Do I Need Renters Insurance in Massachusetts? 7 Key Facts 2025

Why Massachusetts Renters Need to Know About Insurance Protection

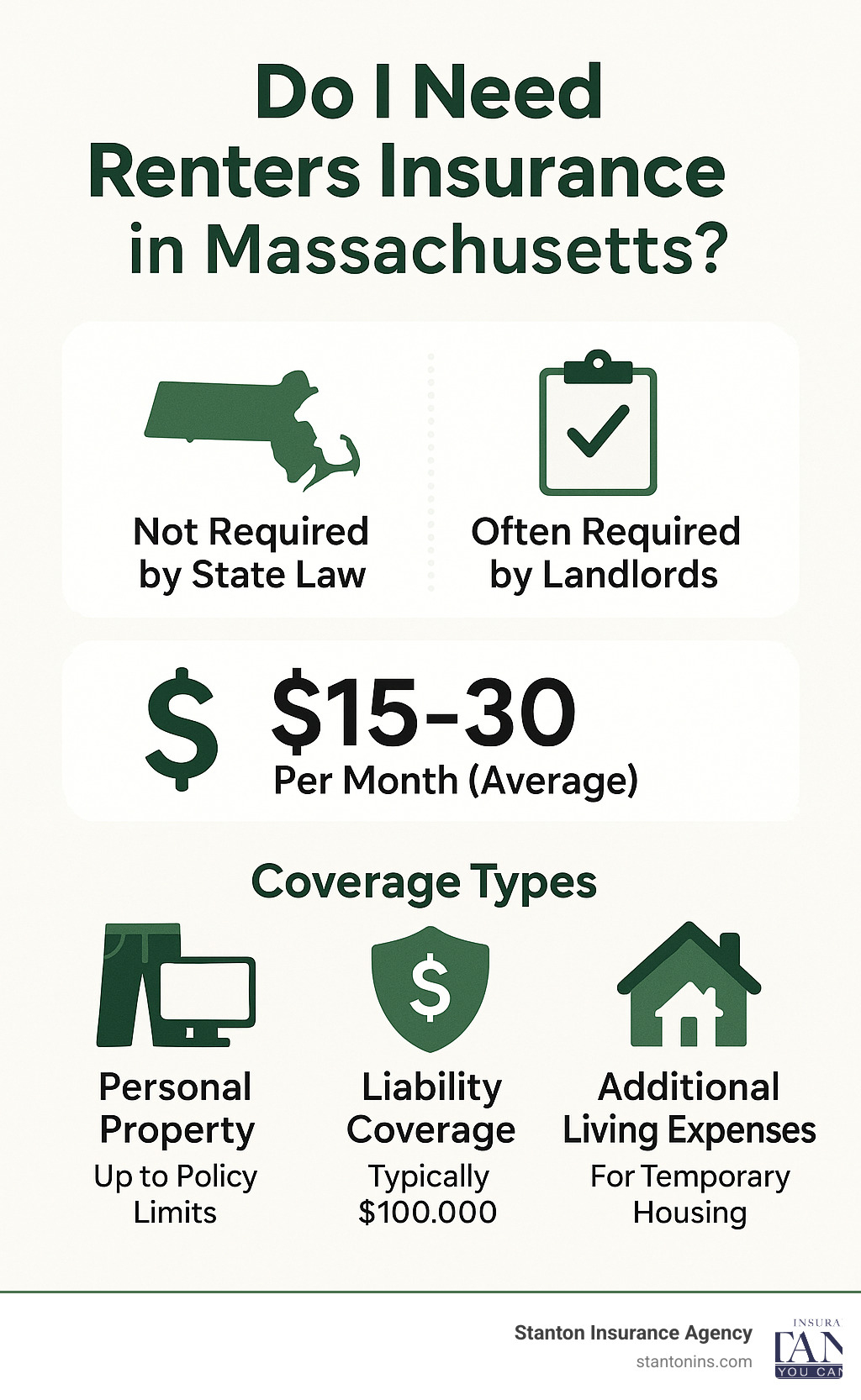

Do I need renters insurance in Massachusetts? The short answer is: while state law doesn’t require it, most landlords do – and you absolutely should have it regardless.

