Why Is Car Insurance So Expensive in Massachusetts? 5 Shocking Reasons

Unique Factors Driving Massachusetts Car Insurance Costs

Why is car insurance so expensive in Massachusetts? In a nutshell:

- No-fault state regulations requiring Personal Injury Protection (PIP) coverage

- High costs associated with auto repairs

- Mandatory coverages such as uninsured motorist protection

- Dense urban areas leading to increased accidents

- Severe weather causing more claims

Massachusetts stands out as one of the most expensive states for car insurance. For full coverage, drivers can pay around $3,928 per year, far above the national average. Rising costs are fueled by several unique factors specific to the Bay State.

Rising Costs: Why Now?

The cost of car insurance in Massachusetts isn’t static; it’s steadily increasing. More sophisticated cars require expensive repairs, and the state’s severe weather events lead to more claims. Additionally, healthcare costs are rising, making accident-related medical claims more costly for insurers.

Massachusetts-Specific Factors

The state’s no-fault insurance rules mean that insurers must cover medical expenses regardless of who caused the accident. Urban population density increases the likelihood of accidents and claims. The presence of uninsured drivers and more severe weather events add to the premium burden for everyone.

My name is Geoff Stanton. With experience in car insurance, especially focusing on why car insurance is so expensive in Massachusetts, I’ve seen how unique local factors elevate costs. This article aims to unpack these complexities.

Why Is Car Insurance So Expensive in Massachusetts?

Car insurance in Massachusetts is among the most expensive in the country. Several unique factors contribute to these high rates.

No-Fault State

Massachusetts is a no-fault state, which means that your own insurance pays for your medical expenses and some other losses, regardless of who caused the accident. This is managed through Personal Injury Protection (PIP) coverage. PIP covers up to $8,000 in medical expenses, lost income, and household services.

This system aims to reduce litigation and speed up the compensation process. However, it also means that insurers have to cover more claims, leading to higher premiums.

High Car Repair Costs

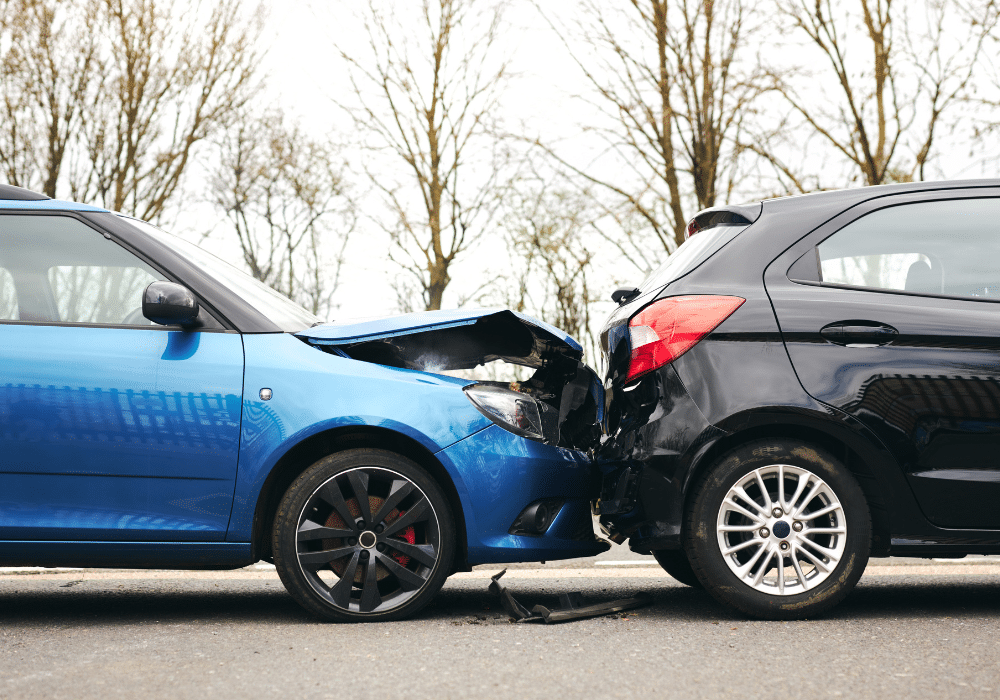

Car repairs in Massachusetts are more expensive due to advanced technology in modern vehicles. Features like electronic sensors for auto emergency braking, lane-keeping assist, and cross-traffic alert systems are located in vulnerable areas like bumpers and fenders. These parts often bear the brunt of crashes, leading to higher repair costs.

