurance company runaround. When billing questions arise or you need to see a specialist, everything happens within their system. Members consistently report smoother experiences and better care coordination.

Forward-thinking insurers recognize that healthcare access shouldn’t depend on your zip code. Their virtual care options and prescription home delivery services work especially well for busy professionals and rural residents who might struggle to access specialists locally.

Modern insurance treats health insurance like it should work in 2025—intuitive, responsive, and actually helpful. Step-tracking rewards programs can put up to $240 back in your pocket annually, while concierge teams provide personalized guidance when medical situations get complicated.

Ranking criteria for the best health insurance companies for individuals

Evaluating best health insurance companies for individuals requires looking beyond flashy marketing to understand what you’ll actually experience as a member. We analyze premiums across different age groups and income levels, deductible structures, copay amounts, and out-of-pocket maximums to understand your true costs.

Network quality matters enormously when you don’t have an employer HR department to help resolve provider issues. We examine not just the number of doctors and hospitals in each network, but how often members actually get care at in-network rates. The best insurers maintain broad networks and work hard to keep key providers in-network.

While all ACA-compliant plans offer $0 preventive coverage for recommended screenings and immunizations, some insurers go further. They might cover additional wellness services or provide improved virtual preventive care options that save you time and money.

Digital tools have become essential for individual plan members who manage their own healthcare decisions. The ability to check benefits, find providers, estimate costs, and access virtual care through user-friendly apps often determines whether you’ll love or hate your insurance experience.

Financial strength ratings from agencies like A.M. Best ensure your chosen insurer can reliably pay claims. Individual plan members have fewer protections than those in large employer groups, so we prioritize companies with strong balance sheets and consistent profitability. You want an insurer that will be there when you need them most.

For more detailed information about quality ratings, you can review the quality rating system information available through Healthcare.gov.

How Individual Plans Differ & Key Factors to Compare

Shopping for individual health insurance feels like navigating a maze compared to simply accepting whatever your employer offers. When you’re buying coverage on your own, you become the decision-maker for every aspect of your plan – and that responsibility comes with both freedom and complexity.

The biggest difference you’ll notice is cost. Individual health insurance premiums averaged $456 monthly in 2020, but here’s the catch – you might not pay anywhere near that amount. Unlike employer plans where you’re stuck with whatever contribution your company decides, individual plans come with potential subsidies that can dramatically reduce your costs.

Marketplace versus off-exchange plans represent your two main shopping avenues. Think of the marketplace (HealthCare.gov or your state’s exchange) as the place where financial help lives. Buy through the marketplace, and you might qualify for premium tax credits or cost-sharing reductions based on your income. Purchase the same plan off-exchange directly from an insurer, and you’ll pay full price – but sometimes gain access to additional plan options not available through the marketplace.