Here’s what you need to know:

- State Requirement: Massachusetts law does NOT mandate renters insurance

- Landlord Requirements: Most landlords legally require proof of coverage before move-in

- Your Risk: Without coverage, you’re personally liable for replacing everything you own

- Cost: Average premiums range from $15-30 per month (less than $1 per day)

- Coverage: Protects personal belongings, liability claims, and temporary housing costs

Why this matters: 37% of Massachusetts households rent their homes, but only 41% of renters carry insurance. That means most renters are one fire, break-in, or water leak away from financial disaster.

Your landlord’s property insurance covers the building structure – but zero of your personal belongings. If a kitchen fire destroys your laptop, furniture, and clothes, you’re paying to replace everything out of pocket without renters insurance.

I’m Geoff Stanton, a 4th generation insurance professional and President of Stanton Insurance in Waltham, Massachusetts. Having helped countless Bay State renters steer the question “do I need renters insurance in Massachusetts,” I’ve seen how a $20 monthly policy can prevent thousands in unexpected expenses.

Basic do i need renters insurance in massachusetts vocab:

– what does renters insurance cover

– how much is renters insurance in massachusetts

– can a landlord require renters insurance in massachusetts

What Exactly Is Renters Insurance?

Picture this: you’re sitting in your cozy Boston apartment when you smell smoke from upstairs. Within hours, water damage from sprinklers has soaked your furniture, electronics, and everything you own. Without renters insurance, you’re looking at thousands to replace it all.

Do I need renters insurance in Massachusetts becomes urgent when facing that reality. Renters insurance is your financial protection when disasters strike your rental home.

Renters insurance protects three crucial areas. Personal property coverage handles your belongings when damaged, destroyed, or stolen – everything from your smartphone and gaming console to your winter coats and coffee maker.

Liability protection is your legal shield. If your friend slips on your wet bathroom floor and breaks their wrist, or you accidentally start a kitchen fire that damages your neighbor’s unit, liability coverage handles medical bills and legal costs. Most Massachusetts policies start with $100,000 in liability coverage.

The third piece is loss of use coverage, also called additional living expenses. When your apartment becomes unlivable due to a covered disaster, this pays for hotel rooms, restaurant meals, and other extra costs while displaced.

Two key terms: your deductible is what you pay out of pocket before insurance kicks in – typically $500 in Massachusetts. Policy limits are the maximum your insurance will pay for covered losses.

Replacement Cost vs. Actual Cash Value

Here’s where many Bay State renters make costly mistakes without realizing it.

Let’s say someone steals your three-year-old MacBook that originally cost $1,200. How much should insurance pay?

With actual cash value coverage, your insurer calculates what that laptop is worth today after depreciation. That $1,200 laptop might only be valued at $600 now. After your $500 deductible, you’d receive just $100.

Replacement cost coverage pays what you’d need to spend today to buy a similar new laptop – let’s say $1,100. After your $500 deductible, you’d receive $600 – enough to actually replace what you lost.

| Coverage Type | Original Cost | Current Value | Payout (with $500 deductible) |

|---|---|---|---|

| Actual Cash Value | $1,200 | $600 | $100 |

| Replacement Cost | $1,200 | $1,100 | $600 |

Replacement cost coverage typically adds just a few dollars monthly, but can mean the difference between replacing your belongings and being stuck with inadequate compensation. Understanding your coverage options can help you determine which approach makes sense for your situation.

Do I Need Renters Insurance in Massachusetts?

Here’s the truth about do I need renters insurance in Massachusetts: while the state won’t force you to buy it, your landlord probably will – and you’d be smart to get it either way.

Massachusetts doesn’t legally require renters insurance. There’s no state law mandating coverage like auto insurance. But Massachusetts General Law Chapter 186, Section 15B gives landlords the right to require renters insurance as part of your lease agreement.

