Condo Master Insurance: Top 3 Crucial Facts in 2025

Condo master insurance is a critical component for anyone involved in a condominium community, whether you’re a resident, board member, or property manager. This type of insurance, required by all condo associations, covers the physical structure of the building and shared spaces, ensuring financial protection against common risks and liabilities. Key highlights include:

- Coverage: Protects the condo structure, common areas, and provides liability coverage.

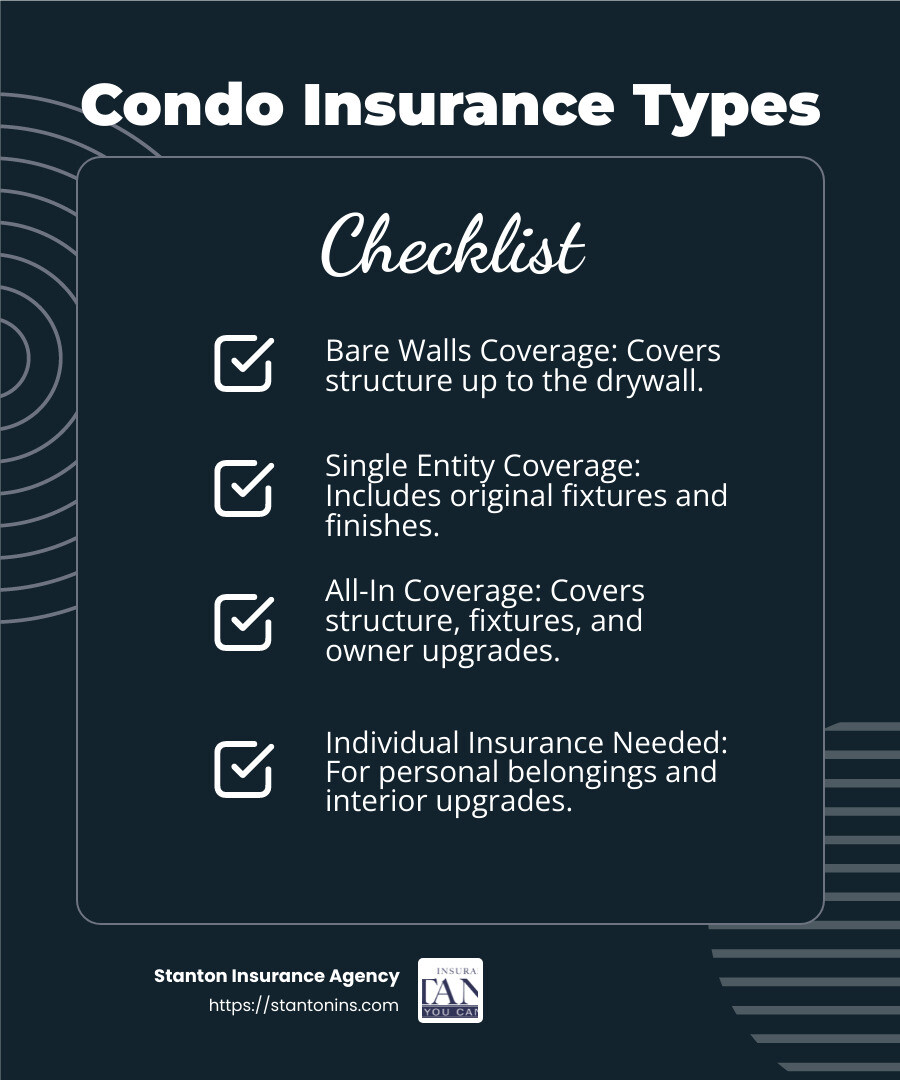

- Types: Includes bare walls, single entity, and all-in coverage options.

- Purpose: Ensures compliance with lender requirements and protects owners from shared liability.

Understanding condo master insurance is vital not only for compliance but also for safeguarding community interests. In the following sections, we’ll dig into the specifics of what this insurance entails and discuss various coverage levels and their importance.

I’m Geoff Stanton, President of Stanton Insurance. With years of experience in the insurance field, especially in Massachusetts, I specialize in condo master insurance and work to ensure clients receive comprehensive coverage custom to their needs.