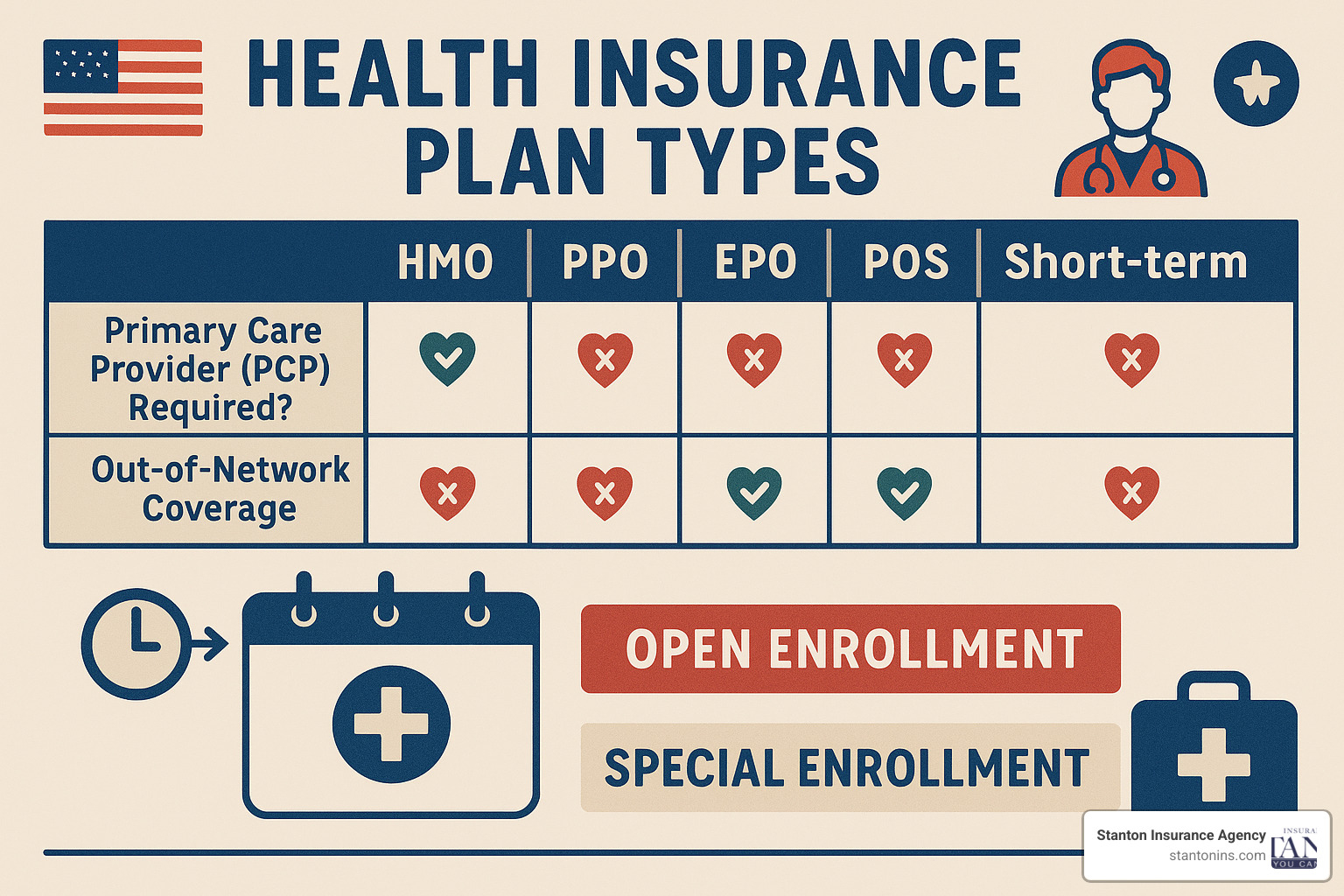

The best health insurance companies for individuals offer multiple plan types, each with distinct rules about how you access care. HMO plans require you to choose a primary care physician who becomes your healthcare quarterback, coordinating referrals to specialists. PPO plans give you the freedom to see any provider but reward you with lower costs when you stay in-network. EPO plans blend HMO networks with PPO flexibility – no referrals needed, but zero coverage if you venture outside the network. POS plans attempt to combine the best of all worlds, though they can feel complicated to steer.

Short-term plans deserve special mention because they’re not really health insurance in the traditional sense. These plans can bridge coverage gaps when you’re between jobs or waiting for open enrollment, but they don’t include essential health benefits like prescription drugs or maternity care. Catastrophic plans are available to people under 30 or those with hardship exemptions – they cover major medical expenses but come with high deductibles.

Self-employed individuals often find individual plans more attractive than expected because they can deduct premiums as a business expense. Students have unique options too – staying on parent plans until age 26 or exploring student health plans through their schools.

Special enrollment periods become your lifeline when life throws curveballs. Lost your job? Got married? Moved to a new state? These qualifying events open a window outside the November 1 to December 15 open enrollment period, ensuring you don’t face coverage gaps or penalties.

Understanding your options starts with knowing where to look for comprehensive guidance. Our personal insurance page covers the full spectrum of individual coverage options. If you’re transitioning from employer coverage, our guide to COBRA insurance explains how to bridge the gap while you shop for permanent coverage.

Must-know cost terms

Health insurance speaks its own language, and fluency in cost terminology can save you thousands of dollars. Let’s break down the terms that actually matter when you’re comparing plans and budgeting for healthcare expenses.