Boston-area landlords now require proof of renters insurance about 95% of the time. College towns like Cambridge, Amherst, and Northampton make it basically universal for student housing. Even smaller Massachusetts communities see more landlords requiring coverage every year.

The state’s official position, according to Massachusetts government guidance, is that while renters insurance isn’t mandatory, experts strongly recommend it for financial protection.

Here’s the legal nuance: landlords can’t charge you an insurance fee directly (M.G.L. 186 § 15B limits move-in costs to first month’s rent, last month’s rent, security deposit, and key charges). But requiring you to buy your own policy? Totally legal.

What If My Landlord Demands Proof?

When your lease says “must provide proof of renters insurance,” don’t stress. Your insurance company will generate a certificate of insurance – a one-page summary proving you have active coverage.

Most insurers can produce this certificate instantly online or through your agent. You’ll want to add your landlord as an “interested party” on your policy too. This means they’ll get notification if your coverage ever lapses.

Already signed your lease and just found the insurance requirement? You can typically get coverage and provide proof within 24-48 hours. More info about requirements breaks down exactly what landlords can demand.

Does My Landlord’s Policy Cover My Stuff?

This is the misconception that gets renters in trouble: your landlord’s insurance covers exactly zero of your personal belongings.

Your landlord’s property insurance covers the building structure – walls, floors, roof, built-in fixtures. But your furniture, electronics, clothes, and everything else that makes your apartment feel like home? That’s all on you to replace.

A burst pipe floods your apartment and ruins your mattress, dresser, and laptop? Your landlord’s insurance pays to fix the flooring and drywall. You’re writing checks to replace everything you lost.

Without renters insurance, you’re looking at serious out-of-pocket risk. The average Massachusetts renter would need $5,000 or more to replace their belongings after a total loss. Most people don’t have that cash available, which is why that $20 monthly premium is such a bargain.

What’s Covered—and What’s Not

When wondering do I need renters insurance in Massachusetts, understanding coverage makes the decision clearer. Massachusetts renters insurance operates on a “named perils” basis – protecting you against specific disasters listed in your policy.

Coverage is comprehensive for everyday risks. Fire and smoke damage top the claims list. Theft and vandalism coverage kicks in if someone breaks into your apartment. Water damage from burst pipes, overflowing washing machines, or your upstairs neighbor’s bathtub leak is covered. New England weather brings wind and hail damage from intense storms. Your policy also handles lightning strikes, falling objects like tree branches, and explosions.

Your liability protection becomes your financial lifeline when someone gets hurt in your space or you accidentally cause damage elsewhere. Your friend trips over your coffee table and breaks their wrist, or your washing machine floods the apartment below – these situations can cost thousands in medical bills and repairs.

Additional living expenses cover costs when you can’t live in your apartment. Hotel bills, restaurant meals, extra transportation, and storage fees – all covered while your place gets repaired.

Some things aren’t covered. Flood damage requires separate flood insurance. Earthquake damage rarely happens here but can be added. Your policy won’t pay for pest infestations, normal wear and tear, or intentional damage. Business property needs separate coverage.

More info about coverage explains which scenarios trigger payouts.

Do I Need Extra Coverage for Valuables?

Your standard policy has built-in limits on certain belongings. Most policies cap jewelry coverage at $1,000 to $2,000 total, and electronics might be limited to $2,500. If your engagement ring cost $3,000 or your gaming setup is worth $4,000, you have a coverage gap.

The solution is scheduling these items with additional coverage called riders or floaters. We see this most often with engagement rings, high-end electronics, musical instruments, art and collectibles, and bicycles – popular among Boston and Cambridge renters.

Scheduled items get covered for their full appraised value with broader protection. If you accidentally drop your scheduled engagement ring down a drain, it’s covered.

Will Roommates Be Covered?

Spouses and children are automatically covered under one policy. Domestic partners may qualify depending on your insurer’s rules. Unrelated roommates typically need separate policies, and visiting friends aren’t covered for their belongings.

Liability coverage gets complicated with roommates. If your roommate accidentally causes water damage to the apartment below, your policy might not cover it. We usually recommend each roommate carry their own policy to avoid coverage gaps and disputes.