Key condo master insurance vocabulary:

– do condos need homeowners insurance

– how much condo insurance do i need

– what is not covered by condo insurance

What is Condo Master Insurance?

Condo master insurance is a specialized insurance policy designed to protect the shared aspects of a condominium complex. It’s a crucial safety net for condo associations and their members, ensuring that the building and its common areas are covered against various risks.

Definition and Coverage

At its core, a condo master insurance policy covers the physical structure of the condominium building. This includes the exterior walls, roofing, and sometimes the interiors, depending on the policy type. The policy also extends to shared spaces, providing liability coverage for accidents or damages occurring in these areas.

There are different types of coverage under condo master insurance, which can be customized to the needs of the condominium association. These include:

- Bare Walls Coverage: Covers only the structural elements up to the drywall.

- Single Entity Coverage: Includes built-in items like fixtures and finishes.

- All-In Coverage: The most comprehensive, covering all real property, including improvements made by owners.

Common Areas

Common areas in a condo complex are spaces shared by all residents. These can include hallways, lobbies, gyms, pools, and parking lots. The condo master insurance policy covers these areas, ensuring that any damage or liability is not the sole responsibility of individual unit owners.

Imagine a situation where a guest slips and falls in the lobby. The master policy would typically cover the medical expenses and any legal fees associated with such an incident.

HOA Insurance

HOA insurance is a term often used interchangeably with condo master insurance. It refers to the same type of coverage but emphasizes that the Homeowners Association (HOA) is responsible for purchasing and maintaining the policy. The cost is usually included in the monthly or annual association dues paid by condo owners.

This insurance is vital for protecting the financial health of the condo community. Without it, the association and its members could face significant out-of-pocket expenses for repairs, legal claims, or rebuilding efforts.

By understanding the basics of condo master insurance, condo owners and board members can ensure that their community is well-protected and compliant with legal and lender requirements.

Types of Condo Master Insurance Policies

When it comes to condo master insurance, understanding the different types of policies available is key. Each type offers varying levels of protection for the condominium complex. Let’s break them down:

Bare Walls Coverage

Bare Walls Coverage is the most basic type of condo master insurance. It focuses solely on the essential structural elements of the building. This includes the exterior walls, framing, roofing, insulation, piping, wiring, and drywall.

- What’s Covered: The building’s structure up to the drywall.

- What’s Not Covered: Anything inside the individual units, like fixtures, flooring, or appliances.

This type of coverage ensures the condo’s exterior and shared spaces are protected, but unit owners need their own insurance to cover interior elements.

Single Entity Coverage

Single Entity Coverage takes it a step further by including some built-in property within the units. This policy covers everything under bare walls coverage plus certain original fixtures and finishes.

- What’s Covered: Built-in items like light fixtures and countertops that were part of the original unit construction.

- What’s Not Covered: Upgrades or improvements made by the owner after the initial construction.

This option provides a middle ground, offering more protection than bare walls but not as comprehensive as all-in coverage.

All-In Coverage

For those seeking the most comprehensive protection, All-In Coverage is the way to go. This policy covers all real property within the condo structure, including owner-made improvements and upgrades.

- What’s Covered: Everything from the building’s structure to interior fixtures, appliances, and any improvements made by unit owners.

- What’s Not Covered: Typically, personal belongings like furniture or electronics, which require individual condo insurance.

With all-in coverage, unit owners have peace of mind knowing that both original and upgraded aspects of their units are protected under the master policy.

Each of these policies serves a specific purpose and offers different levels of protection. Condo associations must carefully assess their needs and choose the policy that best suits their community. This ensures that both the building and its residents are adequately protected against potential risks.

Next, we’ll dig into the specific coverage details of condo master insurance, including property and liability insurance.

Coverage Details of Condo Master Insurance

Condo master insurance is a crucial safeguard for condominium associations. It ensures that the building and its common areas are protected against various risks. Let’s explore the key coverage areas: property insurance and liability insurance.

Property Insurance

Property insurance is a fundamental component of condo master insurance. It protects the physical structure of the condominium, including:

- Building Structure: This includes the external walls, roofing, and foundation. It’s essential to keep the basic framework of the building intact.

