Management Liability Insurance: Top 5 Crucial Insights

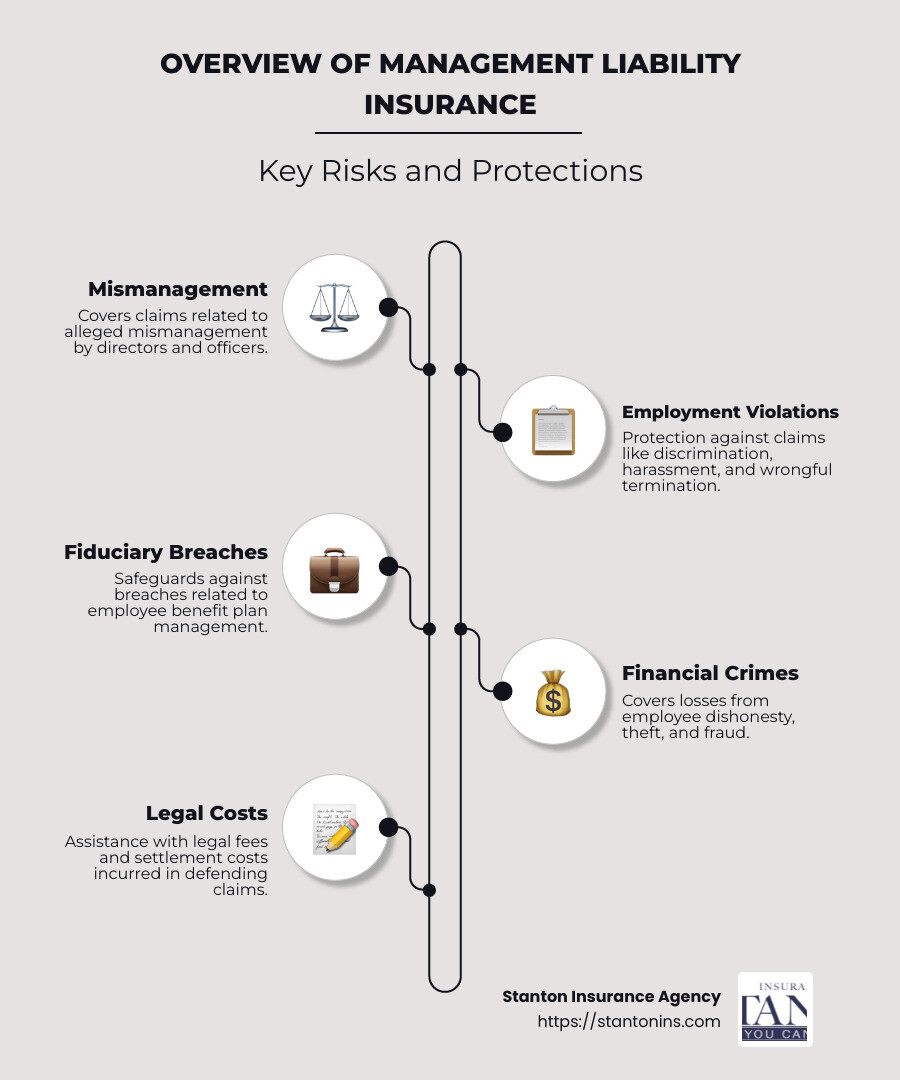

Management liability insurance is essential for safeguarding the leaders of your business. It helps protect directors, officers, and organizations from a range of potential claims, including accusations of mismanagement, employment practices violations, and fiduciary breaches.

Quick Overview:

- What it covers: Mismanagement, employment violations, fiduciary breaches, crimes.

- Who needs it: Directors, officers, business entities, and more.

- Why it’s vital: Protects personal assets, covers legal fees, and ensures financial stability.

Given the litigious nature of today’s business environment, having this coverage provides peace of mind and security. Organizations face numerous risks that can lead to significant financial loss and damage to reputation. These risks come from stakeholders, regulatory bodies, and even the organization’s own employees. Addressing these risks with management liability insurance helps to shield leaders from personal financial exposure and supports the overall stability of the organization.

At Stanton Insurance Agency, we know the importance of protecting your leadership team and your organization. Our expertise in management liability insurance ensures you receive customized coverage and exceptional service.

I’m Geoff Stanton, president of Stanton Insurance Agency and a Certified Insurance Counselor (CIC). With years of experience in management liability insurance, my commitment is to provide solutions that protect your organization and leadership from unforeseen risks. I invite you to reach out for guidance custom to your specific needs.

Management liability insurance vocabulary:

– d&o insurance coverage

– director and officer liability insurance coverage

– what is director and officer liability insurance

What is Management Liability Insurance?