Additionally, a microchip shortage has delayed repairs, extending rental car periods and adding extra costs that insurers pass on to consumers. There’s also a shortage of auto repair technicians, who need constant training to keep up with complex systems. All these factors drive up the cost of car insurance.

Mandatory Coverages

Massachusetts requires several mandatory coverages that add to the overall cost:

- Uninsured Motorist Coverage: Protects you if you’re in an accident caused by someone without sufficient insurance.

- Personal Injury Protection (PIP): Covers medical expenses and other losses regardless of fault.

These mandatory coverages ensure that drivers are well-protected but also contribute to higher premiums.

Urban Population Density

Massachusetts has a high urban population density, especially in cities like Boston. This increases the likelihood of accidents, theft, and vandalism. More accidents mean more claims, which drives up insurance costs for everyone.

Highway Density

Massachusetts has a dense network of highways, which results in a high number of drivers on the road. More drivers mean a higher likelihood of crashes, further contributing to the high cost of car insurance.

These factors combined make car insurance in Massachusetts more expensive than in many other states. Understanding these elements can help you make informed decisions about your coverage.

Personal Factors Affecting Car Insurance Rates

Location

Where you live can significantly affect your car insurance rates. In Massachusetts, city-specific rates vary widely. Urban areas like Boston have higher rates due to increased accident likelihood, theft, and vandalism. Living in densely populated areas means more cars on the road and a higher chance of incidents.

On the other hand, rural areas generally have lower rates. Fewer cars and less traffic congestion mean fewer accidents and lower risk for insurers.

Age

Age is another crucial factor. Younger drivers, especially those under 25, often face higher premiums. Insurance companies consider young drivers high-risk due to their lack of experience and propensity for risky behaviors.

Interestingly, drivers over 65 may also see higher rates. This is because older drivers might have slower reaction times and other age-related issues that increase accident risk.

Here’s a quick look at average annual premiums based on age:

| Age Group | Average Annual Premium |

|---|---|

| Under 25 | $3,000+ |

| 25-65 | $1,200 – $2,000 |

| Over 65 | $2,000+ |

Driving Record

Your driving record plays a big role in determining your car insurance rates. A clean driving record can save you a lot of money. Insurance companies reward safe drivers with lower premiums.

However, violations can significantly increase your rates. For instance, a single speeding ticket can raise your premium by about 29%. More severe violations like a DUI can spike your rates by 80%.

Here’s a quick comparison of average annual premiums based on different violations:

| Violation Type | Average Annual Premium | Percentage Increase |

|---|---|---|

| Clean Record | $1,711 | – |

| DUI | $2,292.76 | 80% |

| Speeding | $1,154.76 | 29% |

| At-Fault Accident (<$1,000) | $1,879.44 | 60% |

Car Model

The make and model of your car also impact your insurance rates. Newer and high-performance vehicles often come with higher premiums. This is because they are more expensive to repair or replace.

Older cars, on the other hand, usually have lower premiums. They are less costly to repair and often lack the advanced technology found in newer models. However, if your older car lacks safety features, this could slightly increase your rates.

In summary, personal factors like location, age, driving record, and car model all play a role in determining your car insurance rates in Massachusetts. Understanding these elements can help you make better decisions when shopping for insurance.

Next, let’s dive into how you can save on your car insurance in Massachusetts.

How to Save on Car Insurance in Massachusetts

Shopping Around

One of the best ways to save on car insurance is to shop around. Rates can vary significantly between companies, even for the same coverage.

Compare rates from at least three different insurers before renewing your policy. Make it a habit to check every 6-12 months. You might be surprised at how much you can save just by switching providers.

Bundling Policies

Another effective strategy is to bundle your policies. Many insurers offer discounts if you combine your car insurance with other types of insurance, like home or renters insurance.

Multi-car discounts are also common. If you have more than one vehicle, insuring them all under the same provider can lead to significant savings.

Increasing Deductibles

Increasing your deductible is a straightforward way to lower your monthly premiums. A higher deductible means you’ll pay more out-of-pocket if you file a claim, but your regular payments will be lower.

For example, raising your deductible from $500 to $1,000 could save you up to 25% on your premium. Just make sure you can afford the higher deductible if you need to use it.

Utilizing Discounts

Always ask about available discounts. Insurers often provide various discounts that can help lower your premium. Here are some common ones:

- Safe driver discount: For those with a clean driving record.