How Much Does Renters Insurance Cost in Massachusetts?

Do I need renters insurance in Massachusetts becomes easier when you realize we’re talking about $15-30 per month – less than most coffee spending.

Massachusetts renters pay an average of $17 per month ($208 annually) for around $35,000 in personal property coverage. More recent data shows costs averaging $22.01 monthly or $264.16 annually statewide.

Where you live matters. Boston and Cambridge apartments cost more to insure than Springfield or Pittsfield. Higher crime rates and property values in urban areas mean higher premiums.

Your building type also affects pricing. New apartment complexes with sprinkler systems and security cost less than third-floor walkups in 100-year-old buildings without modern safety features.

Coverage limits affect pricing, but not dramatically. Bumping personal property coverage from $25,000 to $50,000 typically adds just $3-5 monthly.

Your deductible choice creates the biggest premium impact. Choosing a $1,000 deductible instead of $500 can save $50-100 annually. Just ensure you can afford the higher out-of-pocket cost.

Previous claims and credit score also factor into Massachusetts pricing.

For current rates, check how much is renters insurance in Massachusetts for detailed local pricing.

Smart Ways to Save

Bundle your policies and save 10-25% on both renters and auto insurance with the same company.

Stay claims-free for three to five years for loyalty discounts.

Pay annually instead of monthly and save 5-10% through pay-in-full discounts.

Go paperless for billing and policy documents for small additional savings.

Security features like smoke detectors, burglar alarms, deadbolts, and gated communities qualify for discounts.

Professional discounts are common for teachers, nurses, engineers, and other professionals.