Management liability insurance is a specialized type of coverage designed to protect the key figures in your business—directors and officers—along with the organization itself. This insurance acts as a safety net, shielding personal assets and covering financial losses that might arise from various claims.

Definition and Purpose

At its core, management liability insurance is about protection. It safeguards against claims of mismanagement, breaches of duty, and other allegations that could financially cripple an organization or its leaders. This insurance ensures that directors and officers can perform their roles without the constant fear of personal financial ruin.

Protecting Personal Assets

One of the most significant aspects of management liability insurance is its role in protecting personal assets. Directors and officers can face lawsuits from shareholders, employees, or regulatory bodies. Without insurance, their personal savings, homes, and other assets might be at risk. By having this coverage, they can focus on their responsibilities with the assurance that their personal finances are secure.

Mitigating Financial Losses

Financial losses can arise from various scenarios, including legal fees, settlements, or judgments. Management liability insurance helps absorb these costs, ensuring that the organization remains financially stable even in the face of significant claims. This protection is crucial, especially for small to midsized enterprises that might not have the resources to handle large, unexpected expenses.

Why It Matters

In today’s business world, the risk of litigation is ever-present. Companies must steer complex regulatory environments, and any misstep can lead to costly legal battles. Management liability insurance provides peace of mind, allowing leaders to make bold decisions without the fear of personal or organizational financial devastation.

For businesses in Massachusetts, New Hampshire, and Maine, Stanton Insurance Agency offers expert guidance and custom insurance solutions. Our team understands the unique challenges faced by organizations and is committed to providing coverage that aligns with your specific needs.

Key Components of Management Liability Insurance

Management liability insurance is a comprehensive package that shields directors, officers, and the organization from various risks. Let’s break down its key components to see how it provides this protection.

Directors and Officers (D&O) Liability Insurance

D&O liability insurance acts as a safety net for directors and officers. If they are sued for wrongful acts such as mismanagement or breaches of duty, this insurance covers their personal losses. Without it, they might face crippling legal fees and settlements out of pocket.

- Wrongful Acts: These can include decisions that lead to financial losses, regulatory breaches, or even poor business judgments.

- Personal Losses: The insurance ensures that directors and officers don’t have to dip into their personal savings to cover legal costs.

- Legal Fees and Settlements: Whether the case goes to court or is settled, D&O insurance covers these expenses, helping the organization maintain financial stability.

Employment Practices Liability Insurance (EPLI)

EPLI is crucial for protecting organizations from claims related to employment violations. It covers issues like discrimination, harassment, and wrongful termination.

- Discrimination and Harassment: Employees might file claims if they experience unfair treatment or a hostile work environment.

- Wrongful Termination: If an employee feels they were fired without just cause, EPLI steps in to cover legal defenses and potential settlements.

Fiduciary Liability Insurance

Fiduciary liability insurance protects those who manage employee benefit plans. It covers claims of mismanagement, ensuring compliance with regulations like ERISA (Employee Retirement Income Security Act).

- Benefit Plans: This includes retirement plans and other employee benefits that need careful management.

- Mismanagement: If there are allegations of mishandling these plans, fiduciary liability insurance covers the defense costs and any resulting financial losses.

Commercial Crime Insurance

Commercial crime insurance protects the organization against losses due to employee dishonesty, theft, forgery, and fraud.

- Employee Dishonesty: This coverage is vital if an employee steals or commits fraudulent acts.

- Theft and Forgery: Whether it’s money, securities, or property, this insurance covers losses from theft or forged documents.

Management liability insurance is essential for any organization, providing a robust shield against a variety of risks. By understanding each component, businesses can better protect their leaders and themselves from unforeseen challenges.

Benefits of Management Liability Insurance

Management liability insurance offers several key benefits for directors, officers, and the organizations they lead. Here’s why it’s a must-have:

Financial Protection

Imagine a company facing a costly lawsuit due to alleged mismanagement. Without management liability insurance, the financial burden could be overwhelming. This insurance covers legal fees, settlements, and judgments, ensuring that personal and company assets remain protected. It acts as a financial safety net, so leaders can focus on their roles without worrying about potential financial ruin.

Peace of Mind

Knowing that they are protected gives directors and officers peace of mind. They can make decisions confidently, knowing that they are shielded from personal liability. This peace of mind encourages talented individuals to take on leadership roles, knowing that their personal assets are not at risk.

Decision-Making Confidence

With management liability insurance in place, leaders can make bold decisions that drive business growth. They don’t have to second-guess every move, fearing personal repercussions. This confidence leads to more effective leadership and a more dynamic business environment.