- Low mileage discount: If you drive less than the average annual mileage.

- Multi-vehicle discount: For insuring more than one vehicle.

- Good student discount: For young drivers with good grades.

- Military discount: For active-duty military members and veterans.

- Safety features discount: Having anti-theft devices or advanced safety features can also lower your rates.

Usage-based insurance is another option. These programs track your driving habits and offer lower rates for safe drivers. If you drive less or have excellent driving habits, you could benefit from reduced premiums.

By implementing these tips, you can find a car insurance policy that fits your budget without sacrificing necessary coverage. Next, let’s answer some frequently asked questions about car insurance in Massachusetts.

Frequently Asked Questions about Car Insurance in Massachusetts

Why is car insurance so expensive in Massachusetts?

Car insurance in Massachusetts is known for being pricey. Here are some key reasons:

1. No-Fault State: Massachusetts is a no-fault state, which means all drivers must file claims with their own insurance after an accident, regardless of who is at fault. This leads to more claims and higher premiums.

2. High Car Repair Costs: Modern cars have advanced technology, which makes repairs more expensive. For example, sensors for safety features like auto emergency braking are often located in bumpers and fenders, making even minor repairs costly. Additionally, the microchip shortage and a lack of skilled auto repair technicians have further driven up costs.

3. Mandatory Coverages: Massachusetts requires more types of insurance than many other states, including uninsured motorist coverage and personal injury protection (PIP). These mandatory coverages increase the overall cost of car insurance.

4. Urban Population Density: The state is densely populated, with many drivers living in urban areas. This increases the likelihood of accidents, theft, and vandalism, all of which contribute to higher insurance rates.

5. Highway Density: Massachusetts has a high number of highways relative to its size. More highways mean more drivers and, consequently, a higher likelihood of crashes.

How can I lower my car insurance rates in Massachusetts?

While car insurance is expensive in Massachusetts, there are ways to lower your rates:

1. Shop Around: Compare quotes from different insurers. Rates can vary significantly between companies, so it’s worth checking every 6-12 months.

2. Bundle Policies: If you have home or other types of insurance, consider bundling them with your car insurance. Many insurers offer discounts for multi-policy holders.

3. Increase Deductibles: Opting for a higher deductible can lower your monthly premiums. Just make sure you can afford the out-of-pocket cost if you need to make a claim.

4. Utilize Discounts: Ask about available discounts. Insurers often offer discounts for safe driving, having safety features or anti-theft devices, and completing advanced driver training courses.

5. Explore Usage-Based Insurance: Some programs track your driving habits and offer lower rates for safe drivers or those who drive less frequently.

What are the mandatory car insurance coverages in Massachusetts?

In Massachusetts, the law requires several types of coverage:

1. Bodily Injury to Others: This covers injuries you cause to others in an accident. The minimum required coverage is $20,000 per person and $40,000 per accident.

2. Personal Injury Protection (PIP): PIP covers medical expenses and lost wages for you and your passengers, regardless of who is at fault. The minimum required coverage is $8,000 per person.

3. Bodily Injury Caused by an Uninsured Auto: This covers injuries you and your passengers sustain if you’re hit by an uninsured driver. The minimum required coverage is $20,000 per person and $40,000 per accident.

4. Damage to Someone Else’s Property: This covers damage you cause to another person’s property. The minimum required coverage is $5,000.

These coverages are compulsory, but you can also purchase additional optional coverages for more protection.

For more detailed information or specific questions about car insurance in Massachusetts, reach out to us at Stanton Insurance Agency. We’re here to help you navigate your insurance options and ensure you’re adequately protected.

Conclusion

In summary, car insurance rates in Massachusetts are influenced by several unique factors, including the state’s no-fault insurance laws, high car repair costs, mandatory coverages, and urban population density. These elements combine to make car insurance more expensive here compared to other states.

At Stanton Insurance Agency, we understand these challenges and are committed to providing you with the best possible protection at a competitive price. Our team is dedicated to helping you find the right coverage that suits your needs and budget. We offer personalized service and expert advice to ensure you’re adequately protected on the road.

While price is important, the quality of service and the reliability of your insurer are equally crucial. At Stanton Insurance Agency, we pride ourselves on our reputation for trusted protection and exceptional customer service. We strive to meet and exceed your expectations, providing you with peace of mind knowing you’re in good hands.

For more information or to get a personalized quote, visit our car insurance page. Let us help you navigate the complexities of car insurance in Massachusetts and find the best coverage for you and your loved ones.