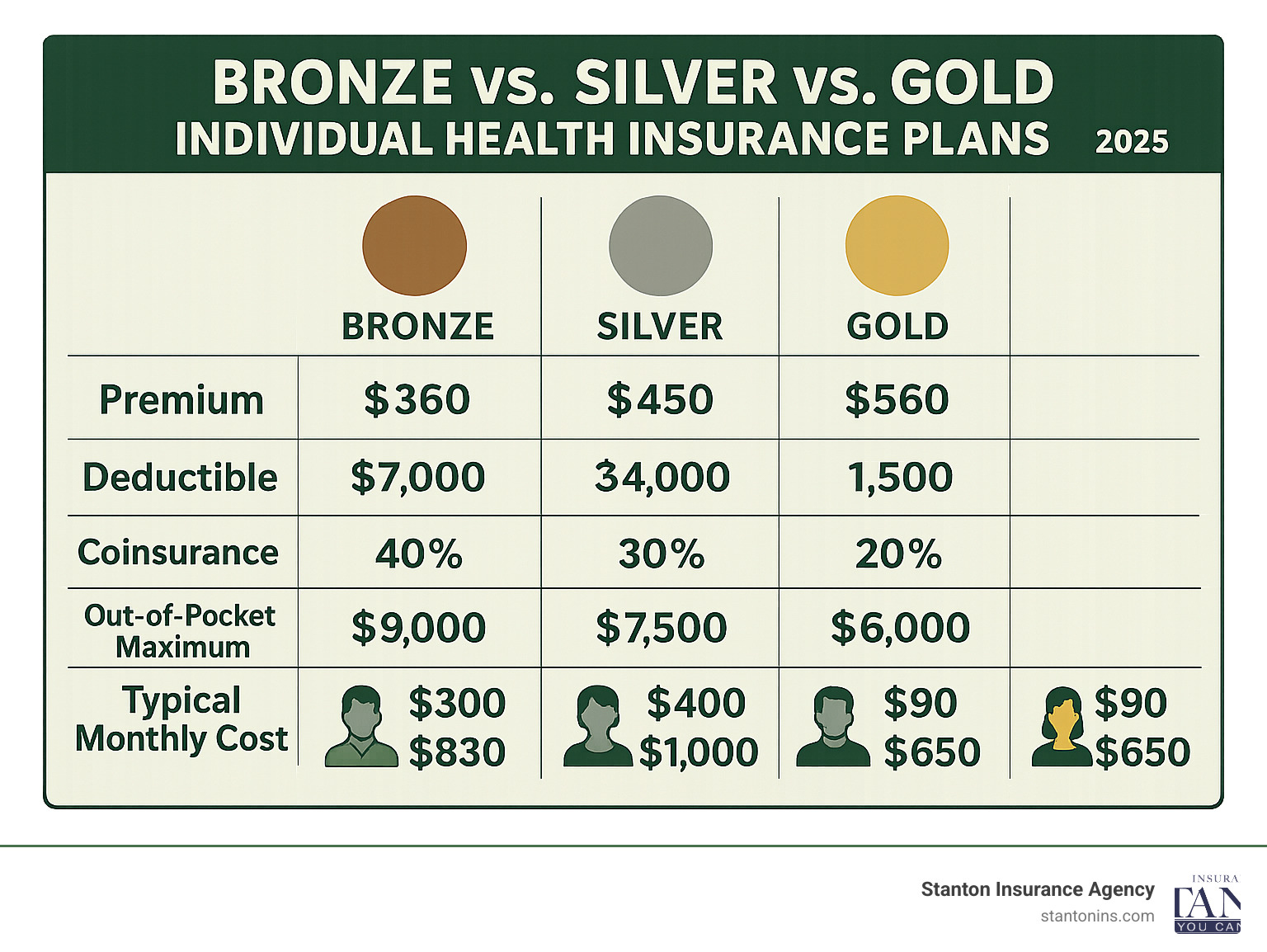

Premiums are your monthly membership fee – think of them like a gym membership that keeps your coverage active. Individual plan premiums average $456 nationally, but your actual cost depends on your age, where you live, and which plan you choose. A 25-year-old in New Hampshire might pay $200 monthly for the same coverage that costs a 55-year-old $600.

Deductibles represent the amount you pay out of your own pocket before your insurance kicks in for most services. Individual plan deductibles typically range from $2,500 to $8,550, with family deductibles reaching $5,000 to $17,100. Here’s the trade-off that trips up many people – higher deductibles usually mean lower monthly premiums, making them attractive if you’re healthy and rarely need medical care.