- Common Areas: These are shared spaces like hallways, lobbies, elevators, and recreational facilities. Protecting these areas is vital since they are the collective responsibility of all unit owners.

- Utilities and Infrastructure: Coverage extends to plumbing, electrical systems, and HVAC units located in the building’s common areas.

However, property insurance has its limits and exclusions. It’s important to note:

- Common Perils Covered: Typically, the policy covers damage from fire, vandalism, and wind.

- Exclusions: Damage from floods, earthquakes, or wear and tear is often not covered. Associations may need separate policies for these risks.

Liability Insurance

Liability insurance is another critical aspect of condo master insurance. It shields the condominium association from financial burdens arising from accidents or injuries that occur in common areas. Here’s what it includes:

- Injury Coverage: If someone is injured in a shared space, liability insurance can cover medical expenses and potential legal costs.

- Legal Expenses: This coverage extends to legal defense costs if a lawsuit is filed against the condo association due to an incident in a common area.

- Common Areas: The protection applies to accidents in places like the pool, gym, or parking lot, ensuring the association isn’t financially liable for mishaps.

Both property and liability insurance are essential for maintaining the safety and financial stability of a condominium complex. By understanding the specifics of these coverages, condo associations can better protect their investments and ensure a harmonious living environment for all residents.

Next, we’ll examine the differences between individual condo insurance and the master insurance policy.

Differences Between Individual Condo Insurance and Master Insurance Policy

Understanding the distinction between individual condo insurance and a condo master insurance policy is crucial for condo owners. Both play essential roles but cover different aspects of condo living.

HO-6 Policy

An HO-6 policy, also known as personal condo insurance, is designed specifically for individual condo unit owners. This policy covers:

- Personal Property: Protects items like furniture, electronics, and clothing against theft or damage. For example, if a fire damages your belongings, your HO-6 policy would cover the cost of replacement.

- Personal Liability: Offers protection if someone is injured inside your unit and decides to sue. Imagine a guest trips over a rug and breaks their arm; this coverage would handle legal and medical expenses.

Master Policy Coverage

The condo master insurance policy, on the other hand, is held by the homeowners association (HOA). It focuses on:

- Building Structure: Covers the external parts of the building, such as the roof and exterior walls. It’s the backbone of the building’s protection.

- Common Areas: Includes shared spaces like lobbies, hallways, and recreational facilities. If a visitor slips in the lobby, the master policy would address the incident.

Key Differences

- Scope of Coverage: The master policy covers the building and common areas, while the HO-6 policy is all about the interior of your unit and your personal belongings.

- Responsibility: As a condo owner, you’re responsible for purchasing an HO-6 policy. The HOA takes care of the master policy, funded through association dues.

- Overlap: There is no direct overlap. The master policy doesn’t cover your unit’s interior or personal items, and your HO-6 policy doesn’t cover the building’s structure or common areas.

Understanding these differences ensures you’re fully protected, both inside your unit and within the community. Next, we will explore the additional coverage options available to improve your condo insurance protection.

Additional Coverage Options

When it comes to condo master insurance, there are several additional coverage options that can enhance your protection. These options address specific risks and offer peace of mind for both condo associations and individual unit owners.

General Liability

General Liability Insurance is essential for condo associations. It covers claims of bodily injury or property damage occurring in common areas. For instance, if a visitor slips on a wet floor in the lobby, general liability insurance would cover medical expenses and any legal fees. This coverage is crucial for protecting the financial health of the association.

Director’s and Officer’s Liability

Director’s and Officer’s (D&O) Liability Insurance is vital for board members. It protects them from personal liability in case of alleged wrongful acts during their duties. For example, if the board fails to install a required hand railing and someone gets injured, D&O insurance would cover defense costs and settlements. This coverage ensures that board members can make decisions without fear of personal financial loss.

Fidelity Liability

Fidelity Liability Insurance safeguards against theft by employees or board members. If someone embezzles funds or forges documents, this insurance covers the loss. However, it does not protect against theft by outsiders. It’s important to ensure that the policy includes coverage for board members to prevent gaps in protection.