Stability

For a business, stability is key. Lawsuits and claims can disrupt operations and damage reputations. Management liability insurance helps maintain stability by covering unexpected legal challenges. This stability allows organizations to continue their operations smoothly, even in the face of legal disputes.

In summary, management liability insurance is not just a protective measure; it’s an enabler for growth and effective leadership. By providing financial protection, peace of mind, decision-making confidence, and stability, it supports the overall health and success of an organization.

Management Liability Insurance for Nonprofits

Nonprofit organizations face unique challenges that can expose them to significant risks. While their missions are noble, nonprofits are not immune to lawsuits. Management liability insurance is crucial for protecting these organizations, especially their board members.

Nonprofit Risks

Nonprofits often operate with limited resources and rely heavily on donations and grants. This dependency can make them vulnerable to financial instability. Additionally, they may face legal claims related to their operations, employment practices, or governance. Without proper insurance, these claims can drain already scarce resources.

Board Members

Board members of nonprofits play a crucial role in governance and decision-making. However, they may not always be familiar with the complexities of running an organization. This lack of experience can lead to potential liabilities. Directors and Officers (D&O) Liability Insurance is essential to protect board members from personal financial loss due to lawsuits alleging wrongful acts.

Funding and Reputation

Funding and reputation are the lifelines of any nonprofit. A lawsuit or claim can jeopardize both. A legal battle can divert funds away from the organization’s mission, while negative publicity can damage its reputation. Management liability insurance helps safeguard against these scenarios, allowing nonprofits to focus on their mission without fear of financial or reputational harm.

Common Claims

Nonprofits can face various legal claims, such as:

- Employment Practices Violations: Allegations of discrimination, harassment, or wrongful termination can arise, similar to for-profit organizations.

- Mismanagement of Funds: Donors and grant providers expect their contributions to be used responsibly. Claims of mismanagement can lead to legal action.

- Breach of Fiduciary Duty: Board members have a duty to act in the best interest of the organization. Alleged breaches, such as conflicts of interest, can result in lawsuits.

In conclusion, management liability insurance is vital for nonprofits to protect their board members, funding, and reputation. It provides the necessary coverage to handle common claims and ensures that the organization can continue its mission without interruption.

Frequently Asked Questions about Management Liability Insurance

What are management liabilities?

Management liabilities refer to the various risks and responsibilities that directors, officers, and managers face while running an organization. These can include:

- Occupational Health & Safety (OH&S) Issues: Companies must ensure a safe working environment. Failure to comply with OH&S regulations can lead to legal action.

- Unfair Dismissal: If an employee believes they were fired without just cause, they might sue the company, leading to significant legal costs.

- Harassment Claims: Allegations of workplace harassment can damage a company’s reputation and result in costly lawsuits.

What is management protection insurance?

Management protection insurance, often known as an all-risks policy, is designed to shield businesses from various financial losses. This comprehensive coverage can include:

- Financial Losses: Protects against claims that can lead to significant monetary damages.

- Crime and Theft: Offers protection against losses stemming from criminal acts like theft or fraud within the organization.

This type of insurance provides peace of mind, knowing that the financial stability of the company is safeguarded against unforeseen events.

What is crime coverage in management liability?

Crime coverage is a crucial component of management liability insurance. It protects businesses from losses due to criminal activities such as:

- Employee Theft: Covers losses from dishonest acts by employees, such as stealing money or property.

- Forgery: Protects against losses from forged documents or signatures.

- Robbery: Offers coverage for theft or robbery incidents, whether by employees or external parties.

This coverage ensures that an organization can recover financially from crimes that could otherwise lead to substantial financial setbacks.

Conclusion

In today’s business environment, management liability insurance is more crucial than ever. It offers vital protection for directors, officers, and managers against a wide array of risks that could lead to significant financial losses. From wrongful acts to employment violations and even criminal activities, this insurance provides a safety net that helps maintain the stability and reputation of an organization.

At Stanton Insurance Agency, we understand the complexities and challenges that businesses face. Our custom management liability insurance solutions are designed to offer peace of mind, ensuring that your organization and its leaders are protected against unforeseen events. This allows you to focus on what truly matters—making confident decisions and driving your business forward.

By choosing us, you’re not just purchasing a policy; you’re gaining a trusted partner committed to safeguarding your valuable assets. Our expertise in the insurance industry means we’re equipped to provide the best possible coverage for your unique needs.

For more information on how we can help protect your business with management liability insurance, visit our business insurance page and let us assist you in securing the future of your organization.