Coinsurance splits the bill after you’ve met your deductible. A typical 80/20 coinsurance arrangement means you pay 20% of covered services while your insurer handles the remaining 80%. Some plans offer 90/10 splits or even 100% coverage after the deductible, particularly for in-network care.

Out-of-pocket maximums function as your financial safety net, capping your annual healthcare spending regardless of how much care you need. Once you hit this limit, your insurer pays 100% of covered services for the rest of the plan year. Federal law caps individual maximums at $9,450 for 2024 and family maximums at $18,900.

Cost-sharing reductions offer a hidden gem for marketplace shoppers earning between 100% and 250% of the federal poverty level. These subsidies apply only to Silver-tier plans and can significantly reduce your deductibles, copays, and coinsurance amounts – sometimes making a Silver plan cheaper than Bronze despite the higher premium.

The math gets complex quickly, which is why we’ve created a detailed guide explaining how much personal health insurance costs in our Massachusetts and New Hampshire service areas. Understanding these terms helps you compare plans accurately rather than simply choosing the lowest premium and hoping for the best.

Comparing Plan Types & Real-World Costs

Choosing between plan types can feel overwhelming, but understanding how each works in practice makes the decision much clearer. Think of it this way: HMO plans operate like having a family doctor who knows your complete health picture and coordinates everything for you. You’ll select a primary care physician who becomes your healthcare quarterback, providing referrals when you need specialists.

This gatekeeper approach keeps costs predictable and premiums low, making HMOs perfect for individuals who prefer structured care and don’t mind the extra step of getting referrals. The trade-off? Less flexibility, but often the most affordable option among the best health insurance companies for individuals.

PPO plans work more like an all-access pass to healthcare. You can see any doctor, visit specialists without referrals, and even get some coverage for out-of-network providers (though you’ll pay more). This flexibility comes with higher monthly premiums, but many people find the freedom worth the extra cost.

EPO plans split the difference beautifully. You get PPO-style freedom to see specialists without referrals, but you’re limited to in-network providers except for true emergencies. Many newer insurers have acceptd this model because it pairs well with digital-first approaches and comprehensive telehealth options.

POS plans blend the best of both worlds by requiring a primary care physician like an HMO while offering some out-of-network coverage like a PPO. These hybrid plans appeal to people who want guidance from a primary doctor but occasionally need flexibility for specialized care.

ACA metal tiers make comparing costs much easier by standardizing how much each plan type covers. Bronze plans cover 60% of your healthcare costs with the lowest premiums but highest deductibles. Silver plans cover 70% and often work best with subsidies. Gold plans cover 80% with higher premiums but lower out-of-pocket costs when you need care. Platinum plans cover 90% but come with the highest monthly costs.

Short-term plans might seem tempting for their low premiums, but they’re designed only for coverage gaps between permanent insurance. They can exclude pre-existing conditions and don’t include essential benefits like prescription drugs or maternity care.

Most plans now treat vision and dental as separate add-ons, though some insurers offer bundled packages. Prescription coverage varies significantly between plans, with different tier structures that can dramatically affect your medication costs.

Here’s what’s exciting: telehealth-first care has revolutionized how we access healthcare. Most plans now include $0 virtual urgent care visits and many preventive services through video calls. This means you can often handle minor illnesses, follow-up appointments, and routine check-ins from home.

Preventive care comes at $0 cost-sharing across all ACA-compliant plans, covering everything from annual physicals to recommended screenings and immunizations. This benefit alone can save you hundreds of dollars annually.

Frequently Asked Questions about the Best Health Insurance Companies for Individuals

When you’re shopping for individual coverage, questions about costs and flexibility naturally come up. These are the most common concerns I hear from clients at Stanton Insurance Agency, and understanding the answers can save you both money and stress down the road.

What subsidies or tax credits can lower my solo health-insurance bill?

Here’s some good news: premium tax credits can cut your monthly insurance costs significantly if you buy coverage through the ACA marketplace. These subsidies work on a sliding scale based on your income, and you might be surprised at how much help is available.

For 2024, single people earning up to $54,360 annually qualify for premium subsidies. If you’re supporting a family of four, that income limit jumps to $111,000. The subsidies are designed to keep your premium costs reasonable – typically between 2.07% and 9.12% of your total income, depending on what you earn.

But wait, there’s more help available. Cost-sharing reductions can lower your deductibles, copays, and coinsurance amounts if you choose a Silver-tier marketplace plan. These extra savings kick in for households earning between 100% and 250% of the federal poverty level. Some Silver plans with these reductions actually provide benefits similar to much more expensive Gold or Platinum plans.