Personal Property Coverage

Personal Property Coverage is crucial for protecting movable items owned by the condo association. This includes office supplies, furniture, and amenities like gym equipment. Without this coverage, the association would have to bear the cost of replacing these items in the event of damage or theft.

Natural Disasters

Natural disasters such as floods, earthquakes, and sinkholes can cause significant damage. While standard policies might exclude these perils, associations can purchase additional coverage. For example, states like California and South Carolina are prone to both earthquakes and flooding. Having specific coverage for these events is essential for associations in high-risk areas.

These additional coverage options provide a safety net for various risks that condo associations and unit owners may face. By understanding and selecting the right coverages, you can ensure comprehensive protection for your condo community. Next, we’ll answer some frequently asked questions about condo master insurance to further clarify your coverage needs.

Frequently Asked Questions about Condo Master Insurance

What is covered under a condo master insurance policy?

A condo master insurance policy is designed to protect the shared aspects of a condominium complex. It primarily covers:

- Common Areas: This includes spaces like hallways, lobbies, elevators, gyms, swimming pools, and any other areas accessible to all residents. If someone is injured in these areas, the master policy often covers medical expenses and legal fees.

- Structure: The policy typically covers the building’s exterior and structural components, such as the roof, outer walls, and foundations. Depending on the type of policy, it may also cover some interior structural elements like wiring and plumbing.

- Liability: This covers incidents that occur in common areas where the condo association might be held responsible. For example, if a visitor slips and falls in the lobby, the master policy’s liability coverage would handle the claim.

How is the master insurance policy paid for?

The costs associated with a condo master insurance policy are usually shared among the condo unit owners. Here’s how it typically works:

- HOA Fees: Homeowners Association (HOA) fees are regular payments made by unit owners. Part of these fees goes towards paying for the master insurance policy.

- Association Dues: In some cases, additional dues or assessments might be required to cover insurance costs, especially if there are unexpected expenses or repairs needed.

These collective payments ensure that the entire condo community is protected, spreading the financial responsibility evenly among all owners.

Do I need additional insurance if my condo has a master policy?

Yes, even with a condo master insurance policy in place, individual unit owners should consider purchasing additional coverage:

- HO-6 Policy: This is often referred to as “walls-in” coverage and is essential for protecting the interior of your unit and personal belongings. It covers items like furniture, appliances, and clothing.

- Personal Belongings: The master policy usually does not cover personal items inside your unit. An HO-6 policy provides this coverage, ensuring your possessions are protected against theft, fire, and other perils.

- Interior Coverage: If you have made upgrades or improvements to your unit, such as custom cabinets or new flooring, an HO-6 policy can cover these improvements. The master policy might not include them.

In summary, while the condo master insurance policy provides broad protection for the building and common areas, individual unit owners need their own insurance to cover personal property and specific interior elements. This dual approach ensures comprehensive coverage for both shared and personal assets.

Conclusion

At Stanton Insurance Agency, we understand the importance of safeguarding your home and ensuring peace of mind. Our expertise in condo master insurance is part of our commitment to providing trusted protection for your valuable assets. We know that navigating the complexities of insurance can be challenging, especially when it comes to understanding the intricacies of condo master insurance policies.

Why Choose Stanton Insurance Agency?

Our local expertise sets us apart. With locations across Massachusetts, New Hampshire, and Maine, we’re deeply rooted in the communities we serve. This means we understand the unique needs and concerns of condo associations and unit owners in these areas. Our team is dedicated to helping you find the right coverage to protect both common areas and individual units.

We pride ourselves on offering personalized service and custom insurance solutions that meet your specific needs. Whether you’re a member of a condo association board or a condo owner looking for additional personal coverage, we’re here to guide you every step of the way.

Get Started with Trusted Protection

Don’t leave your condo’s protection to chance. Let our experienced team help you navigate your insurance options and ensure you have the coverage you need. Contact us today for a free quote and discover how Stanton Insurance Agency can provide the trusted protection you deserve.

By choosing Stanton Insurance Agency, you’re not just getting an insurance policy; you’re gaining a partner committed to safeguarding your home and peace of mind.