Calculating Your Coverage Needs

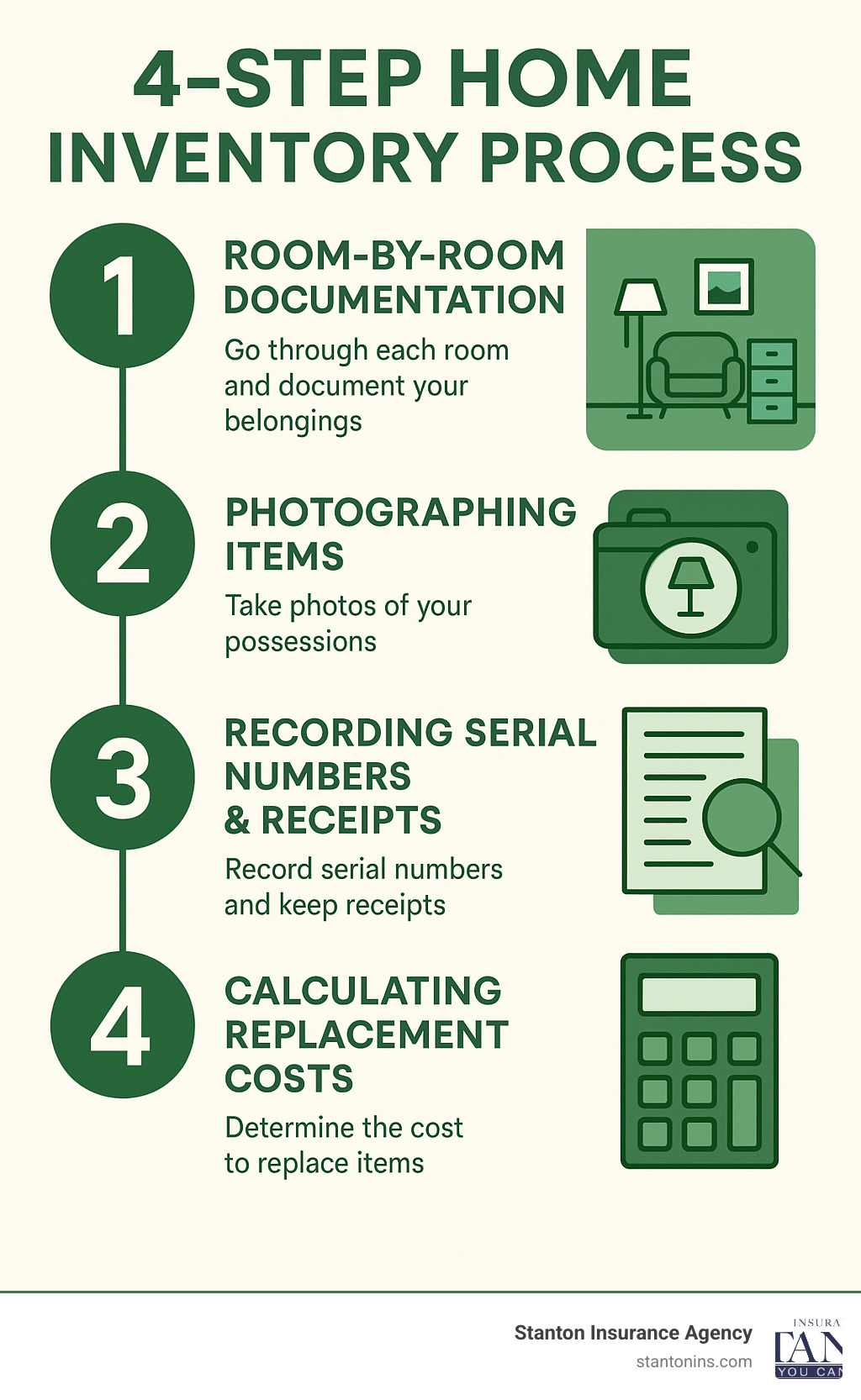

Start with a room-by-room inventory. List everything worth more than $50.

Document everything with photos or video. For expensive items, photograph serial numbers and model information.

Research current replacement costs, not original purchase prices. That $800 laptop from three years ago might cost $1,200 to replace today.

Add everything up and include a buffer. Total your findings and add 10-20% for forgotten items.

Most people are surprised to find their belongings worth $30,000-50,000 or more. Even “barely furnished” college apartments often represent significant investment when counting electronics, clothes, textbooks, furniture, and everything else.

Getting and Using a Policy

Shopping for renters insurance in Massachusetts is straightforward. Most people can get covered with their certificate of insurance within 24 hours – sometimes immediately for last-minute lease signings.

You have three main paths: Online quotes are fastest, letting you compare rates and purchase instantly. Phone sales work well if you prefer talking through options. Local agents provide the best value, especially when asking “do I need renters insurance in Massachusetts?” and wanting personalized guidance.

Local agents understand the Massachusetts rental market and help steer important endorsements like water backup coverage (crucial for basement apartments in older buildings) and personal injury protection.

Timeline for coverage is quick. Online applications can provide instant coverage after payment, while agents usually mean same-day or next-day coverage. Your certificate of insurance is typically available within 24 hours.

Budget-conscious renters can check our cheap renters insurance Massachusetts guide for proven strategies to get comprehensive coverage affordably.

Step-by-Step to File a Claim in Massachusetts

Contact your insurance company immediately – most operate 24/7 claim reporting hotlines. Call as soon as you’re safe and able.

Mitigate further damage smartly. If a pipe bursts, turn off water. If a window breaks, cover it. But don’t make permanent repairs without insurer approval.

Document everything before cleaning up. Take photos of all damage from multiple angles. List damaged items with approximate values.

Your insurer sends required forms within 24-48 hours. Complete and return promptly. For significant claims, an adjuster will inspect damage. Be present and provide all documentation.

Track your claim status by staying in contact with your representative. Most straightforward claims close within 2-4 weeks. Once approved, you’ll receive your payout minus your deductible.

Special Cases: Students & Sublets

College students often assume they’re covered under parents’ homeowners insurance. Parent policies typically cover dorm belongings at just 10% of the home policy’s personal property limit, with no liability protection for independent living.

Dorm living versus off-campus apartments differs significantly. Dorm coverage through parents is minimal and may not cover theft. Off-campus apartments almost always require separate renters insurance.

Study abroad programs present coverage gaps. Most standard policies don’t cover belongings overseas.