The smartest move? Take advantage of advanced premium tax credits that reduce your monthly bill immediately rather than making you wait until tax season. Just remember you’ll need to square up with the IRS when you file your annual return, so keep them updated if your income changes during the year.

How do short-term plans stack up against ACA-compliant coverage?

Short-term health insurance might seem tempting with its lower upfront costs, but these plans come with significant trade-offs that could leave you in a tough spot. Most best health insurance companies for individuals offer these as stopgap solutions, not long-term coverage.

These plans typically last 90 days to just under 12 months and can exclude pre-existing conditions completely. They also skip many essential health benefits that ACA-compliant plans must include. Think of them like buying a car with no airbags – they might get you from point A to point B, but you’re taking on extra risk.

The biggest difference lies in consumer protections. ACA-compliant plans cannot turn you away for pre-existing conditions, must cover essential benefits like prescription drugs and maternity care, and include unlimited annual and lifetime benefits. Short-term plans often exclude these protections entirely.

That said, short-term coverage can work for specific situations. If you’re between jobs waiting for new employer benefits to start, or you’ve just turned 26 and aged off your parents’ plan but missed open enrollment, a short-term plan might provide basic protection until you can get comprehensive coverage.

Can I switch plans outside Open Enrollment if my needs change?

Life happens, and fortunately, Special Enrollment Periods give you flexibility to change your health insurance when major life events occur. You don’t have to wait for the annual November 1 to December 15 open enrollment window if qualifying circumstances arise.

Job loss triggers a 60-day special enrollment period where you can select marketplace coverage or explore COBRA continuation from your former employer. Getting married or divorced creates similar opportunities for both spouses to adjust their coverage to better fit their new situation.

Moving to a new state always qualifies you for special enrollment, since different states offer different plan options. Even moving within Massachusetts or New Hampshire can qualify if your new location has different available plans. Students graduating from college and losing student health coverage also get a special enrollment opportunity.

Income changes that affect your subsidy eligibility open up plan-switching opportunities too. Got a big promotion that pushes you above subsidy limits? Or maybe job loss makes you eligible for better subsidies? You can adjust your coverage to match your new financial situation.

The key is acting quickly. Most special enrollment periods last only 60 days from when the qualifying event happens, and your new coverage typically starts the first day of the month after you make your selection. Don’t wait – these windows close fast.

Conclusion

Finding the right coverage among the best health insurance companies for individuals doesn’t have to feel overwhelming when you understand what matters most. Our analysis shows how large national carriers, strong regional insurers, integrated health-system plans, telehealth-focused providers, and tech-forward newcomers each serve different individual needs.

The biggest lesson I’ve learned in 25+ years of helping Massachusetts and New Hampshire residents is this: the cheapest premium rarely means the best deal. When you factor in deductibles, network restrictions, and out-of-pocket maximums, that bargain Bronze plan might cost you thousands more if you actually need care.

Your individual coverage journey starts with understanding whether marketplace subsidies can slash your monthly costs. Nine out of ten people qualify for some financial help, and those savings can transform a $600 monthly premium into something much more manageable. The key is shopping on-exchange through HealthCare.gov to open up these benefits.

Digital tools have become game-changers for individual plan members who don’t have employer HR departments to call when problems arise. Look for insurers offering 24/7 virtual care, user-friendly mobile apps, and wellness programs that reward you for staying healthy. These features aren’t just nice-to-haves anymore—they’re essential for managing your healthcare independently.

The complexity of individual insurance markets makes working with experienced local agents more valuable than ever. We understand the nuances of our regional provider networks, which plans actually deliver on their promises, and how to maximize your subsidy eligibility. Most importantly, we’re here when you need help navigating claims or coverage issues.

At Stanton Insurance Agency, we’ve guided thousands of individuals through these decisions, always focusing on finding coverage that protects both your health and your budget. The best health insurance companies for individuals are the ones that match your specific situation—whether you’re self-employed, between jobs, or simply want better coverage than your employer offers.

Ready to explore your options? Learn more about working with independent health insurance agencies and find how local expertise can help you make smarter coverage choices. We’re here to serve as your trusted guide through the individual insurance landscape.

Like us on Facebook!