Short-term rentals and sublets require careful attention to policy language. Some exclude coverage for stays under certain periods or unofficial subletting.

Roommate changes throughout the year mean reviewing coverage regularly. When roommates move, you might need to adjust coverage limits or clarify who’s covered.

Frequently Asked Questions about Renters Insurance in Massachusetts

Is renters insurance required by law in MA?

Do I need renters insurance in Massachusetts according to state law? No – Massachusetts doesn’t have any statute requiring renters to carry insurance. You won’t face legal penalties for going without coverage.

But while the state doesn’t require it, your landlord almost certainly will. Massachusetts law gives landlords the right to require renters insurance as a lease condition, and most take advantage of this. Finding an apartment without an insurance requirement is extremely rare in practice.

Does renters insurance pay for a hotel if my unit is uninhabitable?

Yes, through “additional living expenses” or “loss of use” coverage, automatically included in every Massachusetts renters policy.

When a covered disaster makes your apartment unlivable, insurance maintains your normal standard of living. They’ll pay for hotel rooms during repairs, restaurant meals since you can’t cook, and extra costs like pet boarding or additional transportation.

Coverage typically continues until your apartment is habitable again or you find permanent replacement housing. Most policies provide 12-24 months of additional living expense coverage.

Is renters insurance worth it if I don’t own much?

This question comes mostly from college students or young professionals who believe they don’t own anything valuable. Let me change your perspective.

Walk through your apartment and imagine replacing everything from scratch. That “cheap” furniture from Target? Your entire wardrobe? Kitchen supplies, cleaning products, household items? Costs add up faster than expected.

Most renters are shocked when calculating replacement costs. Your basic bedroom setup alone – bed frame, mattress, sheets, dresser, and clothes – easily hits $3,000 to replace. Add living room furniture, kitchen essentials, electronics, and personal items, and you’re looking at $8,000 to $15,000 or more.

Even if you owned almost nothing, the liability protection makes renters insurance worthwhile. If your upstairs neighbor slips on water you spilled in the hallway and breaks their wrist, you could face thousands in medical bills and legal costs. That $20 monthly premium suddenly looks like the smartest money you’ve ever spent.

Renters insurance costs less than most coffee spending each month. For the price of a few lattes, you get complete financial protection against disasters that could derail your finances for years.

Conclusion

So, do I need renters insurance in Massachusetts? After four generations of helping Bay State renters protect their homes and futures, I can tell you with absolute certainty: yes, you do.

Here’s the reality check: while Massachusetts doesn’t legally require renters insurance, nearly every landlord from Boston to the Berkshires will ask for proof of coverage before handing over your keys. But even if they didn’t, you’d still need it.

Think about it this way – you probably spend more on streaming services each month than the $15-30 it costs for comprehensive renters insurance. Yet that small monthly investment protects you from potentially devastating financial losses that could take years to recover from.

Your landlord’s property insurance is designed to rebuild walls and replace fixtures after a disaster. But your laptop, your grandmother’s jewelry, your entire wardrobe, that couch you finally paid off – all of that is on you to replace. Without coverage, you’re essentially self-insuring against risks that could easily cost $10,000, $20,000, or more.

The liability protection alone justifies the cost. One slip-and-fall accident in your apartment could result in a lawsuit that follows you for years. Why risk your financial future when protection costs less than a weekly coffee run?

At Stanton Insurance Agency, we’ve seen too many renters learn this lesson the hard way. The good news? You don’t have to be one of them. We can get you covered within 24 hours, often with same-day certificates of insurance if your landlord needs immediate proof.

We understand Massachusetts renters because we’ve been serving this community for generations. From Cambridge students to Boston professionals to families in Worcester, we know what coverage works and what doesn’t. We’ll help you find the right protection at a price that fits your budget.

Ready to protect what matters most? Get a quote for local renters insurance or give us a call. Because when it comes to your financial security, peace of mind isn’t just worth every penny – it’s priceless.

Don’t wait until it’s too late. Your future self will thank you for making this smart decision today.